Introduction

Cryptocurrency investing has always carried a reputation for complexity. Between volatile price swings, endless token choices, and the constant flood of market news, beginners often feel overwhelmed before they even make their first trade. In 2026, however, a new wave of technology is reshaping the way everyday investors approach crypto: AI crypto portfolio apps in USA 2026.

These apps are designed to simplify portfolio management by automating tasks that once required advanced knowledge or hours of manual effort. From rebalancing holdings to analyzing sentiment data, AI‑powered tools now deliver insights that were previously reserved for professional traders. For beginners, this means less guesswork and more confidence in every decision. The demand for AI crypto portfolio apps in USA 2026 is growing rapidly among beginners.

Investors are turning to AI crypto portfolio apps in USA 2026 for smarter decision‑making. What makes these apps especially powerful is their ability to combine automation with accessibility. Instead of staring at complicated charts, users can rely on intuitive dashboards that highlight wallet flows, risk scores, and smart trading strategies. The result? A smoother path to building wealth without needing to master every technical detail of blockchain or trading. Beginners often rely on AI crypto portfolio apps in USA 2026 to simplify portfolio tracking.

As adoption grows across the United States, these beginner‑friendly platforms are becoming essential for anyone who wants to participate in the crypto economy without being overwhelmed. With automation, AI crypto portfolio apps in USA 2026 reduce complexity for new traders. In fact, many of the features overlap with tools already discussed in our guide to AI‑Powered Investing Apps for Beginners, making portfolio apps the next logical step for new investors. In this post, we’ll explore the best AI crypto portfolio apps in USA 2026, their key features, and how they empower beginners to take control of their financial future.

What Are AI Crypto Portfolio Apps?

At their core, AI crypto portfolio apps in USA 2026 are digital platforms designed to help investors manage their cryptocurrency holdings with minimal effort. Unlike traditional trading apps that focus on buying and selling individual tokens, portfolio apps emphasize the bigger picture: how your assets are balanced, how risks are distributed, and how your investments can grow over time. The rise of AI crypto portfolio apps in USA 2026 marks a turning point in fintech adoption.

These apps use artificial intelligence to analyze wallet flows, market sentiment, and historical performance. At their core, AI crypto portfolio apps in USA 2026 combine automation with accessibility. By processing thousands of data points in real time, they provide recommendations that are far more accurate than manual guesswork. For beginners, this means the ability to make smarter decisions without needing years of trading experience. Unlike trading platforms, AI crypto portfolio apps in USA 2026 focus on long‑term wealth building.

One of the biggest advantages is accessibility. The popularity of AI crypto portfolio apps in USA 2026 reflects the shift toward smarter investing. Instead of complex spreadsheets or endless charts, users interact with simplified dashboards that highlight key metrics such as diversification, volatility, and profit potential. This makes portfolio apps ideal for those who want to participate in crypto markets but don’t have the time or expertise to track every movement. Beginners using AI crypto portfolio apps in USA 2026 gain insights once reserved for professionals.

It’s important to note that portfolio apps differ from trading platforms. While trading apps focus on executing buy/sell orders, portfolio apps are about long‑term management and strategy. They help you rebalance holdings, set automated alerts, and even integrate with multiple wallets to give a complete view of your financial position. Most AI crypto portfolio apps in USA 2026 integrate with multiple wallets for convenience.

For a deeper understanding of how portfolio management works in traditional finance, you can explore Investopedia’s guide to portfolio management. And if you’re curious about how these apps connect with everyday crypto usage, check out our breakdown of Top 10 Cryptocurrency Wallets in USA 2025, which shows how wallets and portfolio apps complement each other.

Key Features Beginners Should Look For

Choosing the right AI crypto portfolio apps in USA 2026 isn’t just about downloading the most popular option. For beginners, the difference between success and frustration often comes down to whether the app includes features that simplify decision‑making and reduce risk. Here are the essentials every new investor should prioritize:

1. Smart Rebalancing

Markets move quickly, and portfolios can become unbalanced in a matter of days. Smart rebalancing ensures your holdings stay aligned with your goals by automatically adjusting allocations. This prevents overexposure to volatile assets and keeps your investments diversified. Smart rebalancing is a hallmark of AI crypto portfolio apps in USA 2026.

2. Automated Alerts

Beginners benefit from timely notifications about price swings, wallet flows, or sentiment changes. Automated alerts help users act quickly without needing to monitor charts all day. This feature is especially useful for those balancing crypto investing with work or studies. Automated alerts in AI crypto portfolio apps in USA 2026 help beginners act quickly.

3. Risk Scoring

AI‑powered risk scoring assigns a clear rating to each asset in your portfolio. Instead of guessing whether a token is “safe,” beginners can rely on objective data to understand volatility and potential downside. This builds confidence and reduces emotional trading. Risk scoring in AI crypto portfolio apps in USA 2026 reduces emotional trading.

