Introduction

Digital payments are no longer just a convenience — they’ve become a necessity in 2025. With more people shopping online, transferring money internationally, and relying on contactless payments, mobile wallets are now the backbone of secure financial transactions. Whether you’re in the USA, UK, Canada, or Australia, choosing the right wallet can make all the difference in how safe, fast, and reliable your payments are.

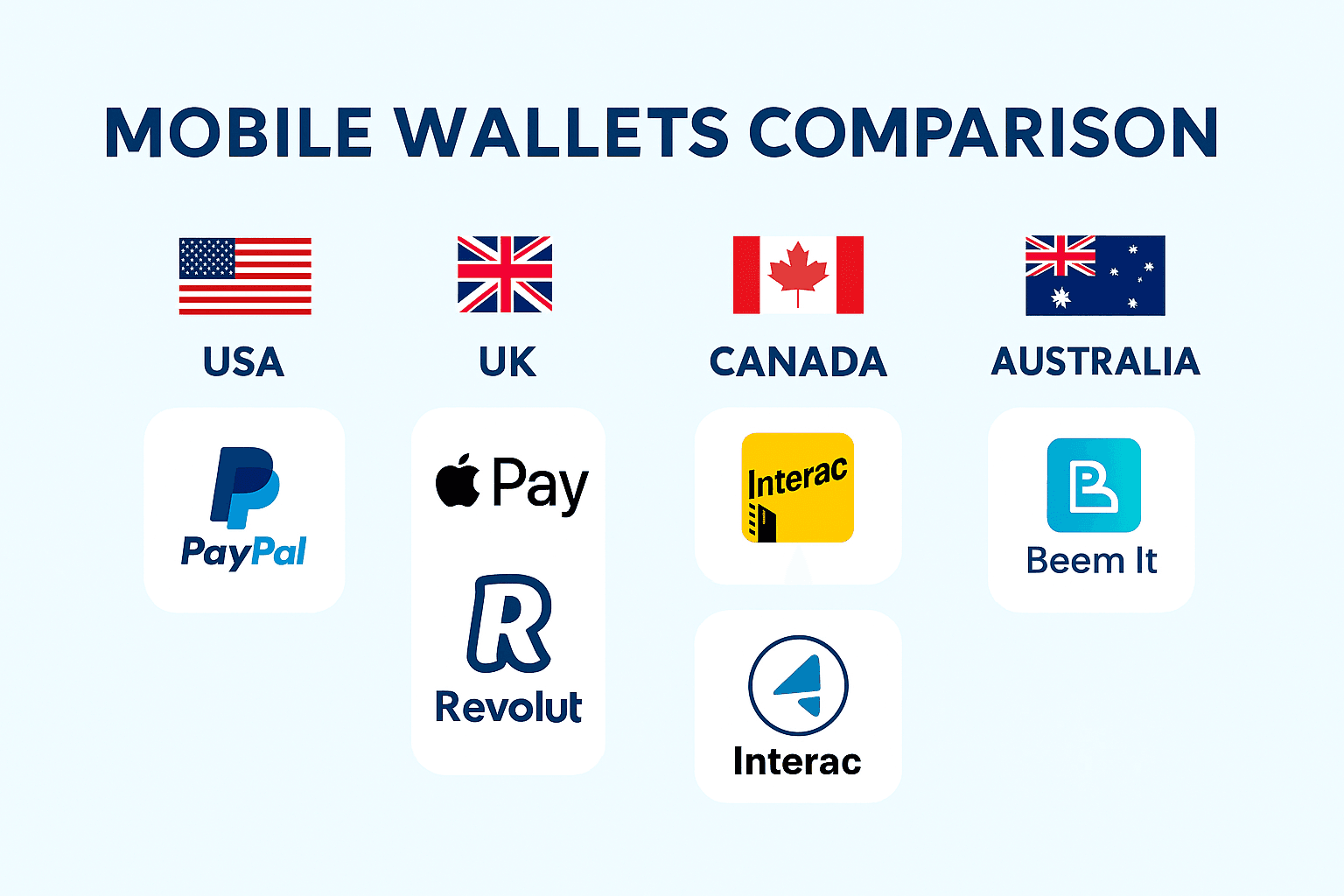

In this guide, we’ll explore the Top 10 Mobile Wallets in USA and compare them with leading options in the UK, Canada, and Australia. Each wallet offers unique features — from biometric security and fraud protection to international compatibility and zero‑fee transfers. By the end of this article, you’ll know exactly which wallet fits your lifestyle, whether you’re sending money abroad, paying bills locally, or shopping online.

Why focus on these countries? Because the Top 10 Mobile Wallets in USA and similar options in the UK, Canada, and Australia are among the most advanced in fintech adoption. They set global standards for security, innovation, and user experience. If a mobile wallet succeeds here, it’s usually trusted worldwide.

