Introduction

In 2025, digital wallets are no longer just a convenient add‑on to traditional banking — they have become the primary way millions of people in the USA manage their money. From paying for groceries with a quick tap to sending funds across borders in seconds, mobile wallets are reshaping the financial landscape. The Top Digital Wallets in USA 2025 are designed to meet the growing demand for speed, security, and flexibility, offering solutions that fit seamlessly into everyday life.

This guide explores the Top Digital Wallets in USA 2025, helping users choose the safest and most versatile options.

The rise of fintech innovation has accelerated this shift. Consumers now expect their wallets to do more than store cards; they want integrated features such as budgeting tools, cryptocurrency support, instant peer‑to‑peer transfers, and global payment options. For businesses, mobile wallets reduce friction at checkout, improve customer trust, and open doors to international markets. For individuals, they provide peace of mind with advanced encryption, biometric authentication, and fraud protection.

Choosing the right wallet in 2025 is not just about convenience — it’s about aligning with your lifestyle and financial goals. Whether you’re an iPhone user relying on Apple Pay, an Android enthusiast using Google Wallet, or someone who needs cross‑border solutions like Wise or Revolut, the Top Digital Wallets in USA 2025 offer tailored benefits for every type of user. This guide explores the leading options, compares their strengths, and explains why mobile wallets are now essential tools in modern personal finance.

By focusing on the Top Digital Wallets in USA 2025, you can simplify payments and enjoy global compatibility.

Why Mobile Wallets Matter in 2025

In 2025, mobile wallets are no longer optional — they are central to how people in the USA manage their financial lives. The Top Digital Wallets in USA 2025 are reshaping personal finance by combining speed, security, and convenience in ways that traditional banking cannot match. Consumers expect instant transactions, seamless integration with e‑commerce platforms, and advanced fraud protection, and digital wallets deliver all of these features.

Security is one of the biggest reasons mobile wallets matter today. With biometric authentication, two‑factor verification, and encrypted transactions, users can trust that their money is safe. This level of protection is especially important in an era where cybercrime and online fraud are rising. At the same time, convenience has become a driving force. Whether it’s tapping a phone at checkout, sending money to family in seconds, or managing subscriptions, mobile wallets simplify everyday financial tasks.

Global reach is another factor that makes these wallets essential. Leading platforms like PayPal, Wise, and Revolut allow users in the USA to send and receive money across borders instantly, supporting international lifestyles and businesses. For younger generations, wallets like Venmo and Cash App add social features and investment tools, making them more than just payment apps.

Ultimately, mobile wallets matter in 2025 because they align with modern expectations: fast, secure, and globally connected. Choosing the right wallet ensures that users can keep pace with the evolving digital economy while enjoying peace of mind in every transaction.

Criteria for Choosing the Best Wallet

With so many options available, selecting the right digital wallet in 2025 requires careful consideration. The Top Digital Wallets in USA 2025 are designed to meet different needs, but not every app is suitable for every user. Understanding the criteria that matter most will help you choose a wallet that aligns with your lifestyle and financial goals.

Security is the first and most important factor. A reliable wallet should offer advanced protection such as biometric login, two‑factor authentication, and real‑time fraud alerts. These features ensure that your money and personal data remain safe, even in the face of rising cyber threats.

Ease of use is equally critical. A wallet should have a clean interface, simple onboarding, and seamless integration with online stores, banks, and subscription services. If the app feels complicated, users are less likely to adopt it for everyday payments.

Transaction fees can also make a big difference. Some wallets charge for transfers or currency conversions, while others offer free or low‑cost services. Comparing fees upfront helps avoid hidden costs.

Finally, global compatibility is essential for users who travel or send money abroad. Wallets like Wise and Revolut excel at cross‑border payments, while PayPal and Apple Pay dominate in the USA.

By evaluating these criteria — security, usability, fees, and global reach — you can confidently select from the Top Digital Wallets in USA 2025 and ensure your financial transactions remain smooth, safe, and cost‑effective.

PayPal

PayPal continues to dominate the digital wallet space in 2025, making it one of the Top Digital Wallets in USA 2025. Known for its reliability and global reach, PayPal is trusted by millions of users for online shopping, peer‑to‑peer transfers, and business transactions. Its biggest strength lies in buyer protection, which ensures that customers feel safe when making purchases across e‑commerce platforms.

