Introduction

When beginners first step into the world of investing, one of the most confusing questions they encounter is the difference between common vs preferred stocks. At first glance, both seem to represent ownership in a company, but the reality is that they function in very different ways. Understanding these differences is not just a matter of financial jargon — it’s the foundation of making smart investment decisions that align with your goals.

Think of it this way: imagine two friends, Ali and Sarah, both investing in the same company. Ali buys common stock, which gives him voting rights and the chance to benefit if the company’s share price rises significantly. Sarah, on the other hand, buys preferred stock, which doesn’t allow her to vote but guarantees her a steady dividend payment every quarter. Over time, Ali might see bigger gains if the company grows rapidly, but Sarah enjoys consistent income even if the stock price fluctuates. This simple example shows why knowing the difference between common vs preferred stocks is so important for beginners.

For new investors, the stock market can feel overwhelming. There are charts, ratios, dividends, and endless financial terms. But at its core, every beginner needs to understand the two basic building blocks: common shares and preferred shares. Common stocks are the most widely traded and represent direct ownership, while preferred stocks act more like a hybrid between stocks and bonds, offering stability and predictable returns.

Why does this matter for you as a beginner? Because choosing between common vs preferred stocks will shape your portfolio strategy. If your goal is long-term growth and you’re comfortable with risk, common stocks may be the right fit. If you prefer steady income and lower volatility, preferred stocks could be better. By the end of this guide, you’ll not only understand the differences but also know how to decide which option matches your financial goals.

What Are Common Stocks?

Common stocks are the most familiar type of shares in the market, and for most beginners, they represent the first step into investing. When you buy common stock, you’re purchasing a piece of ownership in a company. This ownership comes with certain rights and responsibilities, making common stocks the backbone of the stock market.

One of the defining features of common stocks is voting rights. Shareholders typically receive one vote per share, allowing them to participate in important corporate decisions such as electing board members or approving mergers. While beginners may not immediately see the impact of these rights, they highlight the democratic nature of corporate ownership. In contrast to preferred shares, which usually don’t grant voting power, common stocks give investors a voice in shaping the company’s future.

Another key aspect is dividends. Companies may choose to distribute a part of their profits to shareholders in the form of dividends. However, dividends from common stocks are not guaranteed. During profitable years, payouts can be generous, but in tough times, companies may reduce or suspend them altogether. This variability makes common stocks riskier than preferred stocks, but it also means they offer greater potential rewards.

Perhaps the biggest attraction of common stocks is their growth potential. If a company performs well, the value of its shares can rise significantly, creating opportunities for capital gains. For example, investors who bought Apple or Microsoft common stock years ago have seen their investments multiply many times over. This potential for long-term wealth building is why common stocks are often recommended for younger investors who can tolerate short-term volatility.

Of course, common stocks also carry risks. In the event of bankruptcy, common shareholders are last in line to receive payouts after creditors and preferred shareholders. This makes them inherently riskier, but the trade-off is the chance for higher returns.

For beginners, understanding common stocks is essential before comparing them to preferred shares. In the debate of common vs preferred stocks, common shares represent growth, ownership, and influence, while preferred shares lean toward stability and income. Knowing these distinctions helps new investors decide which path aligns with their financial goals.

What Are Preferred Stocks?

Preferred stocks are often described as a hybrid between traditional stocks and bonds. Unlike common shares, they don’t usually grant voting rights, but they provide investors with more predictable income. For beginners, understanding preferred stocks is essential because they represent a safer, income-focused alternative in the debate of common vs preferred stocks.

One of the biggest advantages of preferred stocks is their fixed dividends. Companies that issue preferred shares commit to paying a set dividend, often higher than what common shareholders receive. This makes preferred stocks attractive to investors who want steady cash flow, such as retirees or those seeking passive income. For example, many banks and utility companies issue preferred shares that consistently pay dividends, regardless of short-term market fluctuations.

Another important feature is priority in payouts. If a company faces financial trouble or liquidation, preferred shareholders are paid before common shareholders. This added layer of security reduces risk, making preferred stocks less volatile. While they don’t eliminate risk entirely, they provide more stability compared to common shares, which are last in line during bankruptcy.

Preferred stocks also tend to be less volatile in price. Because they are valued more for their dividend payments than for growth potential, their prices don’t swing as wildly as common stocks. This makes them appealing to conservative investors who prefer stability over speculation. However, this stability comes at a cost: preferred stocks usually have limited growth potential. Unlike common shares, which can skyrocket in value if a company performs well, preferred shares rarely experience significant price appreciation.

For beginners, preferred stocks can be a useful tool in building a balanced portfolio. They provide reliable income and reduce overall risk, but they don’t offer the same long-term wealth-building opportunities as common shares. In the comparison of common vs preferred stocks, preferred shares lean toward safety and income, while common shares lean toward growth and ownership influence.

