Introduction

The story of iRobot bankruptcy 2025 marks one of the most significant turning points in consumer robotics and smart home technology. Founded in 1990 by MIT engineers, iRobot became a household name with the launch of the Roomba in 2002, a product that revolutionized automated cleaning and set the stage for the broader smart home movement. For years, Roomba dominated the market, symbolizing convenience and innovation. Yet, by late 2025, mounting debt, tariff pressures, and intense competition forced iRobot to file for Chapter 11 bankruptcy, reshaping the future of consumer robotics.

This development is not just about one company’s financial struggles; it represents a broader iRobot finance impact on the smart home industry. Investors, consumers, and policymakers are now asking what this means for the stability of robotics firms and the sustainability of AI‑driven household products. The acquisition of iRobot by Picea Robotics, a Chinese manufacturer, adds another layer of complexity, raising questions about global supply chains and market leadership.

For consumers, the Roomba future 2026 remains a pressing concern. Will the brand continue to innovate under new ownership, or will it lose ground to rivals like Ecovacs and Roborock? Early signs suggest that manufacturing in Vietnam will stabilize production, but consumer trust will depend on how well the company adapts to new financial realities.

At the same time, iRobot AI innovation continues to influence the smart home ecosystem. From advanced navigation systems to machine learning‑driven cleaning algorithms, the company’s legacy in AI remains strong. These innovations are part of broader smart home finance trends, where automation and artificial intelligence are reshaping how households manage time, energy, and money.

For readers tracking global investment opportunities, Top 10 Global Investment Trends in 2026 offers insights into how events like iRobot’s bankruptcy fit into the larger financial landscape.

iRobot’s Rise & Fall

The journey of iRobot is a classic example of how innovation can disrupt industries and then struggle under the weight of competition and financial pressures. Founded in 1990 by MIT engineers, the company initially focused on robotics for defense and space exploration. By 2002, iRobot shifted toward consumer markets with the launch of the Roomba, a product that quickly became synonymous with automated cleaning. The success of Roomba transformed iRobot into a household name and positioned it as a leader in consumer robotics.

For nearly two decades, Roomba dominated the market, selling millions of units worldwide and inspiring competitors to enter the space. However, the company’s reliance on a single flagship product left it vulnerable. As rivals like Ecovacs, Roborock, and Shark introduced cheaper and more advanced alternatives, iRobot’s market share began to erode. The failed Amazon acquisition in 2023 further weakened its position, as regulatory hurdles prevented the deal from going through. Without the backing of a tech giant, iRobot struggled to maintain its competitive edge.