4. Multi‑Wallet Integration

Most investors use more than one wallet. Apps that integrate multiple wallets provide a complete view of your holdings in one dashboard. This saves time and ensures you don’t miss hidden risks or opportunities across platforms. Multi‑wallet integration makes AI crypto portfolio apps in USA 2026 more versatile.

For example, our guide to Top 10 Cryptocurrency Wallets in USA 2025 shows how wallets form the foundation of crypto investing, and portfolio apps build on that foundation by adding automation and analytics. Dashboards in AI crypto portfolio apps in USA 2026 simplify complex analytics.

5. Beginner‑Friendly Dashboards

The best apps translate complex data into simple visuals. Instead of overwhelming charts, they use clean dashboards with clear metrics like diversification, profit/loss, and sentiment analysis. This makes crypto investing accessible to anyone, regardless of technical background.

Top AI Crypto Portfolio Apps in USA 2026

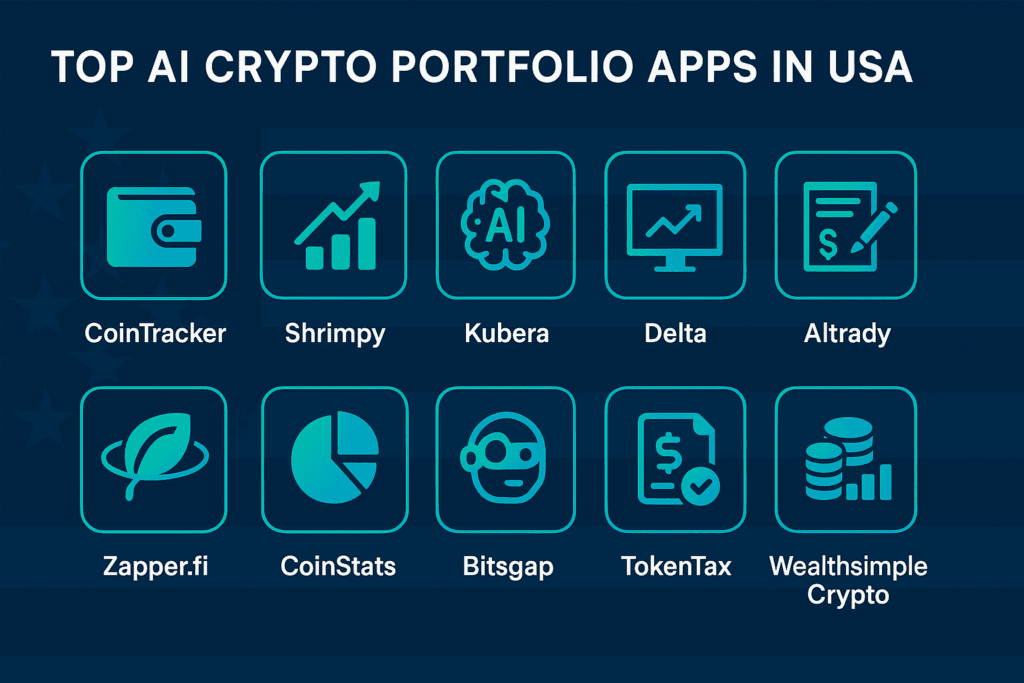

1. CoinTracker AI

CoinTracker has become one of the most trusted AI crypto portfolio apps in USA 2026 thanks to its ability to simplify tax reporting and portfolio tracking. Beginners benefit from automated dashboards that integrate multiple wallets, making it easy to see overall exposure in one place. The app’s AI engine highlights wallet flows and risk scores, helping new investors avoid over‑concentration in volatile tokens. While premium features require a subscription, the value for beginners lies in its compliance tools and ease of use. External reference: CoinDesk frequently covers CoinTracker’s role in crypto tax automation. CoinTracker is among the most trusted AI crypto portfolio apps in USA 2026.

2. Shrimpy AI Portfolio Manager

Shrimpy stands out for its smart rebalancing and social trading features. Beginners can copy strategies from experienced traders while letting AI handle portfolio adjustments automatically. This makes it one of the most practical AI crypto portfolio apps in USA 2026 for those who want to learn while investing. The app integrates with major exchanges, ensuring flexibility, though some advanced features may feel overwhelming at first. Internal link: It complements our guide on AI‑Powered Investing Apps for Beginners. Shrimpy stands out as one of the leading AI crypto portfolio apps in USA 2026.

3. Kubera Crypto Portfolio App

Kubera is unique because it tracks crypto, stocks, and DeFi assets together, giving beginners a holistic view of their finances. Kubera offers multi‑asset tracking within AI crypto portfolio apps in USA 2026. Its AI‑driven dashboards simplify diversification analysis, making it easier to balance risk across multiple asset classes. While subscription costs may deter casual users, serious beginners benefit from its long‑term wealth management approach. External link: Investopedia reviews Kubera as a leading multi‑asset tracker.