So let’s dive into the Top 10 Mobile Wallets in USA and beyond — helping you make smarter, safer choices for your digital payments in 2025.

📝 What Makes a Mobile Wallet Secure?

What Makes a Mobile Wallet Secure?

When choosing among the Top 10 Mobile Wallets in USA, security is the first factor to consider. A mobile wallet isn’t just a convenience tool — it’s where sensitive financial data is stored and protecting that data is critical.

The Top 10 Mobile Wallets in USA stand out because they use advanced encryption, biometric authentication, and fraud monitoring systems. These features ensure that even if your phone is lost or stolen, your funds remain safe. Many wallets also offer instant transaction alerts, so you can spot suspicious activity immediately.

Another key aspect of security is global trust. Wallets that succeed in the USA often expand to the UK, Canada, and Australia, proving their reliability across different financial systems. This is why the Top 10 Mobile Wallets in USA are not just popular locally but also set the benchmark for international fintech standards.

Ultimately, a secure mobile wallet combines technology, user control, and regulatory compliance. By understanding these features, you’ll be better prepared to choose the wallet that fits your lifestyle and keeps your money safe in 2025.

📝 Top Mobile Wallets in USA

Top Mobile Wallets in USA

The Top 10 Mobile Wallets in USA represent the most trusted and widely used payment solutions in 2025. These wallets combine convenience, speed, and advanced security features, making them essential for everyday transactions. Let’s look at the leading options that dominate the American market.

- PayPal

PayPal remains one of the most popular names in online payments. It offers seamless integration with online shopping platforms, peer‑to‑peer transfers, and strong buyer protection. Among the Top 10 Mobile Wallets in USA, PayPal stands out for its global reach and reliability. Learn more about secure payments directly from PayPal’s official website. - Apple Pay

Apple Pay is a favorite for iPhone users, offering biometric security through Face ID and Touch ID. It’s accepted at millions of stores and online platforms. Within the Top 10 Mobile Wallets in USA, Apple Pay is praised for its speed and ease of use. Explore how Apple Pay is transforming contactless payments worldwide. - Google Wallet

Google Wallet provides Android users with a secure and versatile payment option. It supports contactless payments, loyalty cards, and integration with Google services. As part of the Top 10 Mobile Wallets in USA, Google Wallet is valued for its accessibility and wide acceptance. For Android users, Google Wallet offers seamless integration with loyalty cards and payments. - Venmo

Venmo is especially popular among younger users for its social payment features. It allows quick transfers between friends and integrates with PayPal for broader functionality. In the Top 10 Mobile Wallets in USA, Venmo is unique because it combines payments with social interaction.

These wallets highlight why the Top 10 Mobile Wallets in USA are setting global standards. They not only provide secure transactions but also adapt to user lifestyles, whether it’s shopping online, splitting bills, or making international transfers.

📝 Top Mobile Wallets in UK

Top Mobile Wallets in UK

While the Top 10 Mobile Wallets in USA dominate the American market, the UK has its own set of innovative and secure payment apps. These wallets are designed to meet the needs of British consumers, offering seamless integration with local banks, strong security, and international compatibility.

- Revolut

Revolut is one of the UK’s most popular digital wallets, known for its multi‑currency support and low‑fee international transfers. Although it’s UK‑based, it competes with the Top 10 Mobile Wallets in USA by offering global features like crypto trading and budgeting tools. - Monzo

Monzo is a challenger bank that doubles as a mobile wallet. It provides instant notifications, savings pots, and strong fraud protection. Compared to the Top 10 Mobile Wallets in USA, Monzo emphasizes transparency and customer‑friendly banking. - PayPal

PayPal is as strong in the UK as compared to the USA. Its buyer protection and wide acceptance make it a staple in online shopping. Within the Top 10 Mobile Wallets in USA, PayPal is a leader, and its UK presence reinforces its global dominance. - Apple Pay

Apple Pay is widely accepted across UK retailers, transport systems, and online platforms. Just like in the Top 10 Mobile Wallets in USA, Apple Pay in the UK is valued for its speed, biometric security, and convenience.

These wallets highlight how the UK fintech ecosystem mirrors the innovation seen in the Top 10 Mobile Wallets in USA. Together, they set global standards for secure, fast, and user‑friendly digital payments.

📝 Top Mobile Wallets in Canada

Top Mobile Wallets in Canada

Canada’s fintech ecosystem is growing rapidly, and while the Top 10 Mobile Wallets in USA dominate globally, Canadian consumers rely on their own trusted solutions. These wallets are designed to integrate seamlessly with Canadian banks, support Interac transfers, and provide strong security for everyday transactions.

