Introduction

Personal Finance basics. Building wealth in your 20s is one of the smartest decisions you can make. At this stage of life, you have time on your side, and the earlier you start, the more powerful compound interest becomes. Many young adults struggle with budgeting, student loans, or credit card debt, but with the right personal finance strategies, you can set yourself up for long-term financial security.

This guide will walk you through the essentials of money management, saving, investing, and financial planning for young adults. Personal Finance basics. Whether you’re in the USA, UK, Canada, or Australia, these principles apply universally and can help you achieve financial independence.

1. Budgeting & Saving: The Foundation of Wealth

Budgeting is the main point of personal finance basics. Without a clear plan, money slips away faster than you realize.

Why Budgeting Matters

Personal finance basics.

- Helps track expenses and identify wasteful spending

- Ensures you live within your means

- Creates room for savings goals and investments

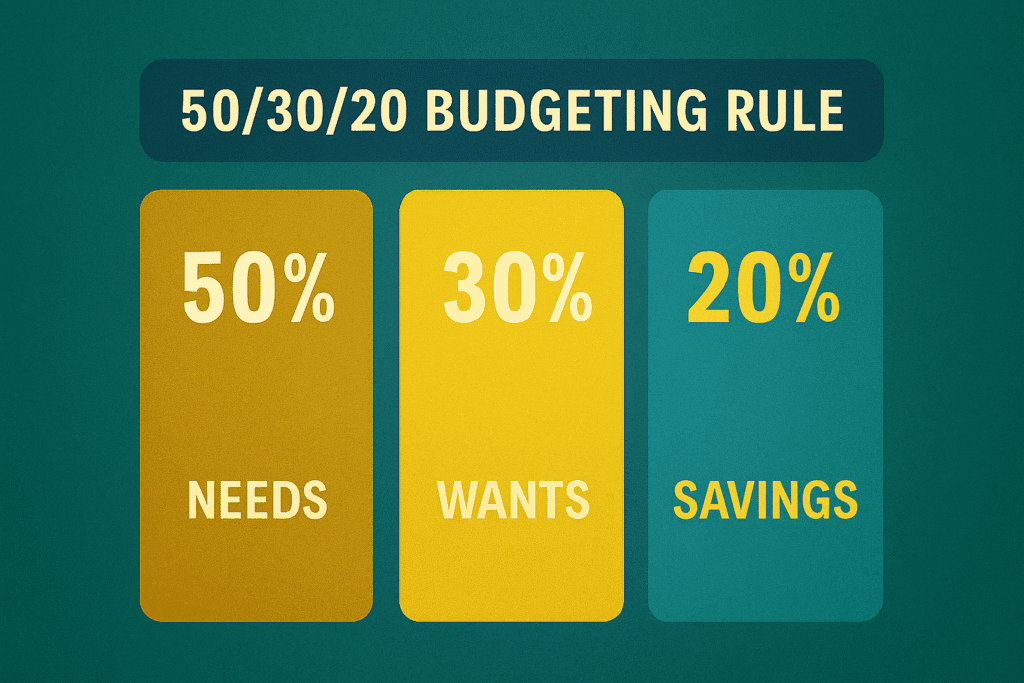

The 50/30/20 Rule

Check out our guide on Best Budgeting Apps for Beginners.

A popular budgeting strategy is the 50/30/20 rule:

- 50% of income → Needs (rent, food, bills)

- 30% → Wants (entertainment, shopping)

- 20% → Savings and debt repayment

This simple framework keeps your finances balanced while ensuring you’re building wealth through these personal finance basics.

Tools for Budgeting

- Budgeting apps like Mint, YNAB, or PocketGuard

- Spreadsheets for manual tracking

- Bank alerts for spending limits

2. Emergency Fund: Your Safety Net

An emergency fund is critical for financial security. Personal finance basics. Life is unpredictable — job loss, medical bills, or car repairs can derail your finances if you’re unprepared.

How Much to Save

Aim for 3–6 months of living expenses. This ensures you can survive unexpected challenges without relying on credit card debt through these personal finance basics.

Where to Keep It

- High-yield savings account (safe, liquid, earns interest)

- Avoid risky investments — this money must be accessible

3. Debt Management: Avoiding Traps

Debt can destroy wealth if not managed properly. Many young adults fall into credit card debt or struggle with student loans because they don’t use these personal finance basics.

Credit Card Debt

- Always pay balances in full to avoid high interest rates

- Use credit cards responsibly to build a strong credit score

- Avoid minimum payments — they trap you in debt cycles

Student Loans

- Explore refinancing options for lower interest rates

- Make extra payments when possible

- Understand repayment plans in your country (USA: federal loans, UK: student finance, Canada: OSAP)

4. Investing Early: The Power of Compounding

Investing in your 20s is the most powerful wealth-building tool. By following these personal finance basics even small amounts grow significantly over decades thanks to compound interest.