4. Delta Investment Tracker

Delta is one of the most beginner‑friendly AI crypto portfolio apps in USA 2026. Its clean mobile interface and real‑time alerts make it ideal for users who want simplicity without sacrificing functionality. Beginners can track multiple wallets, monitor diversification, and receive AI‑powered insights on market sentiment. While advanced analytics are limited compared to competitors, Delta’s strength lies in accessibility and ease of use. Delta remains a beginner‑friendly choice among AI crypto portfolio apps in USA 2026.

5. Altrady AI Trading & Portfolio

Altrady combines portfolio management with automated trading bots, making it a hybrid solution for beginners who want both tracking and execution. Its AI engine helps rebalance portfolios while offering smart trading strategies. Although the learning curve is steeper, beginners who stick with it gain access to professional‑grade tools. Internal link: This connects well with Top 10 Global Investment Trends in 2026. Altrady combines trading bots with AI crypto portfolio apps in USA 2026 features.

6. Zapper.fi

Zapper.fi is a DeFi‑focused portfolio app that integrates wallets and decentralized protocols seamlessly. For beginners exploring decentralized finance, it’s one of the most innovative AI crypto portfolio apps in USA 2026. Its dashboards simplify complex DeFi positions, making them understandable even for new users. While it’s best suited for those curious about DeFi, its AI‑powered analytics provide valuable insights into risk and yield opportunities.

7. CoinStats AI

CoinStats offers sentiment analysis, portfolio alerts, and multi‑exchange support. Beginners benefit from its AI‑driven dashboards that highlight diversification and risk exposure. The free version provides basic tracking, while premium unlocks advanced customization. External link: Glassnode often provides analytics that align with CoinStats’ AI‑driven insights.

8. Bitsgap Portfolio Manager

Bitsgap is known for combining trading bots with portfolio tracking. Beginners can automate strategies while monitoring overall portfolio health. Its AI engine helps identify profitable opportunities and rebalance holdings. While some features may feel advanced, the app remains one of the most versatile AI crypto portfolio apps in USA 2026 for those ready to grow beyond basics.

9. TokenTax AI Portfolio

TokenTax focuses on tax optimization and compliance, making it invaluable for beginners worried about reporting obligations. Its AI‑powered dashboards simplify tax calculations while integrating with multiple wallets. Although it’s more tax‑centric than trading‑focused, it ensures beginners stay compliant while building their portfolios. External link: Investopedia’s crypto tax guide highlights the importance of tools like TokenTax.

10. Wealthsimple Crypto (USA Expansion 2026)

Wealthsimple, already popular in Canada, expanded into the USA in 2026 with a beginner‑friendly crypto portfolio app. Its AI‑powered dashboards integrate traditional finance tools with crypto, making it ideal for new investors who want simplicity and regulatory compliance. While token selection is limited compared to global exchanges, its ease of use and strong compliance make it one of the safest AI crypto portfolio apps in USA 2026. Internal link: Complements Best AI‑Powered Savings Apps in USA 2026.

Benefits for Beginners

For beginners entering the crypto market, the learning curve can feel steep. Prices move quickly, technical jargon is everywhere, and one wrong decision can lead to significant losses. This is where AI crypto portfolio apps in USA 2026 provide a major advantage: they simplify the process and reduce risk while building confidence.

1. Simplifies Decision‑Making

AI tools analyze thousands of data points in real time, turning complex market signals into clear recommendations. Beginners no longer need to guess when to rebalance or which assets to prioritize. Beginners save time by using AI crypto portfolio apps in USA 2026. Instead, they can rely on automated insights that make portfolio management straightforward.

2. Reduces Emotional Trading

One of the biggest challenges for new investors is reacting emotionally to market swings. AI portfolio apps help remove this bias by offering objective, data‑driven strategies. This ensures beginners stick to long‑term goals rather than chasing short‑term hype. Emotional trading is reduced with AI crypto portfolio apps in USA 2026.

3. Provides Educational Insights

Many apps include dashboards that explain diversification, volatility, and risk scoring in simple terms. This not only helps beginners manage their portfolios but also teaches them the fundamentals of investing. Internal link: See how similar tools are used in Best AI‑Powered Savings Apps in USA 2026. Educational dashboards in AI crypto portfolio apps in USA 2026 build confidence.

4. Saves Time

Instead of monitoring charts all day, beginners can set automated alerts and let AI handle the heavy lifting. This makes crypto investing accessible even for students, freelancers, or professionals balancing multiple responsibilities. Accessibility is the biggest advantage of AI crypto portfolio apps in USA 2026.

