Best Budgeting Apps in 2025: Smart Tools for Smarter Money Management

Managing personal finances has never been more critical than in 2025. With inflation, global economic shifts, and rising living costs, individuals across the USA, UK, Canada, and Australia are turning to budgeting apps to take control of their money. Whether you’re a student, a working professional, or a family planner, the right app can help you track expenses, set savings goals, and build financial discipline.

In 2025, budgeting apps aren’t just tools — they’re financial lifelines. With rising interest rates, fluctuating currencies, and the increasing cost of living in high-income countries like the USA, UK, Canada, and Australia, people are turning to digital solutions to stay afloat. According to recent surveys, over 68% of millennials and Gen Z now use at least one budgeting app monthly. These apps are evolving rapidly, offering AI-driven insights, predictive analytics, and even crypto wallet integration. Whether you’re managing student loans, saving for a home, or planning retirement, budgeting apps are now essential for financial survival and success.

Why Budgeting Apps Matter in 2025

The financial landscape has evolved. Traditional spreadsheets and manual tracking are no longer enough. Today best budgeting apps in 2025 offer:

- Real-time expense tracking

- AI-powered financial insights

- Automated savings tools

- Debt payoff calculators

- Multi-currency support

- Bank synchronization

- Subscription management

- Goal-based budgeting

- Credit score monitoring

- Investment tracking

These features empower users to make informed decisions, reduce unnecessary spending, and plan for long-term financial health.

What’s New in Budgeting Apps in 2025

Best Budgeting apps in 2025 are smarter, faster, and more personalized than ever. Here’s what’s new:

- AI-Powered Predictions: Apps now analyze your spending habits and predict future expenses, helping you avoid surprises.

- Crypto Integration: With the rise of digital currencies, many apps now support tracking Bitcoin, Ethereum, and stablecoins.

- Voice Assistant Compatibility: You can ask Alexa or Google Assistant how much you’ve spent this week or what’s left in your entertainment budget.

- Personalized Nudges: Apps send tailored reminders like “You’re close to overspending on dining this month” or “You’ve saved 80% of your vacation goal.”

- Multi-Country Support: Apps now support multiple currencies and tax systems, ideal for freelancers and remote workers in global markets.

These innovations make budgeting apps more than just trackers — they’re now proactive financial coaches.