Security is a major highlight of PayPal. With two‑factor authentication, fraud monitoring, and encrypted transactions, users can confidently send and receive money. The wallet also integrates seamlessly with platforms like eBay, Shopify, and countless online stores, making it a go‑to choice for merchants and consumers alike.

PayPal ranks high among the Top Digital Wallets in USA 2025 for global payments and buyer protection.

PayPal’s global compatibility is another advantage. Whether you’re in the USA, UK, Canada, or Australia, PayPal allows instant transfers across borders. While transaction fees can be higher compared to some competitors, the convenience and trust factor often outweigh the costs.

Apple Pay

Apple Pay has become one of the most widely used mobile wallets in the USA, making it a key contender among the Top Digital Wallets in USA 2025. Designed specifically for iPhone, iPad, and Apple Watch users, Apple Pay offers unmatched convenience through its seamless integration with the iOS ecosystem. With just a tap or a glance, users can complete secure transactions at millions of retail stores, online platforms, and apps.

By focusing on the Top Digital Wallets in USA 2025, you can simplify payments and enjoy global compatibility.

Security is at the heart of Apple Pay’s success. Each transaction is authorized using Face ID, Touch ID, or a passcode, and sensitive card details are never stored on the device or shared with merchants. Instead, Apple Pay uses tokenization, replacing card numbers with unique transaction codes to protect user data. This makes it one of the safest digital wallets available in 2025.

Apple Pay also supports loyalty cards, transit passes, and peer‑to‑peer payments via Apple Cash, making it more versatile than ever. For users in the USA, it’s particularly valuable because of its widespread acceptance across major retailers, banks, and service providers.

Its reliability makes PayPal a top choice in the Top Digital Wallets in USA 2025 list.

Google Wallet

Google Wallet has re‑emerged as one of the most versatile payment solutions, making it a strong contender among the Top Digital Wallets in USA 2025. Built for Android users but also accessible across multiple platforms, Google Wallet offers a simple, secure, and fast way to store cards, make payments, and send money. Its integration with the broader Google ecosystem — including Gmail, Google Pay, and Google Play — makes it especially convenient for users who rely on Google services daily.

By focusing on the Top Digital Wallets in USA 2025, you can simplify payments and enjoy global compatibility.

Security is a major advantage of Google Wallet. Transactions are protected with advanced encryption, biometric authentication, and tokenization, ensuring that sensitive card details are never exposed. Users can also manage loyalty cards, transit passes, and even event tickets directly within the app, making it more than just a payment tool.

For USA users, Google Wallet is widely accepted at retail stores, online platforms, and mobile apps. Its global compatibility also makes it useful for travelers and professionals who need cross‑border payment options. With low transaction fees and seamless usability, Google Wallet continues to be a reliable choice for millions of users in 2025.

Venmo

Venmo has become a cultural phenomenon in the USA, making it one of the most recognizable names among the Top Digital Wallets in USA 2025. Originally designed for peer‑to‑peer transfers, Venmo has evolved into a versatile payment app that blends financial transactions with social interaction. Users can send money instantly to friends and family, split bills, or pay for services, all while sharing notes or emojis that make the experience more engaging.

By focusing on the Top Digital Wallets in USA 2025, you can simplify payments and enjoy global compatibility.

Security remains a priority for Venmo. Transactions are protected by encryption, PIN codes, and biometric authentication, ensuring that users can transfer money safely. While Venmo is primarily focused on the USA market, its integration with PayPal allows users to connect with a broader ecosystem of online payments.

One of Venmo’s unique features is its social feed, where users can see and interact with payment activity. This makes it especially popular among younger audiences who value transparency and community. In addition, Venmo now supports business payments, allowing small merchants and freelancers to accept money directly through the app.

Its reliability makes venmo a top choice in the Top Digital Wallets in USA 2025 list.

Cash App

Cash App has quickly grown into one of the most versatile payment platforms in the USA, earning its place among the Top Digital Wallets in USA 2025. Originally designed for peer‑to‑peer transfers, Cash App now offers a wide range of financial services, including Bitcoin trading, stock investing, and even direct deposit for paychecks. This makes it more than just a wallet — it’s a complete financial toolkit for everyday users.

By focusing on the Top Digital Wallets in USA 2025, you can simplify payments and enjoy global compatibility.

Security is a major focus for Cash App. Transactions are encrypted, and users can enable PIN codes or biometric authentication to protect their accounts. The app also provides instant notifications for every transaction, giving users full visibility and control over their money.