- Interac e‑Transfer

Interac is a uniquely Canadian payment system that allows instant transfers between bank accounts. It’s widely used for personal and business payments. Although not part of the Top Mobile Wallets in USA, Interac competes strongly by offering unmatched local convenience. Canada’s trusted solution, Interac e‑Transfer, connects directly with banks for secure transfers. - Wealthsimple Cash

Wealthsimple Cash combines mobile wallet functionality with investment features. It allows peer‑to‑peer transfers and integrates with Wealthsimple’s broader financial ecosystem. Compared to the Top Mobile Wallets in USA, Wealthsimple Cash appeals to Canadians who want payments and investing in one app. - PayPal

PayPal is as popular in Canada as it is in the USA. Its buyer protection and global acceptance make it a staple for online shopping. Within the Top Mobile Wallets in USA, PayPal is a leader, and its Canadian presence reinforces its worldwide dominance. - Apple Pay

Apple Pay is widely accepted across Canadian retailers, banks, and online platforms. Just like in the Top Mobile Wallets in USA, Apple Pay in Canada is valued for its biometric security and ease of use.

These wallets show how Canada balances local innovation with global standards. By comparing them with the Top Mobile Wallets in USA, readers can see how Canadian fintech solutions are keeping pace with international leaders while meeting unique local needs.

📝 Top Mobile Wallets in Australia

Top Mobile Wallets in Australia

Australia’s fintech landscape is thriving, and while the Top Mobile Wallets in USA dominate globally, Australian consumers rely on their own trusted solutions. These wallets are designed to integrate with local banks, support AUD transactions, and provide strong security for everyday payments.

- Beem It

Beem It is a uniquely Australian wallet that allows instant transfers between bank accounts. It’s widely used for peer‑to‑peer payments and small business transactions. Although not part of the Top Mobile Wallets in USA, Beem It competes strongly by offering unmatched local convenience. - CommBank App

The Commonwealth Bank’s mobile app doubles as a powerful wallet. It provides contactless payments, budgeting tools, and strong fraud protection. Compared to the Top Mobile Wallets in USA, CommBank App emphasizes integration with Australia’s largest banking network. - Apple Pay

Apple Pay is widely accepted across Australian retailers, transport systems, and online platforms. Just like in the Mobile Wallets in USA, Apple Pay in Australia is valued for its biometric security and ease of use. - Google Wallet

Google Wallet provides Android users with a secure and versatile payment option. It supports contactless payments, loyalty cards, and integration with Google services. Within the Top Mobile Wallets in USA, Google Wallet is praised for accessibility, and its Australian adoption shows global consistency.

These wallets highlight how Australia balances local innovation with global standards. By comparing them with the Top 10 Mobile Wallets in USA, readers can see how Australian fintech solutions are keeping pace with international leaders while meeting unique local needs.

📝 Comparison Table

Comparison of Mobile Wallets Across Countries

To help readers quickly evaluate options, here’s a side‑by‑side comparison of the Top Mobile Wallets in USA with leading wallets in the UK, Canada, and Australia. This table highlights availability, security features, and international compatibility.

| Wallet | Country | Key Features | Global Reach | Security Level |

|---|---|---|---|---|

| PayPal | USA, UK, Canada, Australia | Buyer protection, online shopping integration | Very High | Strong |

| Apple Pay | USA, UK, Canada, Australia | Biometric security, contactless payments | High | Strong |

| Google Wallet | USA, Australia | Android integration, loyalty cards | Medium | Strong |

| Venmo | USA | Social payments, peer‑to‑peer transfers | Medium | Moderate |

| Revolut | UK | Multi‑currency, crypto support | High | Strong |

| Monzo | UK | Instant notifications, savings pots | Medium | Strong |

| Interac e‑Transfer | Canada | Bank‑to‑bank transfers | Low | Strong |

| Wealthsimple Cash | Canada | Payments + investing | Medium | Strong |

| Beem It | Australia | Instant transfers, local focus | Low | Moderate |

| CommBank App | Australia | Bank integration, budgeting tools | Medium | Strong |

This comparison shows how the Top 10 Mobile Wallets in USA align with international leaders. By analyzing features side by side, readers can see which wallets offer the best mix of security, convenience, and global usability.

📝 Future of Mobile Wallets

Future of Mobile Wallets

Mobile Wallets in USA are not just shaping today’s digital payments — they’re paving the way for the future. As technology evolves, mobile wallets are expected to integrate even deeper into everyday life, offering features that go beyond simple transactions.

One major trend is biometric authentication. While the Top 10 Mobile Wallets in USA already use Face ID and fingerprint scanning, future wallets may rely on voice recognition or even behavioral patterns to verify identity. This will make payments faster and more secure.

Another development is integration with blockchain technology. Some of the Top Mobile Wallets in USA are experimenting with crypto support, allowing users to store, send, and spend digital currencies alongside traditional money. This hybrid approach could redefine how people view financial systems.

