Introduction

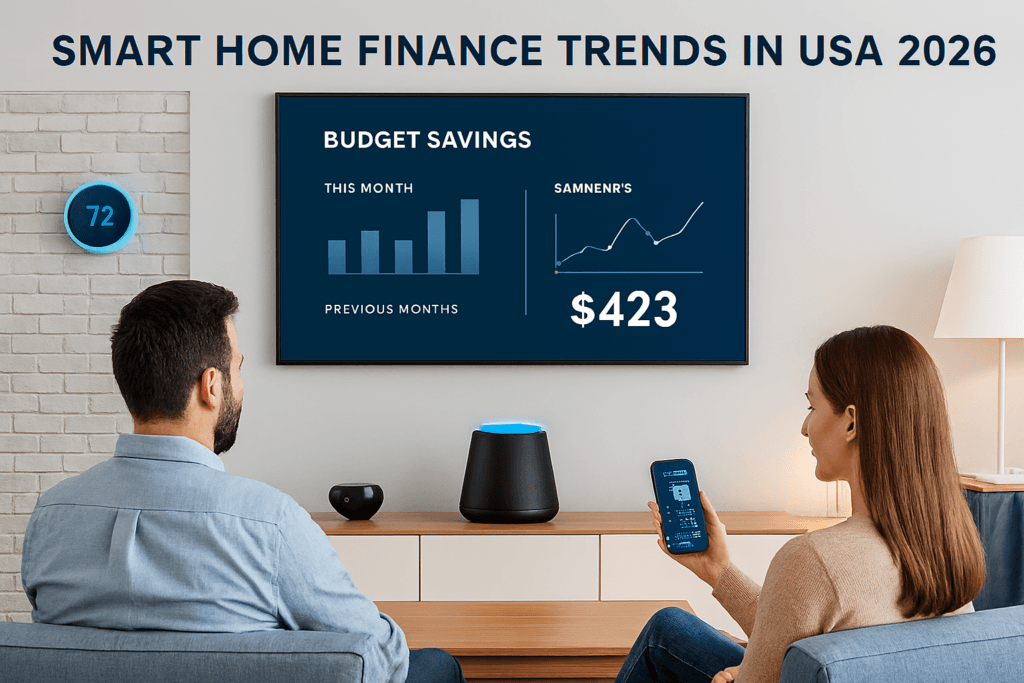

The year 2026 marks a turning point in how households across the USA manage money. With the rise of smart home finance trends, technology is no longer just about convenience — it is becoming a core driver of financial efficiency. From AI‑powered budgeting apps to connected devices that reduce utility costs, the smart home is evolving into a financial ecosystem where automation and savings go hand in hand.

At the center of this transformation is AI household finance 2026, where artificial intelligence helps families make smarter decisions about spending, saving, and investing. Smart thermostats, lighting systems, and connected appliances are not only improving comfort but also lowering monthly expenses. Meanwhile, digital wallets and AI‑driven investment tools are seamlessly integrating into daily life, reshaping how households interact with money.

For American families, these innovations represent more than just futuristic gadgets. They are practical solutions to everyday financial challenges. Rising living costs, inflation, and the demand for efficiency have made smart home automation savings a necessity rather than a luxury. By adopting these tools, households can achieve measurable financial benefits while staying ahead in a rapidly digitizing economy.

Globally, the USA is leading the way, but similar adoption is visible in the UK, Canada, and Australia. This makes the future of smart home economy a worldwide phenomenon, with lessons and opportunities that extend beyond borders.

This article explores the Top 10 Smart Home Finance Trends in USA 2026, highlighting how AI and automation are reshaping household money management. Whether you are a homeowner, investor, or simply curious about the future of finance, these insights will show how technology is redefining the way we live and save.

Rise of AI in Household Finance

One of the most significant smart home finance trends in 2026 is the rise of AI household finance. Artificial intelligence is no longer limited to predictive algorithms in banking apps; it has become a daily companion for families managing budgets, savings, and investments. By analyzing spending habits, forecasting bills, and suggesting personalized savings strategies, AI tools are reshaping how households interact with money.

In the USA, AI budgeting apps are leading this transformation. These apps connect directly with smart home devices, tracking utility usage and recommending cost‑saving measures. For example, if a smart thermostat detects higher energy consumption, the AI system can automatically adjust settings and update the household budget. This seamless integration between devices and finance platforms is creating a new era of smart home automation savings.

The impact extends beyond budgeting. AI‑driven investment platforms are helping families grow wealth by offering tailored recommendations based on risk tolerance and financial goals. For beginners, tools like AI‑Powered Investing Apps for Beginners provide accessible entry points into the world of automated investing.