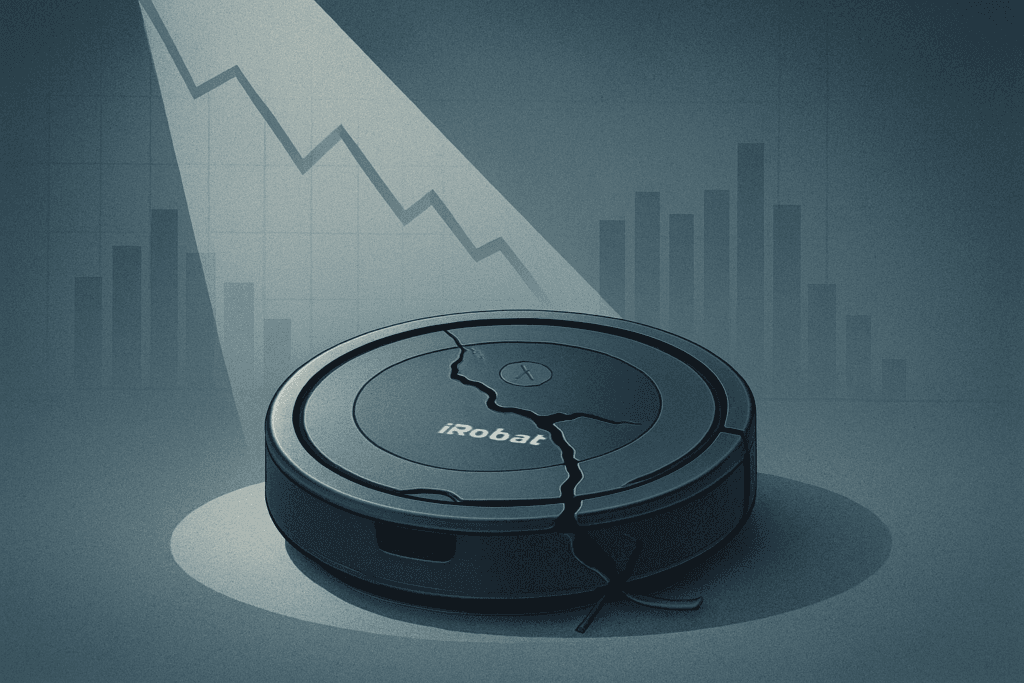

By 2024, revenues had dropped to $682 million, and the company faced mounting debt and tariff challenges. This financial decline culminated in iRobot bankruptcy 2025, a moment that shocked both consumers and investors. The filing highlighted the broader iRobot finance impact on the smart home industry, raising questions about the sustainability of robotics firms in a highly competitive market.

Despite these challenges, iRobot continued to invest in innovation. Its work in navigation systems, AI‑driven cleaning algorithms, and smart home integration demonstrated the company’s commitment to progress. These efforts reflect ongoing iRobot AI innovation, which remains influential even as the company transitions under new ownership.

Looking ahead, the Roomba future 2026 will depend on how well iRobot adapts to new financial realities and consumer expectations. The acquisition by Picea Robotics offers hope for stability, but success will require balancing innovation with affordability. For readers interested in how these shifts align with broader market forces, Smart Money Moves 2025 provides insights into how consumer finance trends intersect with technology adoption.

Ultimately, iRobot’s rise and fall illustrate the risks and rewards of pioneering in consumer robotics. Its story is a reminder that even industry leaders must evolve continuously to survive in the fast‑changing world of smart home finance trends.

Bankruptcy Details

The announcement of iRobot bankruptcy 2025 sent shockwaves through both the consumer robotics industry and financial markets. On December 2025, iRobot officially filed for Chapter 11 protection in Delaware, citing mounting debt, tariff pressures, and intensifying competition as the primary reasons behind its collapse. This filing marked the end of an era for a company that once defined the smart home robotics category with its Roomba vacuum.

The financial decline had been building for years. By 2024, iRobot’s revenue had dropped to $682 million, a sharp fall compared to its peak years. The company’s stock price plummeted nearly 78%, reflecting investor concerns about sustainability. This downturn highlighted the broader iRobot finance impact, showing how even established players can falter when innovation slows and rivals gain ground.

A key factor in the bankruptcy was the failed Amazon acquisition in 2023. Regulatory hurdles prevented the deal from closing, leaving iRobot without the financial backing it desperately needed. Without Amazon’s resources, the company struggled to compete against lower‑cost rivals like Ecovacs and Roborock, who were aggressively expanding in global markets. According to Reuters, iRobot filed for Chapter 11 in Delaware, citing debt and tariff pressures.

The Chapter 11 filing allowed iRobot to restructure under new ownership. Chinese manufacturer Picea Robotics stepped in, acquiring the company and pledging to stabilize operations. Manufacturing will continue in Vietnam, ensuring that production lines remain active. For consumers, this means the Roomba future 2026 is not in jeopardy — devices will still function, apps will remain supported, and new models are expected to be released. However, brand loyalty may be tested as customers adjust to the idea of iRobot being managed by a new parent company.

From a technological standpoint, iRobot AI innovation remains a valuable asset. The company’s expertise in navigation systems, machine learning algorithms, and smart home integration will likely continue under Picea’s leadership. These innovations are critical to maintaining relevance in the evolving landscape of smart home finance trends, where automation and AI are increasingly tied to household efficiency and cost savings.