One of Cash App’s standout features is its integration with cryptocurrency. Users can buy, sell, and store Bitcoin directly within the app, making it a popular choice for those interested in digital assets. Combined with its simple interface and low fees, Cash App appeals to both casual users and those looking to expand their financial options.

Its reliability Cash app a top choice in the Top Digital Wallets in USA 2025 list.

Samsung Pay

Samsung Pay remains one of the most innovative mobile wallets in the USA, securing its place among the Top Digital Wallets in USA 2025. Unlike many competitors, Samsung Pay offers dual technology support: NFC (Near Field Communication) for modern tap‑to‑pay systems and MST (Magnetic Secure Transmission) for older card readers. This unique combination ensures that users can make payments almost anywhere, even at terminals that don’t support newer wallet solutions.

By focusing on the Top Digital Wallets in USA 2025, you can simplify payments and enjoy global compatibility.

Security is a major strength of Samsung Pay. Every transaction is authenticated through fingerprint, iris scan, or PIN, and sensitive card details are never shared with merchants. Instead, tokenization replaces card numbers with unique codes, protecting users from fraud and data theft. Samsung also integrates its Knox security platform, adding another layer of defense against cyber threats.

For USA users, Samsung Pay is widely accepted across retail stores, restaurants, and service providers. It also supports loyalty cards, gift cards, and transit passes, making it a versatile tool for everyday life. Combined with its global reach and compatibility with major banks, Samsung Pay continues to be a reliable choice for Android users who value flexibility and security.

Its reliability makes Samsung Pay a top choice in the Top Digital Wallets in USA 2025 list.

Zelle

Zelle has become one of the most widely used peer‑to‑peer payment solutions in the USA, earning its place among the Top Digital Wallets in USA 2025. Unlike many other wallets, Zelle is directly integrated into the banking system, allowing users to send and receive money instantly between accounts at major U.S. banks. This makes it especially convenient for people who prefer not to rely on third‑party apps but still want the speed of digital transfers.

Security is one of Zelle’s strongest features. Since it operates within existing bank apps, transactions benefit from the same encryption and fraud monitoring that banks already provide. Users don’t need to share sensitive account details — only an email address or phone number is required to complete a transfer.

By focusing on the Top Digital Wallets in USA 2025, you can simplify payments and enjoy global compatibility.

For USA users, Zelle is particularly valuable because of its widespread adoption. Most major banks and credit unions support Zelle, meaning millions of customers can access it without downloading a separate app. While Zelle is limited to domestic transfers and doesn’t support international payments, its speed and reliability make it a top choice for everyday peer‑to‑peer transactions.

Its reliability makes Zelle a top choice in the Top Digital Wallets in USA 2025 list.

Skrill

Skrill has established itself as a powerful option for international payments, making it one of the Top Digital Wallets in USA 2025. Originally popular among online gaming and trading communities, Skrill has expanded into mainstream finance by offering low‑cost transfers, cryptocurrency support, and global accessibility. For USA users who frequently send money abroad or engage in cross‑border transactions, Skrill provides a reliable and cost‑effective solution.

By focusing on the Top Digital Wallets in USA 2025, you can simplify payments and enjoy global compatibility.

Security is a key strength of Skrill. The wallet uses advanced encryption, two‑factor authentication, and fraud monitoring to protect user accounts. It also allows users to store multiple currencies, making it easier to manage international payments without worrying about hidden conversion fees.

Another standout feature is Skrill’s integration with cryptocurrency. Users can buy, sell, and hold digital assets directly within the wallet, giving it an edge over competitors that focus solely on fiat transactions. Combined with its simple interface and competitive fees, Skrill appeals to both everyday users and professionals who need flexible payment options.

Its reliability makes Skrill a top choice in the Top Digital Wallets in USA 2025 list.

Wise (TransferWise)

Wise, formerly known as TransferWise, has become one of the most trusted platforms for international payments, making it a standout among the Top Digital Wallets in USA 2025. Unlike traditional banks that often charge hidden fees, Wise is built on transparency. It shows users the real exchange rate and applies only a small upfront fee, which makes it one of the most cost‑effective solutions for cross‑border transfers.

Security is a major strength of Wise. The platform is regulated in multiple countries, including the USA, and uses advanced encryption to protect transactions. Users can also set up multi‑currency accounts, allowing them to hold, send, and receive money in dozens of currencies without worrying about expensive conversions.