Glassnode provides analytics that show how AI‑driven insights reduce risk and improve decision‑making for everyday investors. Smarter investing starts with AI crypto portfolio apps in USA 2026.

Risks and Limitations

While AI crypto portfolio apps in USA 2026 offer powerful tools for beginners, it’s important to recognize that no technology is without drawbacks. Understanding these risks helps new investors use these apps wisely and avoid over‑reliance on automation.

1. Over‑Reliance on AI

Beginners may be tempted to trust AI recommendations blindly. While these apps provide valuable insights, they cannot predict every market movement. Relying solely on AI without personal judgment can lead to missed opportunities or unexpected losses.

2. Data Privacy Concerns

Portfolio apps often require access to wallets, exchanges, and personal financial data. This raises questions about security and privacy. Beginners should ensure they use apps with strong encryption and compliance standards. External reference: Glassnode highlights the importance of secure analytics in crypto investing.

3. Market Volatility Still Applies

Even the best AI cannot eliminate crypto’s inherent volatility. Sudden price swings, regulatory changes, or global events can impact portfolios in ways no algorithm can fully anticipate. Beginners must remain cautious and avoid investing more than they can afford to lose.

4. Subscription Costs

Many advanced features, such as tax optimization or multi‑wallet integration, are locked behind paid plans. For beginners, this can be a barrier, especially if they are just starting with small investments. Internal link: Compare this with free options discussed in Top 10 Cryptocurrency Wallets in USA 2025.

By recognizing these limitations, beginners can use AI crypto portfolio apps in USA 2026 as supportive tools rather than complete solutions, balancing automation with personal responsibility.

Future Outlook

The rise of AI crypto portfolio apps in USA 2026 is only the beginning of a larger transformation in digital finance. As artificial intelligence continues to evolve, these apps will expand beyond simple portfolio tracking into full‑scale financial ecosystems that reshape how beginners and professionals alike manage wealth.

1. Integration with DeFi

Decentralized finance (DeFi) is expected to play a bigger role in mainstream investing. Future portfolio apps will integrate directly with DeFi protocols, allowing beginners to access yield farming, staking, and liquidity pools without needing advanced technical knowledge. Internal link: This trend aligns with insights from Top 10 Global Investment Trends in 2026.

2. ESG‑Focused Portfolios

Environmental, Social, and Governance (ESG) investing is gaining traction worldwide. AI portfolio apps will begin offering ESG‑filtered crypto portfolios, helping beginners align their investments with ethical and sustainable values. This adds a new dimension to long‑term wealth building. ESG scoring will soon be part of AI crypto portfolio apps in USA 2026.

3. AI‑Driven Compliance and Security

Regulation in the crypto space is tightening, especially in the USA. Future apps will use AI to automate compliance checks, tax reporting, and fraud detection. Beginners will benefit from safer environments where risks are flagged before they become costly mistakes. External reference: World Economic Forum highlights how AI is reshaping compliance and digital trust. Compliance automation is a future trend for AI crypto portfolio apps in USA 2026.

4. Personalized Financial Coaching

Beyond analytics, portfolio apps will evolve into personal finance coaches. By analyzing spending habits, savings goals, and investment behavior, AI will provide tailored recommendations that go beyond crypto, helping beginners build holistic financial strategies. DeFi integration will expand within AI crypto portfolio apps in USA 2026.

The future of AI crypto portfolio apps in USA 2026 points toward deeper integration, smarter compliance, and more personalized guidance. For beginners, this means easier access to advanced tools that were once reserved for professionals, making the path to financial independence clearer than ever. Personalized coaching will evolve inside AI crypto portfolio apps in USA 2026.

Conclusion: Smarter Investing Starts Here

Starting your cryptocurrency journey can be simple and stress‑free. With the rise of AI crypto portfolio apps in USA 2026, beginners now have access to tools that simplify decision‑making, reduce emotional trading, and provide educational insights that build confidence. These apps are more than just trackers — they are gateways to smarter, more sustainable investing.

By leveraging automation, risk scoring, and multi‑wallet integration, new investors can focus on long‑term growth rather than short‑term volatility. While risks such as over‑reliance on AI and subscription costs remain, the benefits far outweigh the limitations when used responsibly. The future of AI crypto portfolio apps in USA 2026 points toward holistic financial ecosystems.

Looking ahead, the future of portfolio apps points toward deeper integration with DeFi, ESG‑focused investing, and AI‑driven compliance. This means beginners will continue to gain access to advanced tools once reserved for professionals, making financial independence more achievable than ever.

If you’re ready to take the next step, explore our related guides like AI‑Powered Investing Apps for Beginners and Top 10 Global Investment Trends in 2026 to expand your knowledge. Bookmark RevoValue and stay updated with the latest fintech insights — because smarter investing starts with the right tools, and the right tools start here.