Best Budgeting Apps in 2025

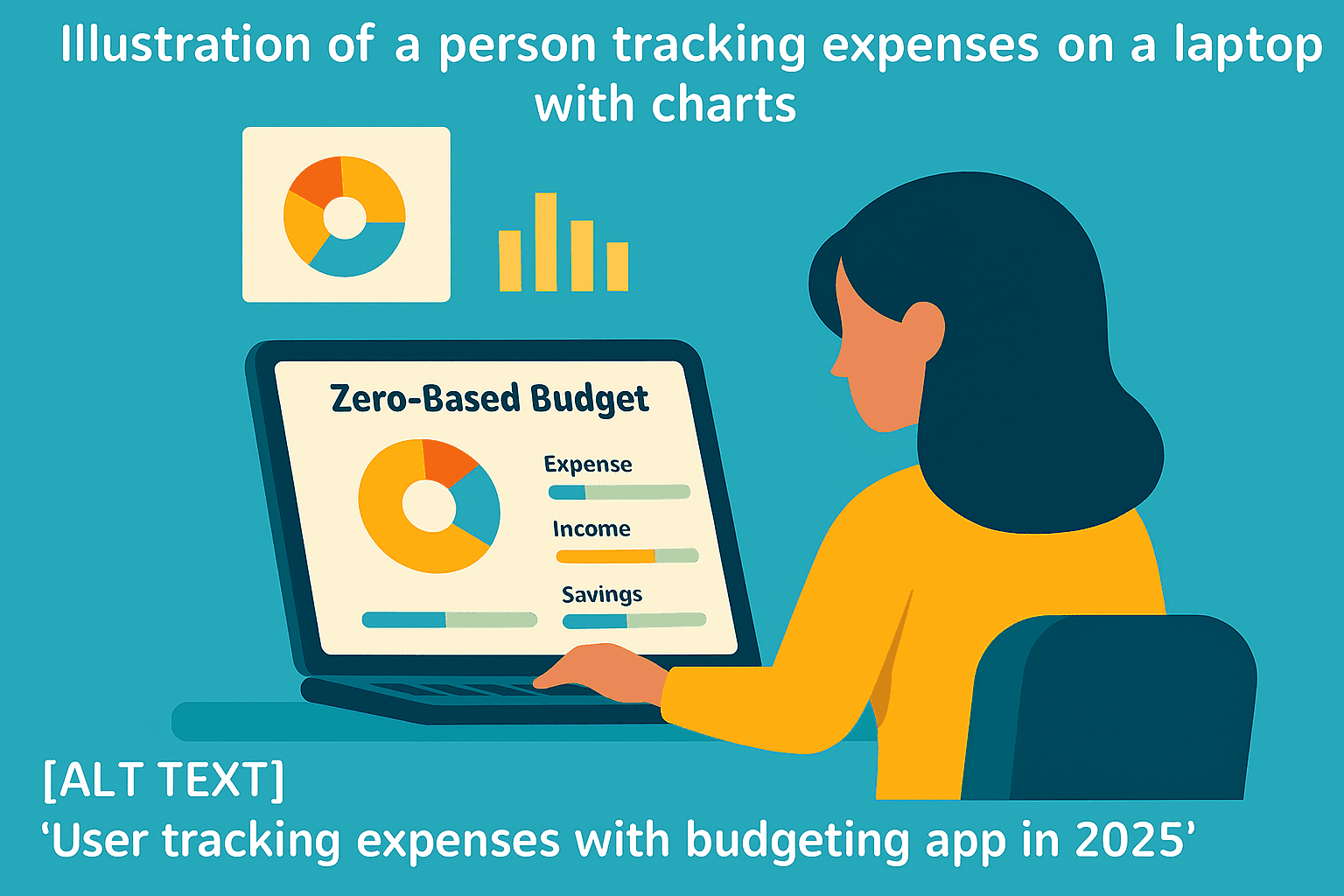

1. YNAB (You Need A Budget)

Focused keywords: zero-based budgeting, financial goals, expense tracking

YNAB holds 1st place in the list of best budgeting apps in 2025 and remains a favorite in 2025 for its zero-based budgeting approach. It encourages users to assign every dollar a job, promoting intentional spending.

Key Features:

- Goal tracking

- Bank syncing

- Real-time updates

- Educational resources

Best For: Users who want full control over every dollar.