Industry experts highlight that this trend is not just hype. According to Bloomberg, AI adoption in personal finance is expected to grow by more than 40% annually through 2026, driven by consumer demand for efficiency and transparency. This rapid growth underscores the importance of households embracing AI as a financial partner rather than just a technological novelty.

Ultimately, the rise of AI household finance 2026 represents a shift toward smarter, more proactive money management. By combining automation with financial intelligence, families can achieve greater control over their finances while preparing for the future of the smart home economy.

Savings Through Smart Home Automation

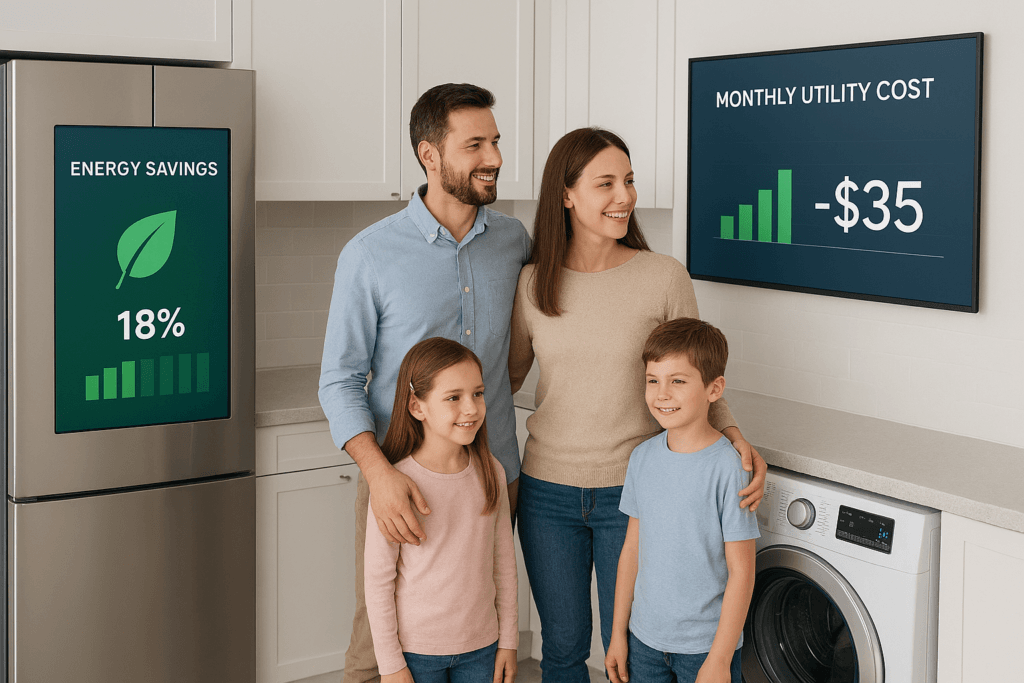

Among the most practical smart home finance trends in 2026 is the ability of connected devices to deliver measurable automation savings. What began as convenience features — smart thermostats, lighting systems, and connected appliances — has now evolved into financial tools that help households cut costs and manage budgets more effectively.

In the USA, families are reporting significant reductions in monthly expenses thanks to smart home automation savings. Smart thermostats, for example, can lower heating and cooling bills by 15–20% annually by learning user preferences and adjusting energy usage automatically. Similarly, smart lighting systems reduce electricity consumption by ensuring lights are only on when needed. These savings, when combined across multiple devices, create a noticeable impact on household finances.

The financial benefits extend beyond utilities. Connected appliances such as refrigerators and washing machines now include AI‑driven monitoring that alerts users to inefficiencies or potential breakdowns, preventing costly repairs. By integrating these devices with budgeting apps, households can track savings in real time and adjust spending habits accordingly.

For readers exploring practical applications, Top 10 Mobile Wallets in USA 2026 demonstrates how digital wallets complement automation by streamlining payments and tracking expenses. Together, these tools form a holistic approach to smart home finance.

Industry analysts at The Verge note that adoption of smart home devices is accelerating, with cost savings being a primary driver. As more households embrace automation, the financial impact will continue to grow, making smart homes not just a lifestyle upgrade but a financial strategy.

Ultimately, smart home automation savings highlight how technology is reshaping household money management. By reducing costs and improving efficiency, these devices are proving that the smart home is also a financially smart home.

Integration of Digital Wallets

Another major smart home finance trend in 2026 is the seamless integration of digital wallets into household money management. What began as a convenient way to pay for online purchases has now evolved into a cornerstone of the future of smart home economy. Digital wallets are no longer just apps on smartphones — they are becoming embedded into smart home ecosystems, enabling families to manage transactions, track expenses, and automate payments directly from connected devices.

