Introduction

The world of cryptocurrency is evolving faster than ever, and AI-Powered Crypto Analytics 2026 is at the center of this transformation. Investors in the USA, UK, Canada, and Australia are increasingly turning to AI crypto trading tools 2026 to gain an edge in volatile markets. These tools combine machine learning, predictive modeling, and blockchain transparency to deliver insights that were once impossible to achieve manually.

Unlike traditional analysis, AI‑Powered Crypto Analytics 2026 leverages massive datasets — from on‑chain transactions to global macroeconomic signals — to identify patterns and opportunities. This makes it possible to design smart crypto trading strategies that adapt in real time, reducing risk while maximizing returns. For retail investors, this shift represents a chance to compete with institutional players by using accessible, AI‑driven platforms such as AI‑Powered Investing Apps for Beginners.

At the same time, blockchain analytics for investors is becoming a critical part of portfolio management. By tracking wallet flows, liquidity pools, and decentralized exchange activity, investors can spot trends before they hit mainstream headlines. These insights are not only shaping individual portfolios but also influencing global crypto investment trends 2026, where capital is flowing into AI‑driven exchanges, prediction markets, and sustainable blockchain projects. For the latest coverage of these shifts, resources like CoinDesk provide valuable market intelligence.

The Rise of AI Crypto Trading Tools 2026

The surge of AI crypto trading tools 2026 marks one of the most significant shifts in digital asset investing. These platforms use artificial intelligence to analyze thousands of data points — from price movements and trading volumes to social sentiment and blockchain activity — in real time. For investors, this means actionable insights that go far beyond traditional chart reading.

One of the key advantages of AI‑Powered Crypto Analytics 2026 is predictive modeling. By identifying recurring patterns, AI tools can forecast potential market swings and suggest entry or exit points. This capability is especially valuable in crypto markets, where volatility can erase gains within minutes. Investors who adopt smart crypto trading strategies powered by AI are better positioned to minimize risk while capturing upside opportunities.

Popular platforms like IntoTheBlock and Glassnode have become essential resources for both retail and institutional investors. These tools provide dashboards that highlight wallet flows, liquidity trends, and on‑chain metrics. For example, tracking whale movements through blockchain analytics for investors can reveal early signals of market sentiment shifts. To understand how wallets themselves play a role in this ecosystem, see Top 10 Cryptocurrency Wallets in USA 2025.

The adoption of AI crypto trading tools 2026 is not limited to advanced traders. Beginner‑friendly apps are integrating AI features, making it easier for new investors to participate. This democratization of analytics aligns with broader global crypto investment trends 2026, where accessibility and transparency are driving growth.

Blockchain Analytics Insights for Investors

One of the most powerful aspects of AI‑Powered Crypto Analytics 2026 is its integration with blockchain analytics for investors. Unlike traditional financial systems, blockchain data is open and transparent, allowing anyone to track wallet flows, liquidity pools, and decentralized exchange activity. When combined with AI, this transparency becomes a strategic advantage for investors.

For example, AI can analyze millions of on‑chain transactions to detect unusual wallet movements. Tracking whale activity through blockchain analytics for investors often provides early signals of market sentiment shifts. Investors who act on these signals can design smart crypto trading strategies that anticipate volatility rather than react to it.

Platforms like IntoTheBlock and Glassnode are leading this space, offering dashboards that highlight liquidity trends, token adoption, and exchange flows. These insights are not only useful for day traders but also for long‑term investors building diversified portfolios.

The role of blockchain analytics extends beyond crypto trading. It is increasingly shaping global crypto investment trends 2026, as institutional investors demand transparency before committing capital. By leveraging AI‑driven blockchain insights, funds can evaluate the health of decentralized finance ecosystems, assess risks, and identify growth opportunities.

For readers seeking a broader context, Fintech Innovations 2025: Personal Finance explains how blockchain is transforming personal finance and why transparency is becoming a non‑negotiable requirement. Together, these developments show that blockchain analytics is no longer a niche tool — it is a mainstream necessity for modern investors.

Smart Strategies for Successful Crypto Trading

The true value of AI‑Powered Crypto Analytics 2026 lies in its ability to design smart crypto trading strategies that adapt to market volatility in real time. Unlike static technical analysis, AI systems continuously learn from new data, adjusting predictions and recommendations as conditions change. This dynamic approach is helping investors in the USA, UK, Canada, and Australia stay ahead in highly competitive markets.

