“Looking to build wealth in 2025? These 10 smart money moves will help you grow your finances across the US, UK, and Canada.“

Building wealth in 2025 requires more than just saving a few dollars here and there. With inflation, rising interest rates, and global economic shifts, smart financial strategies are essential. Whether you’re in the USA, UK, or Canada, these 10 money moves will help you grow wealth, protect your assets, and prepare for the future.

Automate Your Savings

Consistency is the secret to wealth. By automating transfers into a high-yield savings account or investment platform, you remove the temptation to spend.

- USA: Online banks like Ally or Marcus offer competitive APYs.

- UK: Look into Premium Bonds or high-interest ISAs.

- Canada: Consider TFSA-linked savings accounts.

👉 Automation ensures you never miss a contribution, and over time, compound interest does the heavy lifting.

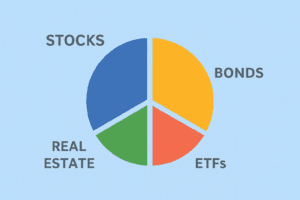

Diversify Your Investments

Putting all your money into one asset is risky. Diversification spreads risk and increases stability through these smart money moves.

- Stocks & ETFs: Track major indexes like the S&P 500 or FTSE 100.

- Bonds: Safer, steady returns.

- Real Estate: REITs allow property investment without owning physical property.

- Alternative Assets: Fractional shares, gold ETFs, or even crypto (with caution).

👉 A balanced portfolio protects against market volatility.

Maximize Tax-Advantaged Accounts

Governments reward savers with tax breaks — use them.

- USA: IRAs and 401(k)s grow tax-free or tax-deferred.

- UK: ISAs let you save/invest up to £20,000 tax-free annually.

- Canada: RRSPs and TFSAs are powerful tools for retirement and short-term goals.

👉 Missing out on these accounts means leaving free money on the table.

Audit and Cut Recurring Expenses

Subscriptions and hidden fees drain wealth. These smart money moves audit your monthly expenses:

- Cancel unused streaming services.

- Negotiate lower insurance premiums.

- Switch to cheaper utility providers.

👉 Every $50 saved monthly equals $600/year, which invested can grow significantly over time.

Invest in Inflation-Protected Assets

Inflation erodes purchasing power. Protect yourself with assets designed to keep pace.

- USA: Treasury Inflation-Protected Securities (TIPS).

- UK: Index-linked gilts.

- Canada: Real-return bonds.

👉 These instruments ensure your money grows even when prices rise.

Boost Your Credit Score with smart money moves

A strong credit score saves thousands in interest.

- Pay bills on time.

- Keep utilization below 30%.

- Avoid unnecessary new debt.

👉 In the USA, a score above 750 unlocks the best mortgage rates. In the UK and Canada, similar thresholds apply.

Explore Side Income Streams

2025 is the year of multiple income streams. These smart money moves help you a lot.

- Freelancing (Upwork, Fiverr).

- Affiliate marketing (finance tools, credit cards).

- Dividend stocks or ETFs.

- Blogging (like RevoValue!) with AdSense and affiliate links.

👉 Side hustles accelerate wealth-building and reduce reliance on one paycheck.

Stay Educated on Financial Trends

Knowledge is wealth. Follow these smart money moves and trusted finance blogs, subscribe to newsletters, and track market updates.

- USA: CNBC, Investopedia.

- UK: Financial Times, MoneySavingExpert.

- Canada: Globe and Mail, Wealthsimple blog.

👉 Staying informed helps you adapt quickly to economic changes.

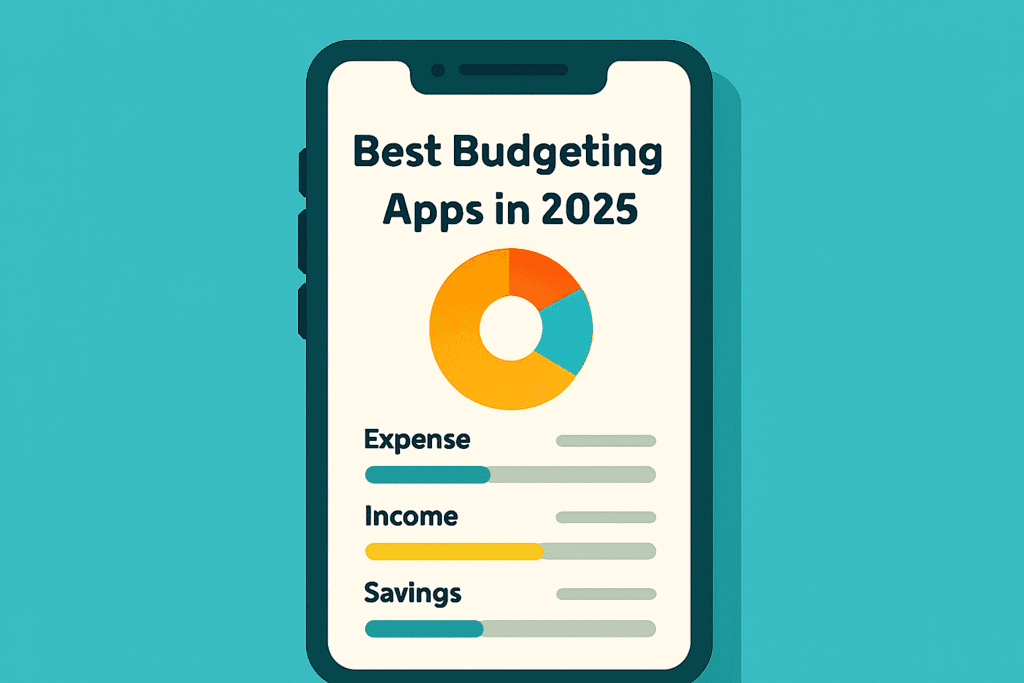

Use Budgeting Apps

Budgeting is the foundation of financial success.

- USA/Canada: Mint, YNAB, Wealthsimple.

- UK: Emma, Monzo budgeting tools.

👉 Apps provide real-time insights into spending, helping you stick to goals.

Plan for Retirement Early.

- Use retirement calculators to project needs.

- Increase contributions annually.

- Diversify between stocks, bonds, and retirement accounts.

👉 Even small contributions in your 20s using these smart money moves can grow into six figures by retirement.

Why These Moves Matter in 2025

- Inflation: Prices are rising globally.

- Interest Rates: Borrowing costs are higher.

- Digital Economy: Side hustles and online income are more accessible.

- Globalization: Investment opportunities are worldwide.

👉 Financial agility is the key to thriving in this environment.

Example Wealth-Building Scenario

Imagine saving $500/month in a diversified portfolio averaging 7% annual returns:

- After 10 years: ~$86,000

- After 20 years: ~$246,000

- After 30 years: ~$566,000

👉 Consistency + smart investing = long-term wealth.

Final Thoughts

Wealth in 2025 isn’t about luck — it’s about smart, consistent action. By automating savings, diversifying investments, maximizing tax accounts, and exploring side hustles, you set yourself up for financial freedom.

Start with one move today — and let RevoValue guide your journey to smarter money decisions. AlphaGamma’s list of best finance websites highlights resources that support smart money moves in 2025.

These smart money moves will surely help you.

For more details and information visit our homepage

Pingback: iRobot Bankruptcy 2025: Resilient Roomba Future and Smart Home Finance Outlook 2026 - RevoValue