Artificial intelligence is also playing a role. Imagine a wallet that analyzes your spending habits and automatically suggests budgeting strategies. The Top Mobile Wallets in USA are already testing AI‑driven fraud detection, which will become more advanced in the coming years.

Finally, global interoperability is key. As wallets expand to markets like the UK, Canada, and Australia, the Top Mobile Wallets in USA will set the standard for cross‑border payments. This means fewer fees, faster transfers, and more convenience for international users.

The future of mobile wallets is about more than payments — it’s about creating a secure, intelligent, and globally connected financial ecosystem.

For more insights, check out our guide on Fintech innovations 2025 to see how mobile wallets connect with broader digital payment innovations.

📝 Tips for Choosing the Right Wallet

Tips for Choosing the Right Wallet

With so many options available, selecting the best wallet can feel overwhelming. By comparing the best 10 Mobile Wallets in USA with international alternatives, you can make a smarter choice.

- Security First

Always prioritize wallets with strong encryption and biometric authentication. The Top Mobile Wallets in USA excel in this area, offering fraud alerts and instant notifications. - Compatibility

Make sure the wallet works with your devices and banks. For example, Apple Pay is perfect for iPhone users, while Google Wallet suits Android. Within the Top Mobile Wallets in USA, compatibility is a major strength. - Global Reach

If you travel or send money abroad, choose a wallet with international support. PayPal, part of the Top 10 Mobile Wallets in USA, is widely accepted worldwide, making it ideal for cross‑border payments. - Extra Features

Look for wallets that offer budgeting tools, loyalty programs, or crypto support. Some of the best 10 Mobile Wallets in USA are adding these features to stand out from competitors. - User Experience

A wallet must have a simple interface and should be easy to use. The Top 10 Mobile Wallets in USA are designed with intuitive interfaces, ensuring smooth transactions for all users.

By following these tips, you’ll be able to choose a wallet that balances security, convenience, and innovation. Whether you’re in the USA, UK, Canada, or Australia, the Top 10 Mobile Wallets in USA provide a benchmark for what a reliable mobile wallet should look like.

📝 Final Thoughts on Global Adoption

Final Thoughts on Global Adoption

The rise of mobile wallets shows how financial technology is connecting people worldwide. The Top 10 Mobile Wallets in USA are not only shaping American transactions but also influencing fintech ecosystems in the UK, Canada, and Australia. Their success demonstrates that secure, fast, and user‑friendly payments are now a global expectation.

By comparing local innovations with the Mobile Wallets in USA, readers can see how different regions adapt to unique banking systems while following international standards. This global adoption proves that mobile wallets are more than tools — they’re gateways to financial inclusion, helping millions access secure payments in 2025 and beyond.

The Top 10 Mobile Wallets in USA continue to inspire fintech ecosystems worldwide. Their innovation influences adoption in the UK, Canada, and Australia, proving that secure, fast, and user‑friendly wallets are now a global necessity. As these solutions expand, they redefine how people everywhere experience digital payments.

For a deeper dive into how mobile wallets connect with personal finance, explore our earlier post on Fintech Innovations 2025: Digital Wallets & Mobile Banking.

📝 Conclusion + Call to Action

Conclusion

Mobile wallets have transformed the way people manage money in 2025. From instant transfers to biometric security, they’ve become essential tools for everyday life. By exploring the Top 10 Mobile Wallets in USA, and comparing them with leading options in the UK, Canada, and Australia, readers can see how global fintech innovation is shaping secure, fast, and user‑friendly payments.

The best 10 Mobile Wallets in USA stand out because they combine convenience with trust. Whether it’s PayPal’s buyer protection, Apple Pay’s biometric security, or Venmo’s social payments, these wallets are setting the benchmark for digital transactions worldwide. When compared with UK leaders like Revolut and Monzo, Canadian solutions like Interac and Wealthsimple Cash, or Australian wallets like Beem It and CommBank App, it’s clear that the best 10 Mobile Wallets in USA influence global standards.

Choosing the right wallet depends on your lifestyle. Do you shop online frequently? Do you send money internationally? Or do you prefer a wallet integrated with your local bank? Whatever your needs, the best 10 Mobile Wallets in USA and their global counterparts offer solutions that are secure, reliable, and tailored to modern financial habits.

Call to Action

Ready to upgrade your digital payments? Explore these wallets today, download the one that fits your needs, and experience the future of secure transactions. Don’t forget to share this guide with friends and family — because smarter payments mean safer living in 2025.

Pingback: Best Fintech Innovations 2025 Personal Finance | Abdullah – Finance Blogger - RevoValue – Smart Finance Insights

Pingback: Best Online Payment Apps in USA 2025 – Secure, Fast & Trusted Options

Pingback: 10 Best AI Powered Investing Apps for Beginners with Mobile Wallets in USA, UK, Canada, Australia (2025)