One of the most effective smart crypto trading strategies involves combining AI signals with blockchain analytics for investors. For example, when whale wallets begin accumulating tokens, AI can flag this as a bullish signal. By integrating this insight with predictive modeling, investors can time entries more effectively. Similarly, AI can detect liquidity shifts across decentralized exchanges, helping traders avoid sudden slippage or price manipulation.

Another strategy is sentiment analysis. AI tools scan millions of social media posts, news headlines, and regulatory updates to gauge market mood. This allows investors to anticipate short‑term volatility and adjust positions accordingly. Platforms like IntoTheBlock already provide sentiment dashboards that combine on‑chain data with external signals, making them invaluable for traders seeking an edge.

Retail investors can also benefit from simplified versions of these strategies. Beginner‑friendly apps now integrate AI features that recommend portfolio allocations or highlight trending tokens. This democratization of analytics aligns with broader global crypto investment trends 2026, where accessibility is key. For a practical guide on how AI is already shaping personal finance, see Top 10 AI‑Powered Personal Finance Tools in USA 2025.

Ultimately, smart crypto trading strategies powered by AI are not about eliminating risk — they are about managing it intelligently. By combining predictive analytics, blockchain transparency, and sentiment tracking, investors can build portfolios that are resilient in uncertain times.

Global Trends in Crypto Investments 2026

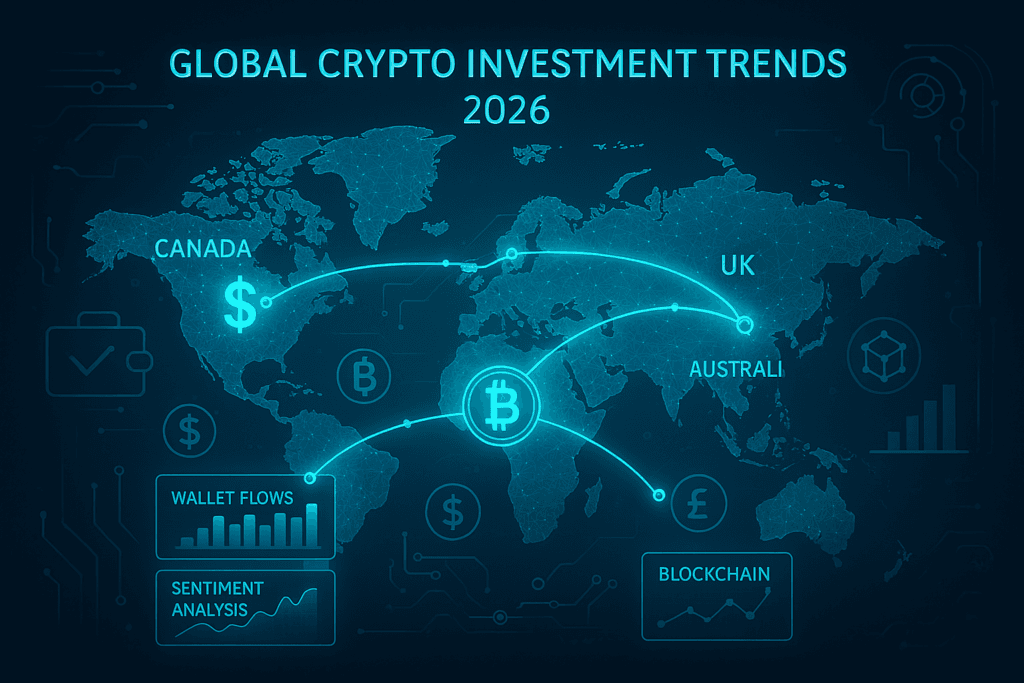

The expansion of global crypto investment trends 2026 shows how artificial intelligence is reshaping digital finance across regions. Investors in the USA, UK, Canada, and Australia are adopting AI‑Powered Crypto Analytics 2026 to navigate volatile markets and identify opportunities that were once hidden.

In the USA, institutional adoption of AI crypto trading tools 2026 is accelerating. Hedge funds and asset managers are using predictive analytics to manage risk and optimize portfolios. Platforms like CoinDesk regularly report on how AI is influencing U.S. crypto markets, highlighting the growing demand for transparency and automation.

In the UK, regulatory clarity is driving innovation. AI‑driven smart crypto trading strategies are being integrated into fintech platforms, making it easier for retail investors to participate. This aligns with broader fintech adoption trends already covered in Fintech Innovations 2025: Personal Finance.