Common vs Preferred Stocks: Key Differences

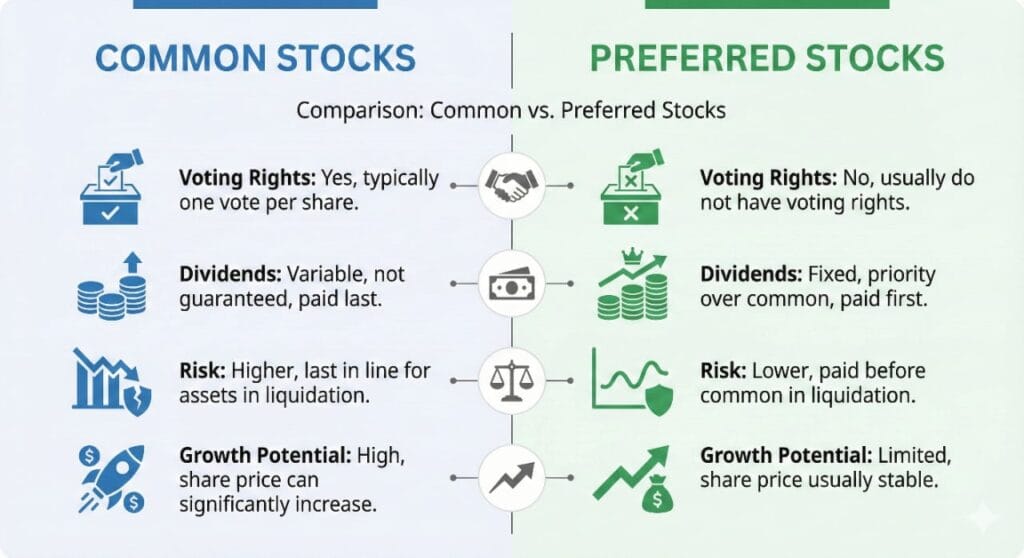

Understanding the differences between common vs preferred stocks is essential for beginners because each type of share offers unique benefits and drawbacks. While a simple table can highlight the distinctions, diving deeper into each feature helps clarify how these differences impact your investment strategy.

Ownership Rights

Common stocks grant shareholders voting rights, allowing them to influence corporate decisions such as electing board members or approving mergers. This ownership power gives investors a voice in shaping the company’s future. Preferred stocks, however, typically do not provide voting rights. For beginners, this means that owning common shares offers more involvement, while preferred shares focus purely on financial returns.

Dividend Payments

Dividends are one of the most noticeable differences in the common vs preferred stocks debate. Common stock dividends are variable and depend on company performance. If profits are strong, shareholders may receive generous payouts, but dividends can be reduced or eliminated during downturns. In common vs preferred stocks, preferred stocks, on the other hand, offer fixed dividends, providing predictable income regardless of short-term market conditions. This makes preferred shares appealing to investors who prioritize stability and cash flow.

Risk Level

Risk tolerance plays a major role in choosing between common vs preferred stocks. Common stocks carry higher risk because shareholders are last in line during bankruptcy or liquidation. Preferred shareholders, however, have priority in payouts, making them less risky. Beginners who are risk-averse may lean toward preferred shares, while those seeking growth may accept the higher risk of common shares in common vs preferred stocks.

Growth Potential

Common stocks are known for their potential to generate significant capital gains. If a company grows rapidly, the value of common shares can increase dramatically, rewarding long-term investors. Preferred stocks, however, are designed more for income than growth. Their prices remain relatively stable, and while dividends are reliable, they don’t usually appreciate in value. For beginners in common vs preferred stocks, this means common stocks are better for wealth-building, while preferred stocks are better for steady returns.

Priority in Payouts

In the event of distribution, preferred shareholders are paid before common shareholders. This priority provides an added layer of security, making preferred stocks less risky. In common vs preferred stocks, common shareholders, being last in line, face greater uncertainty. This distinction is critical for beginners to understand, as it directly affects how safe their investment is in worst-case scenarios.

Pros and Cons for Beginners

When deciding between common vs preferred stocks, beginners should carefully weigh the advantages and disadvantages of each. Both types of shares serve different purposes, and understanding their pros and cons helps new investors align choices with their financial goals.

✅ Pros of Common Stocks

The biggest advantage of common stocks is their growth potential. If a company performs well, the value of its shares can rise significantly, creating opportunities for long-term wealth building. Common shareholders also enjoy voting rights, giving them influence over corporate decisions. For beginners who want to feel connected to the companies they invest in, this ownership aspect can be motivating. Additionally, common stocks are widely available and easy to buy or sell through online brokers, making them accessible for new investors.

❌ Cons of Common Stocks

The downside of common stocks is their higher risk. Dividends are not guaranteed, and during economic downturns, companies may cut or eliminate payouts. In the event of bankruptcy, common shareholders are last in line to receive compensation, which increases uncertainty. Beginners who invest only in common stocks must be prepared for volatility and potential losses.