In the USA, adoption of mobile wallets has surged as households seek faster, more secure ways to handle finances. Smart appliances and home assistants now allow users to pay utility bills, order groceries, or even schedule maintenance services using integrated wallet systems. This level of automation not only saves time but also ensures that payments are tracked and recorded in real time, reducing the risk of missed bills or overspending.

For readers exploring practical options, Top 10 Mobile Wallets in USA 2026 provides a comprehensive guide to the most reliable platforms available today. These wallets complement smart home automation by offering secure transactions and advanced budgeting features.

Industry reports from Reuters highlight that digital wallet usage in the USA is expected to grow by over 25% annually through 2026, driven by consumer demand for convenience and security. This growth underscores the importance of households adopting wallet solutions that integrate smoothly with smart home devices.

Ultimately, the integration of digital wallets represents a critical step in reshaping household money management. By combining automation, security, and accessibility, digital wallets are transforming smart homes into financial hubs where every transaction is effortless and efficient.

AI‑Driven Investment Tools

A defining aspect of smart home finance trends in 2026 is the growing role of AI‑driven investment tools. These platforms are transforming how households in the USA approach wealth building, making investing more accessible, personalized, and efficient. By leveraging artificial intelligence, families can now receive tailored recommendations that align with their financial goals, risk tolerance, and spending habits.

Unlike traditional investment advisors, AI tools analyze vast amounts of data in real time, from market movements to household budgets. This integration allows smart homes to function as financial ecosystems, where devices and apps collaborate to optimize both savings and investments. For example, if a budgeting app detects surplus funds, it can automatically suggest transferring them into an AI‑powered portfolio.

For beginners, resources like AI‑Powered Investing Apps for Beginners provide a practical entry point into this evolving landscape. These apps simplify complex financial decisions, offering clear insights and automated strategies that reduce the barriers to investing.

Industry experts at Morningstar emphasize that AI‑driven investment platforms are expected to dominate retail finance by 2026, with adoption rates growing rapidly among younger households. This trend highlights the future of smart home economy, where financial intelligence is embedded into everyday living.

The benefits are clear: improved portfolio performance, reduced emotional bias, and enhanced financial literacy. By combining automation with predictive analytics, AI‑driven investment tools empower households to take control of their financial future without requiring deep expertise.

Ultimately, the rise of AI‑driven investment tools demonstrates how smart homes are evolving beyond convenience into powerful financial hubs. As adoption grows, these platforms will play a central role in reshaping household money management across the USA and beyond.

Blockchain Security and Smart Contract Integrity

As smart homes evolve into financial ecosystems, security has become one of the most critical smart home finance trends in 2026. With devices handling sensitive data such as utility bills, savings, and investment transactions, households must ensure that automation does not compromise privacy or financial integrity.

One of the most promising solutions is the use of smart contracts powered by blockchain technology. These digital agreements execute automatically when predefined conditions are met, eliminating the need for intermediaries and reducing the risk of fraud. For example, a smart contract could automatically pay a utility bill once a household’s budget confirms available funds, ensuring timely payments without manual intervention.

In the USA, adoption of blockchain‑based financial tools is accelerating. Families are increasingly turning to platforms that combine AI with smart contracts to secure transactions and safeguard household budgets. This integration not only enhances transparency but also builds trust in the future of smart home economy.

For readers exploring related innovations, Fintech Innovations 2025: Personal Finance provides insights into how emerging technologies are reshaping financial security.

Industry experts at Bloomberg emphasize that blockchain adoption in consumer finance is expected to grow significantly through 2026, driven by demand for secure, automated solutions. This trend highlights the importance of households embracing smart contracts as part of their financial strategy.

Ultimately, the integration of security and smart contracts ensures that smart homes are not only convenient but also resilient against cyber threats. By combining automation, AI, and blockchain, households can achieve a new level of financial confidence in managing everyday transactions.

Global Perspective

While the USA is leading the adoption of smart home finance trends, the impact is increasingly global. Countries such as the UK, Canada, and Australia are following closely, adapting AI‑driven tools and automation to fit their unique financial landscapes. This international expansion highlights the future of smart home economy, where households worldwide are embracing technology to manage money more effectively.

In the UK, smart home automation is being integrated with digital banking platforms, allowing families to monitor utility savings alongside real‑time financial dashboards. Canada has seen rapid adoption of AI budgeting apps, particularly among younger households seeking to balance rising living costs with smarter savings strategies. Meanwhile, Australia is focusing on energy‑efficient smart devices, with government incentives encouraging households to adopt technologies that reduce bills and improve sustainability.