For investors, the bankruptcy serves as a cautionary tale. It underscores the importance of diversification, regulatory awareness, and adaptability in fast‑moving industries. To understand how events like iRobot’s collapse fit into broader market dynamics, readers can explore Top 10 AI‑Powered Personal Finance Tools in USA 2025, which highlights how AI is reshaping consumer finance beyond robotics.

Ultimately, the bankruptcy details reveal both the fragility and resilience of iRobot. While the filing exposed deep financial vulnerabilities, the acquisition by Picea Robotics offers a pathway to recovery. The coming years will determine whether iRobot can rebuild its reputation and reclaim its place in the smart home ecosystem.

Effects on Consumer Experience

The announcement of iRobot bankruptcy 2025 raised immediate concerns among millions of households that rely on Roomba and other iRobot products. For many, the brand has become synonymous with convenience, automation, and trust in smart home technology. The question most consumers asked was simple: Will my Roomba still work?

The good news is that existing devices will continue to function. Apps, software updates, and customer support remain active under the new ownership of Picea Robotics. Manufacturing operations in Vietnam are expected to stabilize production, ensuring that new models will still reach global markets. This means the Roomba future 2026 is secure in terms of usability, though the pace of innovation may depend on how quickly the new leadership invests in research and development.

Consumer trust, however, is more complex. While iRobot has built a reputation for reliability, bankruptcy often creates uncertainty. Some households may hesitate to purchase new devices until they see proof of stability. Others may shift toward competitors like Ecovacs or Roborock, who are aggressively expanding their product lines. This dynamic highlights the broader iRobot finance impact, where consumer confidence directly influences sales and market recovery.

From a technology perspective, iRobot AI innovation remains a strong asset. Features such as advanced navigation, dirt detection, and adaptive cleaning algorithms have set Roomba apart from rivals. If Picea Robotics continues to build on these strengths, consumers could benefit from even smarter devices that integrate seamlessly into the broader smart home ecosystem. These innovations align with ongoing smart home finance trends, where automation reduces household costs and increases efficiency.

For readers exploring how technology adoption affects personal finance, Best AI‑Powered Savings Apps in USA 2026 offers practical insights into how AI tools can help households manage budgets more effectively. As highlighted by The Verge, existing Roomba devices will continue to function, with apps and support remaining active.

Ultimately, the impact on consumers will depend on how well iRobot balances affordability with innovation. If the company can maintain product quality while addressing financial challenges, the Roomba will remain a trusted companion in homes worldwide. If not, competitors may seize the opportunity to redefine the smart home market.

Economic and Market Impact

The collapse of iRobot highlights the fragile balance between innovation, competition, and financial sustainability in consumer robotics. The iRobot bankruptcy 2025 was not simply the result of one bad year; it reflected deeper structural challenges that investors and analysts must consider when evaluating technology companies.

By 2024, iRobot’s revenue had fallen to $682 million, a sharp decline from earlier highs. Its stock price dropped nearly 78%, erasing billions in market value. This dramatic downturn illustrates the broader iRobot finance impact, where overreliance on a single product line and failure to diversify revenue streams left the company vulnerable. Investors who once saw iRobot as a safe bet in the smart home sector were forced to reconsider the risks of consumer robotics.

Competition played a central role in this decline. Rivals such as Ecovacs, Roborock, and Shark introduced lower‑cost alternatives with advanced features, eroding iRobot’s market share. These competitors leveraged aggressive pricing strategies and rapid innovation cycles, leaving iRobot struggling to keep pace. The failed Amazon acquisition in 2023 further compounded the problem, depriving iRobot of the financial backing and ecosystem integration that could have stabilized its position.

Despite these setbacks, iRobot AI innovation remains a valuable asset. The company’s expertise in navigation systems, adaptive cleaning algorithms, and smart home integration continues to influence the industry. Under new ownership by Picea Robotics, these innovations could be leveraged to rebuild consumer trust and expand product offerings. If executed effectively, this could reshape the Roomba future 2026, ensuring that the brand remains relevant in a crowded marketplace.