✅ Pros of Preferred Stocks

Preferred stocks offer predictable income through fixed dividends, which is especially appealing for conservative investors or those seeking passive income. They also provide priority in payouts, meaning preferred shareholders are compensated before common shareholders if a company faces financial trouble. This added security makes preferred stocks less risky and more stable in value.

❌ Cons of Preferred Stocks

On the flip side, preferred stocks lack voting rights, so investors have no say in corporate decisions. They also have limited growth potential, meaning beginners won’t see the same capital appreciation as they might with common shares. For those focused on building wealth over decades, preferred stocks may feel restrictive.

Which Should Beginners Choose?

Choosing between common vs preferred stocks ultimately depends on your personal goals, risk tolerance, and investment timeline. Both types of shares serve different purposes, and beginners should think carefully about what they want to achieve before making a decision.

If your primary goal is long-term growth, common stocks are usually the better choice. They allow you to benefit from capital appreciation as companies expand and increase profits. For example, investors who bought common shares of tech giants like Apple or Microsoft years ago have seen their investments multiply many times over. Common stocks also give you voting rights, which means you have a say in corporate decisions. While this may not matter to every beginner, it reinforces the sense of ownership.

On the other hand, if your priority is steady income and lower risk, preferred stocks may be more suitable. Their fixed dividends provide predictable cash flow, making them ideal for conservative investors or those who want passive income. Preferred shares also carry less risk because they have priority in payouts during liquidation. However, they don’t offer the same growth potential as common shares, which means you may miss out on big gains if the company performs exceptionally well.

For many beginners, the best approach is to combine both common and preferred stocks in a diversified portfolio. This way, you can enjoy the growth potential of common shares while balancing risk with the stability of preferred shares. In the debate of common vs preferred stocks, the right choice is not one-size-fits-all — it’s about aligning your investments with your financial goals and comfort level with risk.

FAQs

Beginners often have specific questions when comparing common vs preferred stocks. Addressing these FAQs not only clears confusion but also strengthens your understanding of how each type of share works in real-world investing.

Are preferred stocks safer than common stocks?

Yes, preferred stocks are generally considered safer because they provide fixed dividends and have priority in payouts during liquidation. However, “safer” doesn’t mean risk-free. Preferred shares can still lose value if the issuing company struggles. In the debate of common vs preferred stocks, preferred shares lean toward stability, while common shares carry more risk but greater growth potential.

Do preferred stocks always pay dividends?

Preferred stocks are designed to pay regular dividends, but payments depend on the issuing company’s financial health. While dividends are more reliable than those of common shares, they can still be suspended in extreme cases. Beginners should research the company’s track record before relying on preferred dividends as guaranteed income.

Can beginners mix common vs preferred stocks in one portfolio?

Absolutely. Many investors combine both types to balance risk and reward. Common stocks provide growth opportunities, while preferred stocks add stability and income. For beginners, this mix can be a smart way to diversify and reduce overall risk.

Which type of stock is better for long-term investing?

Common stocks are usually better for long-term wealth building because they offer capital appreciation. Preferred stocks, while stable, don’t typically grow in value. That said, retirees or income-focused investors may prefer the steady dividends of preferred shares. The choice between common vs preferred stocks depends on your financial goals and timeline.

Do common stocks always outperform preferred stocks?

Not necessarily. In bull markets, common stocks often outperform due to growth potential. But in uncertain times, preferred stocks may deliver better returns because of their reliable dividends. Beginners should understand that performance varies with market conditions.

Conclusion

For beginners, understanding the difference between common vs preferred stocks is one of the most important steps in building a strong investment foundation. These two types of shares may seem similar at first glance, but they serve very different purposes. In common vs preferred stocks, common stocks represent ownership, voting rights, and the potential for long-term growth. Preferred stocks, on the other hand, provide stability, fixed dividends, and priority in payouts, making them attractive to income-focused investors.

The choice between common vs preferred stocks ultimately depends on your personal goals. If you’re young, have time on your side, and want to build wealth over decades, common stocks may be the better fit. If you’re more conservative, prefer predictable income, or want to reduce risk, preferred stocks can provide peace of mind. Many beginners find that a balanced portfolio containing both types of shares offers the best of both worlds — growth potential from common stocks and stability from preferred stocks.

As you continue your investing journey, remember that there is no one-size-fits-all answer. The right choice depends on your risk tolerance, financial objectives, and long-term plan. By understanding the differences between common vs preferred stocks, you’re already ahead of most beginners who dive into the market without a clear strategy.

👉 To take the next step, explore our pillar guide on How to Start Investing in Stocks, where you’ll learn how to open a brokerage account, place your first trade, and build a diversified portfolio.

Pingback: Proven Guide: How to Invest in Stocks for Beginners in 2025 - RevoValue – Smart Finance Insights

Pingback: 10 Best AI Powered Investing Apps for Beginners with Mobile Wallets in USA, UK, Canada, Australia (2025)