For readers interested in cross‑market comparisons, Best 10 Digital Banking Apps in USA, UK, Canada, Australia provides insights into how financial technology is evolving across these regions.

Industry reports from Fidelity Investments emphasize that global adoption of AI‑powered finance tools is expected to grow steadily through 2026, driven by consumer demand for transparency, efficiency, and automation. This trend suggests that smart home finance is not just a U.S. phenomenon but a worldwide movement reshaping household money management.

Ultimately, the global perspective shows that smart home finance is becoming a universal standard. By learning from innovations in the USA and adapting them to local contexts, households in the UK, Canada, and Australia are building financial resilience while preparing for a future where technology and money management are inseparable.

Challenges & Risks

While the promise of smart home finance trends in 2026 is exciting, households must also recognize the challenges and risks that come with adopting these technologies. As AI and automation become central to household money management, issues of privacy, cost, and accessibility remain critical concerns.

One of the biggest risks is data privacy. Smart home devices constantly collect financial and behavioral data, raising questions about how this information is stored and shared. Without strong safeguards, households may face vulnerabilities to cyberattacks or unauthorized access. Industry experts at Reuters warn that as AI adoption grows, so does the risk of data misuse, making security protocols essential for consumer trust.

Another challenge is the cost of adoption. While smart thermostats, connected appliances, and AI budgeting apps promise savings, the upfront investment can be significant. For many families, especially in developing regions, the financial barrier may slow adoption. This creates a gap between households that can afford smart home automation and those that cannot, potentially widening financial inequality.

Accessibility is also a concern. Not all households have the technical literacy to manage AI‑driven tools effectively. Without proper education and support, families may struggle to maximize the benefits of smart home finance. For readers exploring practical solutions, Best AI Budgeting Apps in 2025 offers insights into user‑friendly platforms designed to simplify adoption.

Ultimately, while smart home automation savings and AI‑driven finance tools offer immense potential, households must balance innovation with caution. By addressing privacy, cost, and accessibility challenges, families can ensure that the future of smart home economy remains inclusive, secure, and beneficial for all.

Future Outlook

Looking ahead, the future of smart home economy promises to reshape household money management far beyond 2026. As AI, automation, and digital finance converge, smart homes are expected to evolve into fully integrated financial ecosystems where every device contributes to savings, efficiency, and wealth creation.

In the USA, adoption of smart home finance trends will accelerate as families demand greater control over their budgets. AI household finance tools will become more predictive, offering real‑time insights into spending patterns and automatically suggesting investment opportunities. Smart contracts will streamline recurring payments, while digital wallets will continue to expand into new areas such as healthcare and insurance.

Globally, the outlook is equally promising. Countries like the UK, Canada, and Australia are expected to follow the U.S. lead, adapting innovations to local needs. For readers exploring broader financial transformations, Top 10 Global Investment Trends in 2026 provides insights into how AI and automation are reshaping wealth management worldwide.

Industry analysts at Charles Schwab predict that by 2030, smart home finance will become a mainstream standard, with AI‑driven platforms managing everything from utility bills to retirement planning. This growth will be fueled by consumer demand for transparency, efficiency, and personalization.

Ultimately, the future outlook suggests that smart homes will no longer be defined solely by convenience or comfort. Instead, they will serve as financial hubs, empowering households to save more, invest smarter, and achieve long‑term stability. By embracing these innovations today, families can position themselves at the forefront of a financial revolution that is set to redefine everyday living in the future of smart home economy.

Conclusion

The journey through the Top 10 Smart Home Finance Trends in USA 2026 reveals how technology is no longer just about convenience — it is becoming the backbone of household money management. From AI household finance tools to smart home automation savings, digital wallets, and AI‑driven investment platforms, families across the USA are embracing innovations that reshape the way they spend, save, and invest.

These trends highlight a clear shift toward the future of smart home economy, where automation and intelligence work together to deliver financial efficiency. By integrating budgeting apps, connected devices, and secure smart contracts, households can achieve greater control over their finances while reducing risks and costs.

For readers who want to explore related innovations, Best AI Stock Trading Apps in USA 2026 provides insights into how AI is transforming investing, while Fintech Innovations 2025: Personal Finance offers a broader look at the technologies driving financial change. Together, these resources build a strong foundation for understanding the evolving landscape of smart home finance.

Industry experts at Fidelity Investments emphasize that households adopting AI and automation early will enjoy long‑term financial resilience. This underscores the importance of staying informed and proactive as these technologies continue to advance.

Ultimately, the conclusion is clear: smart homes are becoming financially smart homes. By embracing these trends today, families can position themselves at the forefront of a financial revolution that promises efficiency, security, and growth. The future of household money management is here — and it is powered by AI, automation, and innovation.