In Canada, energy transition investments intersect with blockchain. AI tools are being used to analyze mining efficiency, carbon footprints, and token sustainability. This reflects how blockchain analytics for investors is expanding beyond trading into ESG‑focused portfolios.

In Australia, fintech startups are leading the charge by embedding AI into mobile trading apps. This democratization of analytics ensures that even beginner investors can access advanced insights. For readers exploring related fintech tools, see Best AI‑Powered Savings Apps in USA 2026.

Across all regions, global crypto investment trends 2026 emphasize accessibility, transparency, and resilience. AI is not only helping investors make smarter decisions but also shaping the future of decentralized finance. By combining predictive analytics, blockchain transparency, and sentiment tracking, investors worldwide are building portfolios that thrive in uncertain times.

Case Studies and Practical Tools

To understand how AI‑Powered Crypto Analytics 2026 is reshaping trading, it’s useful to look at real‑world case studies and the tools investors are using. These platforms demonstrate how AI crypto trading tools 2026 and smart crypto trading strategies are applied in practice.

IntoTheBlock

IntoTheBlock has become a leading platform for blockchain analytics for investors. It provides dashboards that track wallet flows, liquidity pools, and sentiment indicators. For example, when whale wallets accumulate tokens, IntoTheBlock’s AI models flag this as a bullish signal. Investors can then design smart crypto trading strategies around these insights.

Glassnode

Glassnode specializes in on‑chain analytics. Its AI‑driven models highlight exchange inflows and outflows, token adoption rates, and liquidity trends. These insights are critical for institutional investors who want to align with global crypto investment trends 2026 while minimizing exposure to sudden volatility.

Retail Case Study

Retail investors are also benefiting from beginner‑friendly apps that integrate AI features. For example, portfolio apps now recommend allocations based on predictive analytics. This democratization of tools aligns with broader fintech adoption already discussed in AI‑Powered Investing Apps for Beginners.

Institutional Case Study

Hedge funds in the USA are using AI to combine sentiment analysis with blockchain transparency. By scanning millions of news headlines and social media posts, AI systems detect shifts in market mood. When paired with whale tracking, this creates a powerful framework for AI‑Powered Crypto Analytics 2026.

These case studies show that AI is not just a theoretical concept — it is actively shaping portfolios today. Whether through whale tracking, liquidity analysis, or sentiment dashboards, AI crypto trading tools 2026 are becoming indispensable for both retail and institutional investors.

Risks & Challenges

While AI‑Powered Crypto Analytics 2026 offers powerful opportunities, investors must also recognize the risks and challenges that come with adopting these technologies. Over‑reliance on AI crypto trading tools 2026 can create blind spots, especially if models are trained on biased or incomplete data. If the algorithms misinterpret signals, investors may execute trades that amplify losses rather than mitigate them.

Another challenge lies in regulatory uncertainty. Governments in the USA, UK, Canada, and Australia are still developing frameworks for AI‑driven trading. Without clear rules, investors risk compliance issues or sudden restrictions. For example, sentiment analysis tools that scan social media may raise privacy concerns, while predictive models could be scrutinized for market manipulation. Resources like Investopedia provide valuable context on evolving regulations and investor protections.

Technical risks also play a role. AI systems depend on massive datasets, and if blockchain networks experience congestion or attacks, analytics may deliver inaccurate results. Even advanced smart crypto trading strategies can fail when unexpected events — such as geopolitical shocks or exchange outages — disrupt normal market patterns.

Retail investors face additional challenges. Beginner‑friendly apps may oversimplify complex analytics, leading users to believe AI guarantees profits. In reality, blockchain analytics for investors should be seen as a tool for better decision‑making, not a shortcut to instant wealth. For a balanced perspective on how fintech tools evolve, see Best Passive Income Ideas for 2025, which highlights both opportunities and risks in digital finance.

Finally, cybersecurity remains a major concern. As more investors rely on AI platforms, hackers may target these systems to manipulate data or steal funds. Ensuring robust security protocols is essential for sustaining trust in global crypto investment trends 2026.

Investment Opportunities for Retail Investors

While institutional players dominate headlines, retail investors are finding new ways to benefit from AI‑Powered Crypto Analytics 2026. Beginner‑friendly platforms are integrating AI crypto trading tools 2026 into mobile apps, making advanced analytics accessible to anyone with a smartphone. This democratization of technology is one of the most important global crypto investment trends 2026, as it levels the playing field between small investors and large funds.