Beginner-Friendly Investments

- ETFs (Exchange-Traded Funds): Diversified, low-cost, beginner-friendly

- Index funds: Track major markets like S&P 500

- Retirement accounts: 401(k), IRA, UK pensions

Dollar-Cost Averaging

Invest a fixed amount regularly (e.g., monthly). This reduces risk by spreading purchases over time.

Example of Compounding

Investing $200/month at 8% annual return from age 22 → Over $600,000 by age 60.

5. Side Hustles & Income Growth

Relying only on a salary limits your wealth potential. Use these personal finance basics. Side hustles and passive income streams accelerate growth.

Ideas for Young Adults

- Freelancing (writing, design, coding)

- Digital skills (SEO, social media marketing, web development)

- Passive income (blogging, affiliate marketing, dividend stocks)

Reinvest extra earnings into savings or investments to compound faster.

6. Long-Term Financial Planning

Wealth isn’t built overnight. It requires consistent financial planning for young adults. Personal finance basics.

Retirement Accounts

- USA: 401(k), IRA

- UK: Workplace pensions, ISAs

- Canada: RRSP, TFSA

- Australia: Superannuation

Setting Milestones

- Save first $10,000 by mid-20s

- Pay off student loans before 30

- Build an investment portfolio with diversified assets

7. Lifestyle Choices That Impact Wealth

Personal finance basics; Wealth isn’t just about numbers — it’s about habits.

- Avoid lifestyle inflation (spending more as income grows)

- Cook at home instead of eating out daily

- Choose affordable housing early in your career

- Prioritize health — medical bills can drain savings

8. Building Financial Independence

The ultimate goal is financial independence — having enough assets to live without relying on a paycheck through these personal finance basics.

Steps to achieve it:

- Budget and save consistently

- Eliminate high-interest debt

- Invest in ETFs, index funds, and retirement accounts

- Grow income through side hustles

- Reinvest profits for compounding growth

9. Understanding Financial Psychology

Money isn’t just numbers — it’s emotional. Many young adults struggle with money management because of habits formed in childhood or peer pressure.

Common Psychological Traps

- Lifestyle inflation: Spending more as income grows.

- Fear of investing: Avoiding stocks or ETFs due to risk perception.

- Impulse spending: Buying wants instead of focusing on savings goals.

How to Overcome Them

- Track spending with budgeting apps to stay accountable.

- Automate savings so you don’t rely on willpower.

- Set clear financial goals (e.g., save $5,000 in one year).

10. Building Credit Responsibly

A strong credit score is essential in the USA, UK, Canada, and Australia. It affects your ability to rent apartments, get loans, and even secure jobs.

Tips for Young Adults

- Keep credit utilization below 30%.

- Avoid unnecessary credit cards; one or two are enough.

- Check your credit report annually for errors.

Example

If you have a $1,000 credit limit, keeping balances under $300 improves your score.

11. Insurance: Protecting Your Wealth

Insurance may feel unnecessary in your 20s, but it’s a critical part of financial security.

Types of Insurance to Consider

- Health insurance: Prevents medical debt.

- Car insurance: Required in most countries.

- Renters insurance: Protects belongings in shared housing.

- Life insurance: Optional, but useful if you have dependents.

Insurance ensures your emergency fund isn’t wiped out by unexpected events.

12. Building an Investment Portfolio

Once you’ve mastered saving, it’s time to grow wealth through an investment portfolio.

Diversification Basics

- Mix ETFs, index funds, and individual stocks.

- Add bonds for stability.

- Consider global funds for international exposure.

Example Portfolio for Beginners

- 60% ETFs (S&P 500, Nasdaq)

- 20% Bonds

- 10% International funds

- 10% Cash or high-yield savings

This balance reduces risk while maximizing growth.

13. Passive Income Strategies

In your 20s, building these streams accelerates wealth.

Ideas

- Blogging or YouTube (ad revenue, affiliate marketing)

- Dividend-paying stocks

- Rental property (if affordable)

- Selling digital products (eBooks, courses)

Case Study

A student who invests $200/month in dividend ETFs can earn $1,000+ annually in passive income by their 30s.

14. Networking and Career Growth

Your career is your biggest wealth-building tool. Financial planning for young adults must include professional growth.

Tips

- Build LinkedIn connections in your industry.

- Learn digital skills like SEO, coding, or data analysis.

- Seek mentors who can guide your career path.

Example

A marketing graduate who learns SEO and freelancing can double income within 2 years.

15. Global Perspective on Wealth Building

Since your blog targets USA, UK, Canada, and Australia, let’s highlight differences:

- USA: Focus on 401(k), IRA, credit score.