By focusing on the Top Digital Wallets in USA 2025, you can simplify payments and enjoy global compatibility.

For USA users, Wise is especially valuable for international lifestyles — whether you’re sending money to family abroad, paying freelancers in another country, or managing business expenses across borders. Its mobile wallet app is simple to use, with features like instant notifications, budgeting tools, and integration with debit cards for everyday spending.

Its reliability makes Wise a top choice in the Top Digital Wallets in USA 2025 list.

Revolut

Revolut has transformed from a simple money transfer app into a full digital banking solution, making it one of the most versatile options among the Top Digital Wallets in USA 2025. Known for its sleek design and powerful features, Revolut offers users more than just payments — it provides budgeting tools, cryptocurrency trading, stock investing, and multi‑currency accounts all in one platform. This makes it especially appealing to users who want a single app to manage both everyday spending and long‑term financial growth.

Security is a major strength of Revolut. The app uses advanced encryption, biometric login, and instant transaction alerts to protect users. It also allows customers to freeze and unfreeze cards instantly, giving them full control in case of suspicious activity.

By focusing on the Top Digital Wallets in USA 2025, you can simplify payments and enjoy global compatibility.

For USA users, Revolut is particularly valuable because of its global reach. Travelers can spend abroad with minimal fees, while businesses benefit from transparent cross‑border payments. Combined with its modern interface and wide range of financial services, Revolut stands out as more than just a wallet — it’s a complete financial ecosystem.

Its reliability makes Revolut a top choice in the Top Digital Wallets in USA 2025 list.