Pricing: $14.99/month or $99/year

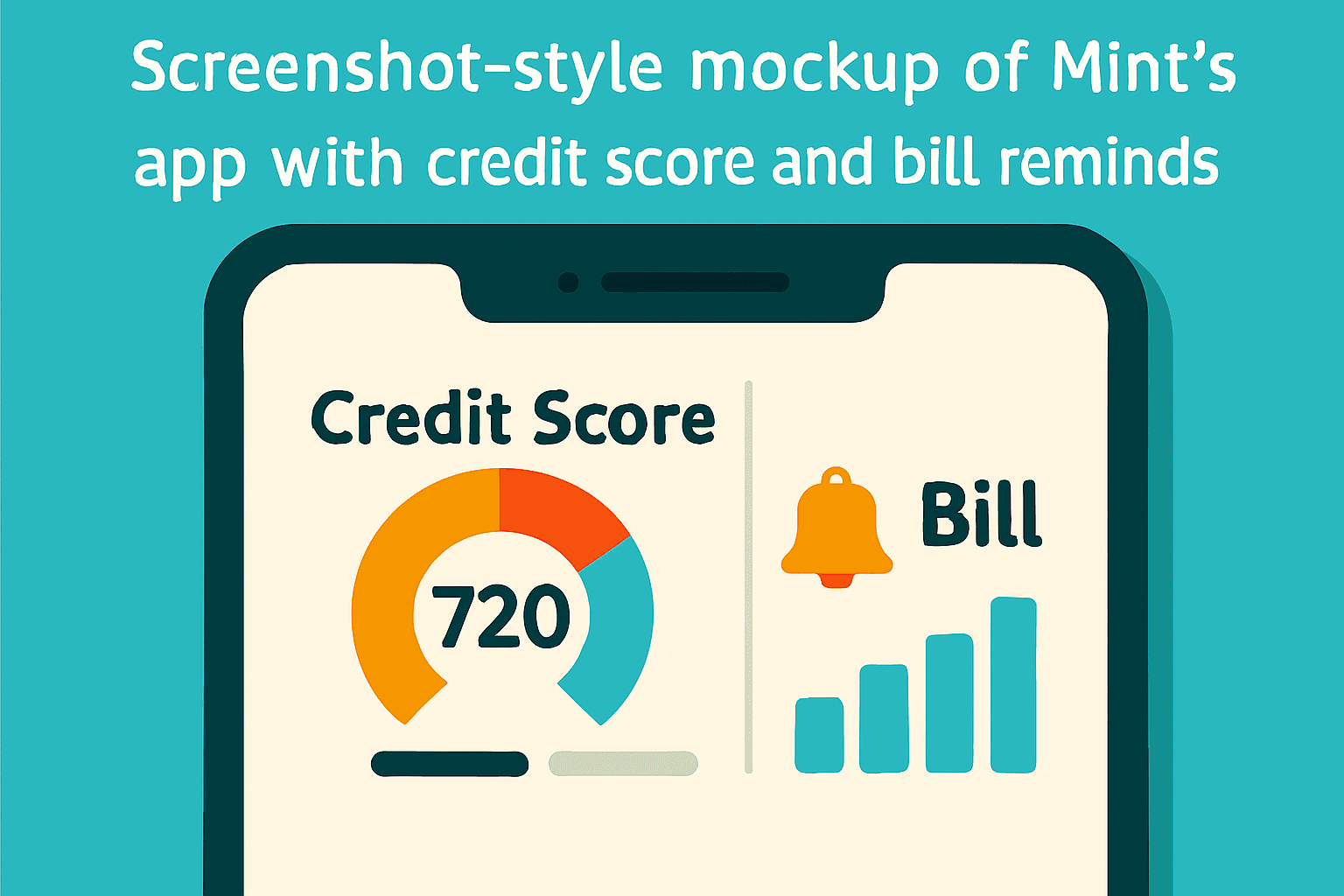

2. Mint by Intuit

Focused keywords: free budgeting app, credit score, bill tracking

Mint continues to dominate in free best budgeting apps in 2025 with robust features. It’s ideal for beginners who want a simple interface and automatic categorization.

Key Features:

- Credit score monitoring

- Bill reminders

- Spending trends

- Investment tracking

Best For: Beginners and casual budgeters.

Pricing: Free (with ads)