For example, apps now provide simplified dashboards that highlight token momentum, liquidity risks, and sentiment indicators. These features allow retail investors to design smart crypto trading strategies without needing deep technical expertise. By combining predictive analytics with blockchain analytics for investors, even beginners can identify opportunities and avoid common pitfalls.

One major opportunity lies in portfolio diversification. AI systems can recommend allocations across different tokens, exchanges, and regions, helping retail investors reduce risk. This aligns with broader fintech adoption trends already discussed in Best AI‑Powered Savings Apps in USA 2026, where automation is guiding smarter financial decisions.

Retail investors also benefit from educational resources integrated into AI platforms. Tutorials, simulations, and predictive models help users understand how markets work. This empowers them to make informed decisions rather than relying solely on speculation. For readers exploring beginner strategies, Beginners Guide to Stock Market Investing 2025 offers a strong foundation that complements AI‑driven crypto tools.

Of course, opportunities come with risks. Retail investors must remember that AI is a tool, not a guarantee of profits. By using AI‑Powered Crypto Analytics 2026 responsibly, they can build portfolios that balance growth with resilience.

Future Outlook

The future of AI‑Powered Crypto Analytics 2026 extends far beyond today’s trading dashboards. As decentralized finance (DeFi) matures, AI will play a central role in automating risk management, liquidity provision, and portfolio optimization. Investors who adopt AI crypto trading tools 2026 now will be better positioned to capitalize on these innovations as they scale globally.

One major development is the integration of AI with prediction markets. Platforms are beginning to use machine learning to forecast outcomes of real‑world events, from elections to commodity prices. This creates new opportunities for smart crypto trading strategies, where investors can hedge risks or speculate with greater accuracy.

Another trend is the rise of ESG‑focused crypto investments. AI systems are being used to evaluate the sustainability of blockchain projects, analyzing energy consumption, carbon footprints, and governance structures. This aligns with broader global crypto investment trends 2026, where institutional investors demand transparency before committing capital. For readers exploring related fintech solutions, see Best AI‑Powered Savings Apps in USA 2026, which highlights how automation is guiding sustainable financial decisions.

DeFi platforms are also evolving. AI will soon automate liquidity pools, detect vulnerabilities in smart contracts, and optimize yield farming strategies. By combining blockchain analytics for investors with predictive modeling, these systems will reduce risks while maximizing returns.

Finally, AI will enhance regulatory compliance. Governments are expected to adopt AI‑driven monitoring tools to oversee crypto markets. This will create both challenges and opportunities for investors, as compliance becomes more automated but also more demanding. For global perspectives on these shifts, resources like the World Economic Forum provide valuable insights into how technology is shaping finance.

The outlook is clear: AI‑Powered Crypto Analytics 2026 is not just a trend, but a foundation for the next era of digital investing. Those who embrace these tools today will be better equipped to thrive in tomorrow’s decentralized economy.

Conclusion + Call‑to‑Action

The rise of AI‑Powered Crypto Analytics 2026 marks a turning point in digital investing. From AI crypto trading tools 2026 that deliver real‑time insights to blockchain analytics for investors that reveal hidden market signals, artificial intelligence is transforming how portfolios are built and managed. Investors in the USA, UK, Canada, and Australia are already leveraging these innovations to design smart crypto trading strategies that balance risk with opportunity.

At the same time, broader global crypto investment trends 2026 show that accessibility and transparency are driving adoption worldwide. Retail investors now have access to beginner‑friendly apps, while institutions are deploying advanced AI systems to manage billions in assets. This convergence demonstrates that AI is no longer a niche tool — it is the foundation of modern crypto investing.

For readers who want to explore related fintech innovations, see Top 10 AI‑Powered Personal Finance Tools in USA 2025 and Best AI‑Powered Savings Apps in USA 2026. These resources highlight how automation is reshaping personal finance alongside crypto analytics. For global perspectives, World Economic Forum continues to provide valuable insights into how technology is shaping the future of finance.

The message is clear: investors who embrace AI‑Powered Crypto Analytics 2026 today will be better prepared for tomorrow’s decentralized economy. Whether you are a beginner exploring your first crypto wallet or an institution managing complex portfolios, AI offers tools to make smarter, faster, and more resilient decisions.

Call‑to‑Action:

If you’re ready to take your investing to the next level, start by exploring AI‑driven platforms and integrating them into your strategy. Bookmark RevoValue for more guides, insights, and tools that help you stay ahead in the fast‑moving world of fintech and crypto.