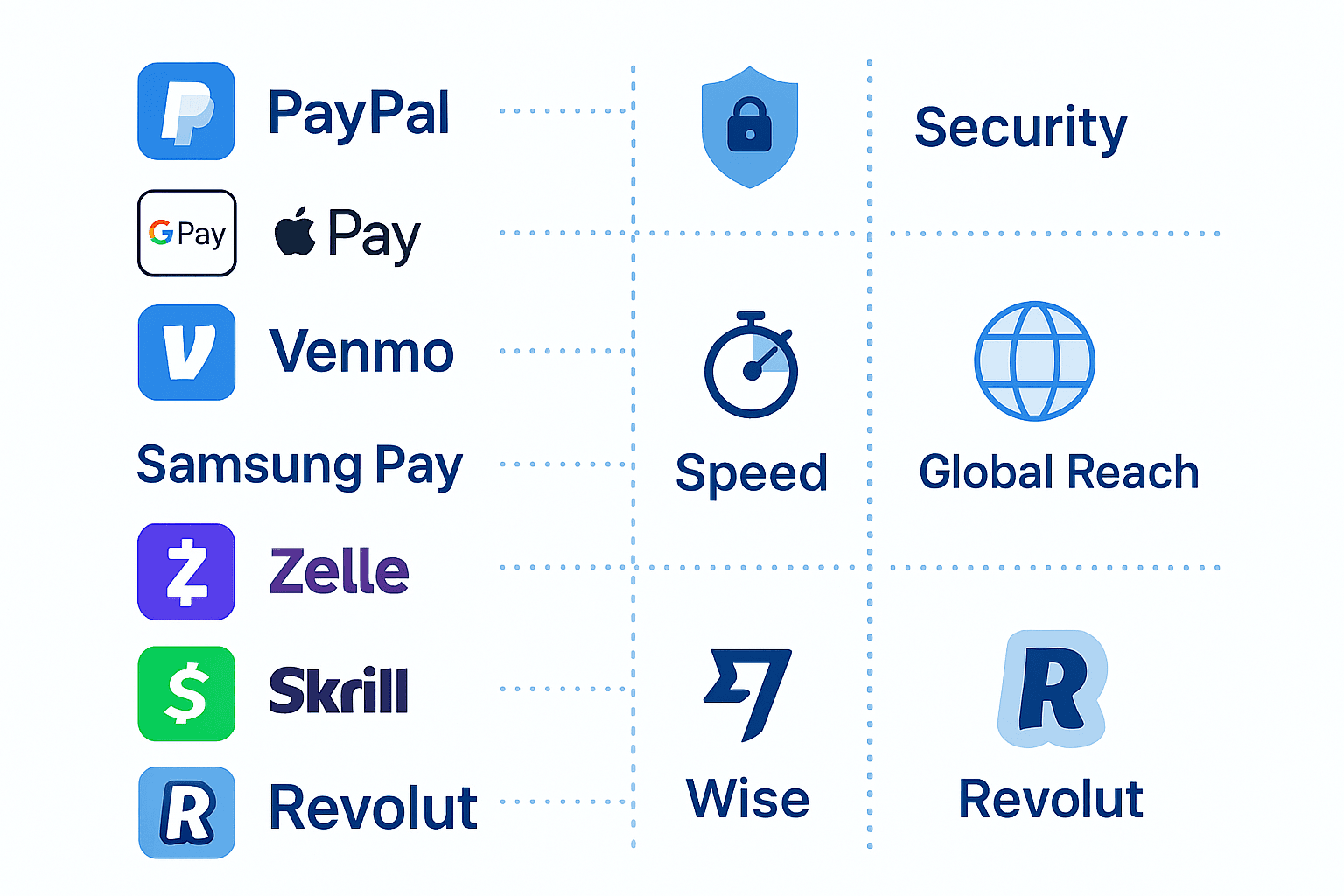

Comparing the Top Digital Wallets in USA 2025

When comparing the Top Digital Wallets in USA 2025, each app serves a unique purpose. After reviewing the leading options, it’s clear that each of the Top Digital Wallets in USA 2025 offers unique strengths tailored to different user needs. Instead of a rigid table, a narrative comparison highlights how these wallets stand apart while serving overlapping purposes.

For users who prioritize global reach, PayPal, Wise, and Revolut stand out. PayPal remains the most trusted for international e‑commerce, while Wise excels at transparent cross‑border transfers, and Revolut offers a complete financial ecosystem with multi‑currency accounts.

By focusing on the Top Digital Wallets in USA 2025, you can simplify payments and enjoy global compatibility.

Those who value seamless integration with devices will find Apple Pay and Google Wallet unmatched. Apple Pay is perfect for iOS users who want biometric security and instant tap‑to‑pay convenience, while Google Wallet provides Android users with a versatile, cross‑platform solution. Samsung Pay adds flexibility by supporting both NFC and MST, making it usable even at older payment terminals.

For peer‑to‑peer transfers, Venmo, Cash App, and Zelle dominate. Venmo adds a social twist, Cash App expands into crypto and investing, and Zelle provides instant bank‑to‑bank transfers directly within U.S. banking apps.

Finally, for users seeking specialized features, Skrill appeals to those who need low‑cost international payments and crypto support, while Revolut offers advanced budgeting and investing tools in addition to payments.

In short, the Top Digital Wallets in USA 2025 are not one‑size‑fits‑all. The best choice depends on whether you value global compatibility, device integration, social features, or advanced financial services. Together, they represent the future of digital finance in the USA.

Together, the Top Digital Wallets in USA 2025 reflect the future of digital finance.

Conclusion

The rise of mobile wallets has transformed the way people in the USA handle money, and the Top Digital Wallets in USA 2025 prove that convenience, security, and global reach are no longer luxuries — they are expectations. From PayPal’s trusted buyer protection to Apple Pay’s seamless iOS integration, from Wise’s transparent international transfers to Revolut’s all‑in‑one financial ecosystem, each wallet offers unique strengths that cater to different lifestyles and financial needs.Choosing from the Top Digital Wallets in USA 2025 ensures you stay ahead in digital finance.

For everyday peer‑to‑peer transfers, Venmo, Cash App, and Zelle provide instant solutions. For global transactions, Skrill, Wise, and PayPal stand out. And for users who want advanced features like crypto trading or budgeting tools, Cash App and Revolut deliver more than just payments. The key is to match your wallet choice with your personal goals — whether that’s saving money on fees, enjoying faster transactions, or managing finances across borders.

As digital finance continues to evolve, adopting the right wallet ensures you stay ahead in 2025. Explore these options, compare their features, and choose the one that aligns with your lifestyle. By adopting one of the Top Digital Wallets in USA 2025, you gain speed, security, and global access. For deeper insights into fintech trends, investing strategies, and passive income opportunities, check out our pillar posts:

By combining the right wallet with smart financial strategies, you’ll be ready to thrive in the digital economy of 2025 and beyond.

By focusing on the Top Digital Wallets in USA 2025, you can simplify payments and enjoy global compatibility.