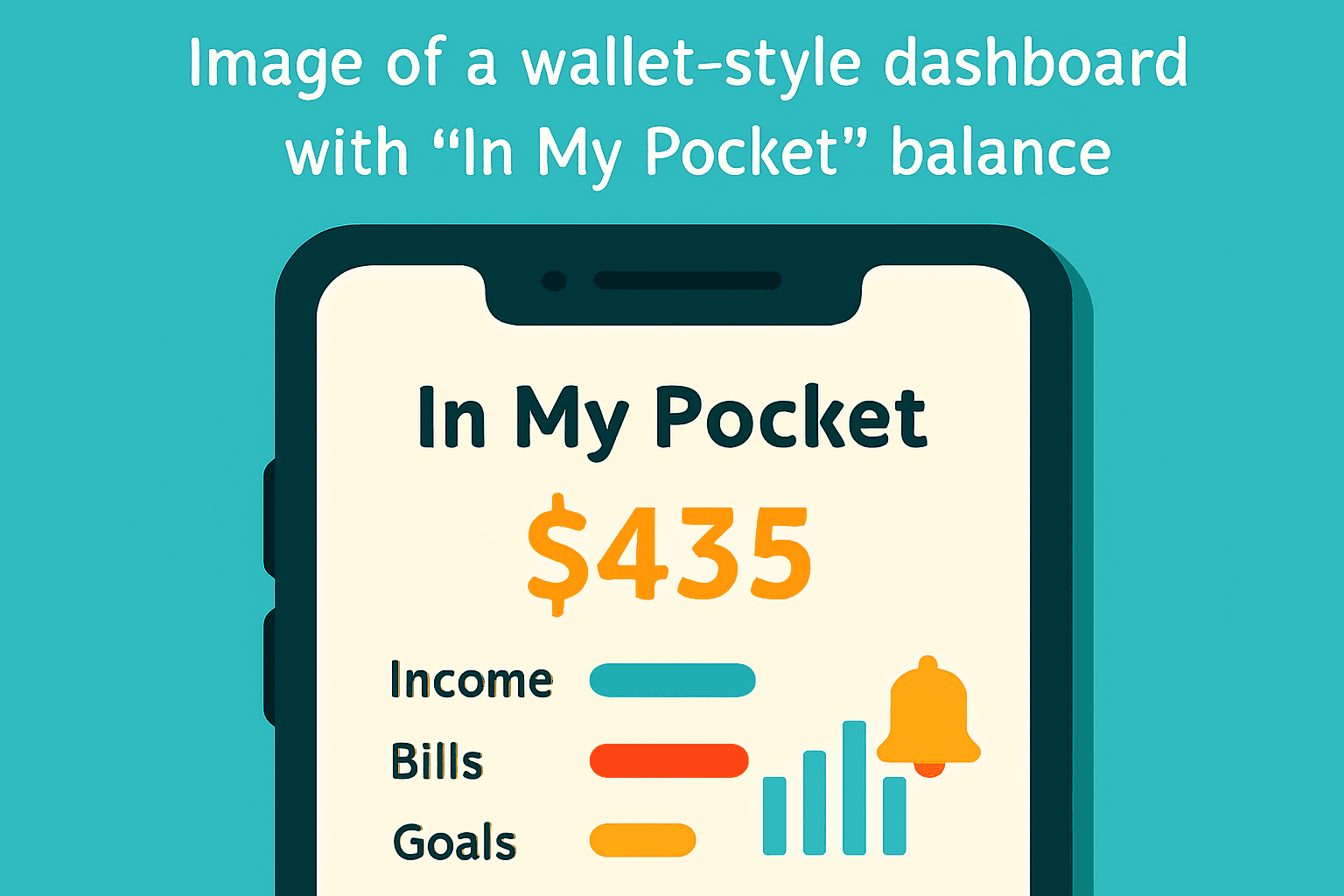

3. PocketGuard

Focused keywords: spend analysis, savings goals, bank integration

PocketGuard helps users understand how much they can safely spend after bills and savings. Its “In My Pocket” feature is a game-changer. It is one of the best budgeting apps in 2025.

Key Features:

- Bank integration

- Subscription tracking

- Savings goals

- Categorized spending

Best For: People who overspend and need guardrails.

Pricing: Free basic plan; $7.99/month for premium

4. Goodbudget

Focused keywords: envelope budgeting, shared budgets, manual entry

Goodbudget is included in one of the best budgeting apps in 2025. It uses the envelope budgeting method, making it ideal for couples or families who want to share budgets.

Key Features:

- Manual transaction entry

- Sync across devices

- Debt tracking

- Reports and charts

Best For: Families and partners managing joint finances.

Pricing: Free basic plan; $8/month for premium

5. EveryDollar by Ramsey Solutions

Focused keywords: debt payoff, zero-based budgeting, financial planning

Built on Dave Ramsey’s principles, EveryDollar is perfect for users focused on debt payoff and financial planning. It is also one of the best budgeting apps in 2025.

Key Features:

- Zero-based budgeting

- Baby Steps integration

- Goal tracking

- Premium bank sync

Best For: Users following the Ramsey method.

Pricing: Free basic plan; $12.99/month for premium

6. Emma

Focused keywords: subscription tracking, financial insights, UK budgeting

Emma is gaining traction in the UK and Canada for its sleek design and subscription tracking features. It is also one of the best budgeting apps in 2025.