From a broader perspective, the bankruptcy underscores the importance of monitoring smart home finance trends. As households increasingly adopt automation, the financial implications extend beyond convenience. Smart devices can reduce energy costs, improve efficiency, and even influence property values. Companies that successfully integrate AI into consumer finance ecosystems will be better positioned to thrive.

For investors seeking to understand how robotics and AI intersect with financial markets, Best AI Stocks to Buy in 2026 offers insights into emerging opportunities. These trends highlight that while iRobot stumbled, the sector as a whole continues to attract significant investment. Market analysts at Bloomberg noted that iRobot’s stock price collapsed nearly 78%, underscoring the risks of consumer robotics investments.

Ultimately, the financial and market implications of iRobot’s bankruptcy serve as a cautionary tale. Innovation alone is not enough; companies must balance technological progress with financial resilience and strategic partnerships. The coming years will reveal whether iRobot, under new leadership, can transform its challenges into opportunities and reclaim its place in the evolving smart home economy.

Global Perspective

The ripple effects of iRobot bankruptcy 2025 extend far beyond the United States. As one of the most recognized names in consumer robotics, iRobot’s financial struggles and restructuring under Picea Robotics have implications for households and investors worldwide.

In the USA, tariffs and regulatory scrutiny played a major role in weakening iRobot’s competitiveness. The failed Amazon acquisition in 2023 highlighted how government oversight can reshape corporate futures. For American consumers, the Roomba future 2026 remains secure in terms of product availability, but questions linger about whether innovation will keep pace with rivals.

In the UK, smart home adoption continues to grow, with households increasingly integrating AI‑driven devices. iRobot’s brand recognition remains strong, but competition from European and Asian manufacturers is intensifying. The broader iRobot finance impact in this region is tied to consumer confidence — if Picea Robotics can maintain quality, the brand may retain its foothold.

In Canada, where smart home penetration is rising steadily, iRobot’s bankruptcy serves as a reminder of the risks in consumer robotics. Canadian households value reliability, and the company’s ability to deliver consistent performance will determine its success.

In Australia, demand for smart home devices is expanding rapidly, driven by urban households seeking efficiency. Here, iRobot AI innovation could play a decisive role. Features like adaptive cleaning and integration with smart home ecosystems align with ongoing smart home finance trends, where automation reduces costs and enhances convenience.

Globally, the acquisition by Picea Robotics signals the growing influence of Chinese firms in consumer robotics. This shift may reshape supply chains, pricing strategies, and innovation cycles. For investors tracking these developments, AI‑Powered Crypto Analytics 2026 offers insights into how AI adoption is influencing financial markets across industries.

Ultimately, iRobot’s bankruptcy is not just a corporate event; it is a global case study in how finance, technology, and consumer behavior intersect. The company’s ability to adapt under new ownership will determine whether it remains a trusted name in homes worldwide or becomes a cautionary tale in the fast‑moving world of smart home automation.

Potential Risks and Key Factors

While the acquisition of iRobot by Picea Robotics offers hope for stability, the iRobot bankruptcy 2025 underscores several risks that investors, consumers, and policymakers must carefully evaluate. These risks highlight the challenges of sustaining innovation in a competitive global market and the financial vulnerabilities that can undermine even established brands.

One of the most pressing concerns is execution risk. Transitioning leadership and restructuring operations often create uncertainty. If Picea Robotics fails to maintain product quality or invest adequately in research, the Roomba future 2026 could be jeopardized. Consumers may lose confidence, and competitors could seize the opportunity to capture market share.

Another challenge lies in regulatory scrutiny. iRobot’s failed Amazon acquisition demonstrated how government oversight can reshape corporate futures. Under new ownership, regulators in the United States and Europe may closely monitor operations, especially given the involvement of a Chinese parent company. This adds complexity to the broader iRobot finance impact, where compliance costs and political tensions could affect profitability.

Consumer trust is also at stake. Bankruptcy often leaves households questioning whether warranties, support, and product updates will remain reliable. While iRobot AI innovation has historically set the brand apart, maintaining credibility will require consistent delivery of updates and new features. Without this, consumers may migrate to rivals offering more transparent guarantees.