- UK: ISAs, workplace pensions, student loan repayment.

- Canada: RRSP, TFSA, OSAP loans.

- Australia: Superannuation, HECS-HELP loans.

This makes your content globally relevant and boosts SEO.

16. Avoiding Common Mistakes in Your 20s

Mistakes to Watch Out For

- Ignoring retirement accounts until 30+

- Using credit cards for lifestyle spending

- Not building an emergency fund

How to Avoid Them

- Stick to index funds and ETFs for stability.

- Automate savings and investments.

- Educate yourself with free resources before investing.

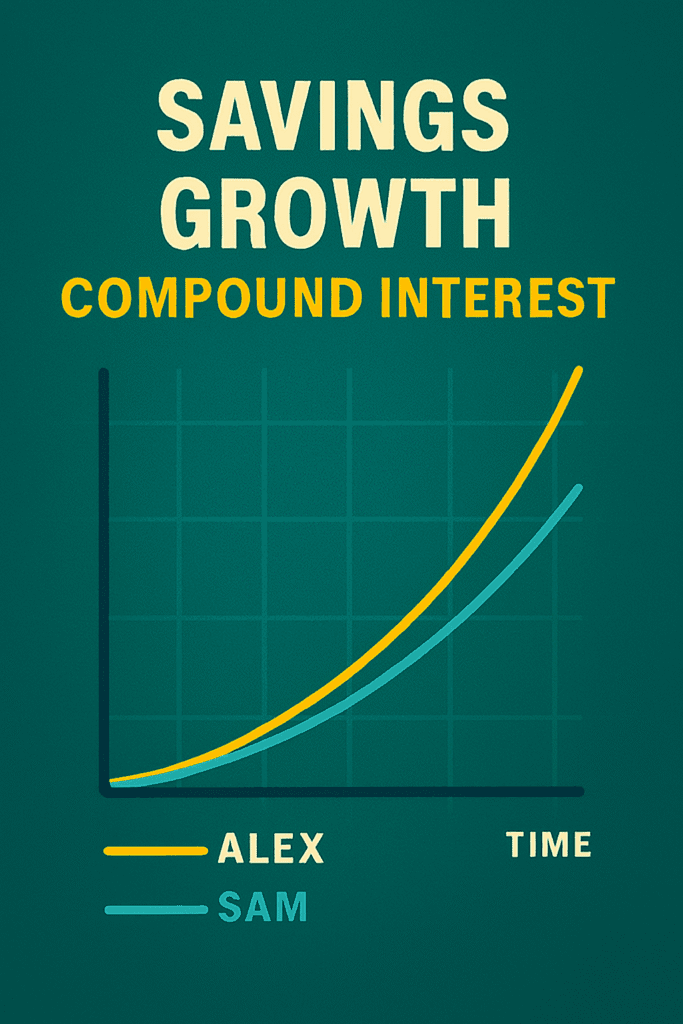

17. Case Study: Two Friends, Two Paths

Imagine two 22-year-olds:

- Alex saves $200/month in ETFs.

- Sam spends freely and starts saving at 30.

By age 60:

- Alex → $600,000+ (thanks to compound interest).

- Sam → $250,000.

This shows why starting early matters.

18. Tools and Resources for Beginners

Recommended Apps

- Budgeting apps: Mint, YNAB

- Investment apps: Robinhood, Vanguard, Fidelity

- Savings apps: Acorns, Chime

Free Learning Resources

- Investopedia (finance basics)

- Khan Academy (economics)

- Blogs and podcasts on personal finance for beginners

19. Building Wealth with Discipline

Wealth isn’t about luck — it’s about discipline.

Daily Habits

- Track expenses every evening.

- Save before spending.

- Read one finance article daily.

- Avoid comparing lifestyle with peers.

Consistency beats occasional big efforts.

According to Investopedia, compound interest is the key to long-term wealth.

20. Final Thoughts

Your 20s are the launchpad for lifelong wealth. Master personal finance basics. By mastering budgeting, building an emergency fund, avoiding credit card debt, and investing in ETFs and index funds, you’ll achieve financial independence faster than most. Add side hustles, passive income, and smart financial planning for young adults, and you’ll be unstoppable.

Remember: wealth is built step by step, not overnight. Start today, stay consistent, and let compound interest reward your discipline.

Conclusion

Your 20s are the perfect time to master personal finance basics. By focusing on budgeting, saving, debt management, and investing early, you’ll build a strong foundation for wealth. Add in side hustles, smart lifestyle choices, and long-term planning, and you’ll be on the path to financial independence.

Remember: start small, stay consistent, and let compound interest work its magic. Your future self will thank you.