Key Features:

- Bank sync

- Subscription alerts

- Cashback offers

- Budget categories

Best For: Millennials and Gen Z users.

Pricing: Free basic plan; £9.99/month for Emma Pro

7. Simplifi by Quicken

Focused keywords: financial dashboard, investment tracking, custom reports

Simplifi is also 1 of the best budgeting apps in 2025 and offers a clean financial dashboard that’s ideal for users who want a bird’s-eye view of their finances.

Key Features:

- Custom reports

- Investment tracking

- Goal setting

- Real-time sync

Best For: Professionals and investors.

Pricing: $3.99/month billed annually

8. Zeta

Focused keywords: couples budgeting, shared expenses, joint accounts

Zeta is considered as one of the best budgeting apps in 2025 and is designed specifically for couples and families who want to manage money together. It supports shared expenses, joint goals, and even relationship-based financial planning.

Key Features:

- Joint and individual budgets

- Bill splitting

- Shared goals

- Financial check-ins

Best For: Couples managing joint finances or planning for marriage.

Pricing: Free basic plan; premium features available

9. Honeydue

Focused keywords: partner finance app, shared budgeting, bill reminders

Honeydue is popular and is included in best budgeting apps in 2025 in the USA for its simplicity and focus on partner finance. It allows couples to track spending together while maintaining individual privacy.

Key Features:

- Shared bill reminders

- Transaction comments

- Budget categories

- Bank sync

Best For: Couples who want transparency without merging accounts.

Pricing: Free

How to Choose the Right App

When selecting a budgeting app, consider:

- Your financial goals (saving, debt payoff, tracking)

- Preferred budgeting style (zero-based, envelope, automated)

- Device compatibility (iOS, Android, desktop)

- Security features (encryption, two-factor authentication)

- Cost vs. value (free vs. premium features)

Budgeting Tips for 2025

Budgeting isn’t just about using the right app — it’s about building the right habits. Here are some expert tips for 2025:

- Automate Your Savings: Set up automatic transfers to savings accounts or investment platforms.

- Review Subscriptions Monthly: Use apps like Emma or PocketGuard to cancel unused services.

- Set Micro-Goals: Instead of “Save $5,000,” aim for “Save $500 this month.”

- Use Calendar Sync: Link your budgeting app with your calendar to track bill due dates and paydays.

- Track Cash Spending: Don’t ignore cash transactions — log them manually to stay accurate.

- Budget Weekly, Not Monthly: Weekly reviews help you stay agile and adjust faster.

Want more tips? Check out our guide:

Smart Budgeting Habits for 2025

For a detailed expert review of these apps, check out Forbes Advisor’s Best Budgeting Apps of 2025.

Want to learn how to set up your first budget using one of these apps? Read our guide:

How to Create a Budget That Actually Works

If you’re just starting your financial journey, don’t miss our previous post:

Top 10 Money Habits That Build Wealth

Final Checklist Before Choosing Your App

Before you commit to a budgeting app, run through this checklist:

✅ Does it support your preferred budgeting style (zero-based, envelope, automated)?

✅ Is it compatible with your devices (iOS, Android, desktop)?

✅ Does it offer bank sync and real-time updates?

✅ Are the security features strong (encryption, 2FA)?

✅ Is the cost worth the value (free vs. premium)?

✅ Does it support your country’s currency and tax system?

Choosing the right app is about fit — not just features.

Final Thoughts

Best budgeting apps in 2025. Budgeting apps are more powerful, intuitive, and personalized than ever. Whether you’re trying to save for a vacation, pay off debt, or simply understand where your money goes, there’s an app tailored for your needs.

By choosing the right tool and staying consistent, you’ll not only improve your financial health — you’ll build habits that last a lifetime.

Pingback: How to Build Wealth in Your 20s; Personal Finance basics (2025 Edition) - RevoValue – Smart Finance Insights

Pingback: Budgeting vs Expense Tracking: What Young Adults in 20s Absolutely Need - RevoValue – Smart Finance Insights