Finally, ethical considerations must be addressed. As AI becomes more integrated into household devices, concerns about data privacy, algorithmic bias, and automation’s effect on employment are growing. These issues are part of wider smart home finance trends, where technology adoption must balance convenience with responsibility.

For readers exploring how technology risks intersect with financial planning, AI Retirement Planning Tools in USA 2026 provides insights into responsible adoption of AI in long‑term strategies.

In summary, iRobot’s path forward is filled with both opportunities and risks. Success will depend on how effectively the company manages execution, regulation, consumer trust, and ethical concerns. These factors will determine whether iRobot can rebuild its reputation or remain a cautionary tale in the evolving smart home economy.

Future Outlook

The path forward after iRobot bankruptcy 2025 is filled with both uncertainty and opportunity. Under the ownership of Picea Robotics, the company has a chance to rebuild its reputation and redefine its role in the smart home ecosystem. The key question is whether iRobot can leverage its legacy of innovation to regain consumer trust and investor confidence.

For households, the Roomba future 2026 appears stable in the short term. Devices will continue to function, apps remain supported, and new models are expected to reach the market. Yet, long‑term success depends on how well iRobot balances affordability with advanced features. Competitors are moving quickly, and consumers will demand more than incremental updates.

From a technological perspective, iRobot AI innovation remains central to its recovery. Advanced navigation, adaptive cleaning, and integration with broader smart home systems are areas where iRobot can still lead. If Picea Robotics invests strategically, these innovations could help the brand differentiate itself in a crowded marketplace.

Financially, the company’s future will be shaped by broader smart home finance trends. As households adopt more automation, the demand for cost‑efficient, AI‑driven devices will grow. This creates opportunities for iRobot to position itself not just as a cleaning solution, but as a key player in household financial efficiency.

For investors tracking these developments, AI‑Powered Investing Apps for Beginners offers insights into how AI adoption is influencing financial strategies. iRobot’s trajectory will be closely watched as a case study in resilience and adaptation.

Ultimately, the future outlook depends on execution. If iRobot can innovate while maintaining consumer trust, it may transform its bankruptcy into a turning point — proving that even setbacks can lead to stronger, smarter growth in the evolving smart home economy.

📝 Section 9: Conclusion

The story of iRobot bankruptcy 2025 is more than a corporate setback; it is a defining moment in the evolution of consumer robotics and smart home technology. Once celebrated as the pioneer of automated cleaning, iRobot now stands as a reminder that even industry leaders must adapt continuously to survive.

For consumers, the Roomba future 2026 remains secure in the short term, with devices continuing to function and new models expected under Picea Robotics. Yet, long‑term success will depend on whether the company can rebuild trust and deliver innovations that match or exceed those of its competitors. The resilience of iRobot’s brand will be tested in the coming years.

From a financial perspective, the iRobot finance impact highlights the risks of overreliance on a single product line and the importance of diversification. Investors can draw lessons from this case, recognizing that technological progress must be paired with financial resilience. The company’s bankruptcy underscores how quickly market dynamics can shift, especially in industries driven by rapid innovation.

Technologically, iRobot AI innovation remains a valuable legacy. Its advancements in navigation, adaptive cleaning, and smart home integration continue to influence the broader market. If nurtured under new ownership, these innovations could help iRobot reclaim its position as a leader in automation.

Finally, the event ties directly into broader smart home finance trends, where households increasingly view automation not just as convenience but as a financial strategy for efficiency and savings. For readers exploring how technology adoption intersects with personal finance, Best 10 Digital Banking Apps in USA, UK, Canada, Australia offers insights into how digital tools are reshaping household management.

In conclusion, iRobot’s bankruptcy is both a cautionary tale and a potential turning point. If the company can balance innovation with financial discipline, it may yet transform its challenges into opportunities — proving that resilience and adaptation are the true hallmarks of success in the smart home economy.