Introduction

Beginner’s Guide to Stock Market Investing (2025 Edition)

Stock market investing has long been one of the most effective ways to build wealth, achieve financial independence, and protect against inflation. For beginners, however, the stock market can feel intimidating — full of jargon, risks, and uncertainty. The good news is that with the right knowledge and strategy, anyone can start investing confidently.

This Beginner’s Guide to Stock Market Investing will help you build confidence and avoid common mistakes.

This Beginner’s Guide to Stock Market Investing (2025 Edition) will walk you through the fundamentals of stock market investing, explain key concepts, highlight common

Why Invest in the Stock Market?

- Wealth Creation: Stocks historically outperform other asset classes over the long term.

- Inflation Protection: Investing helps your money grow faster than inflation erodes it.

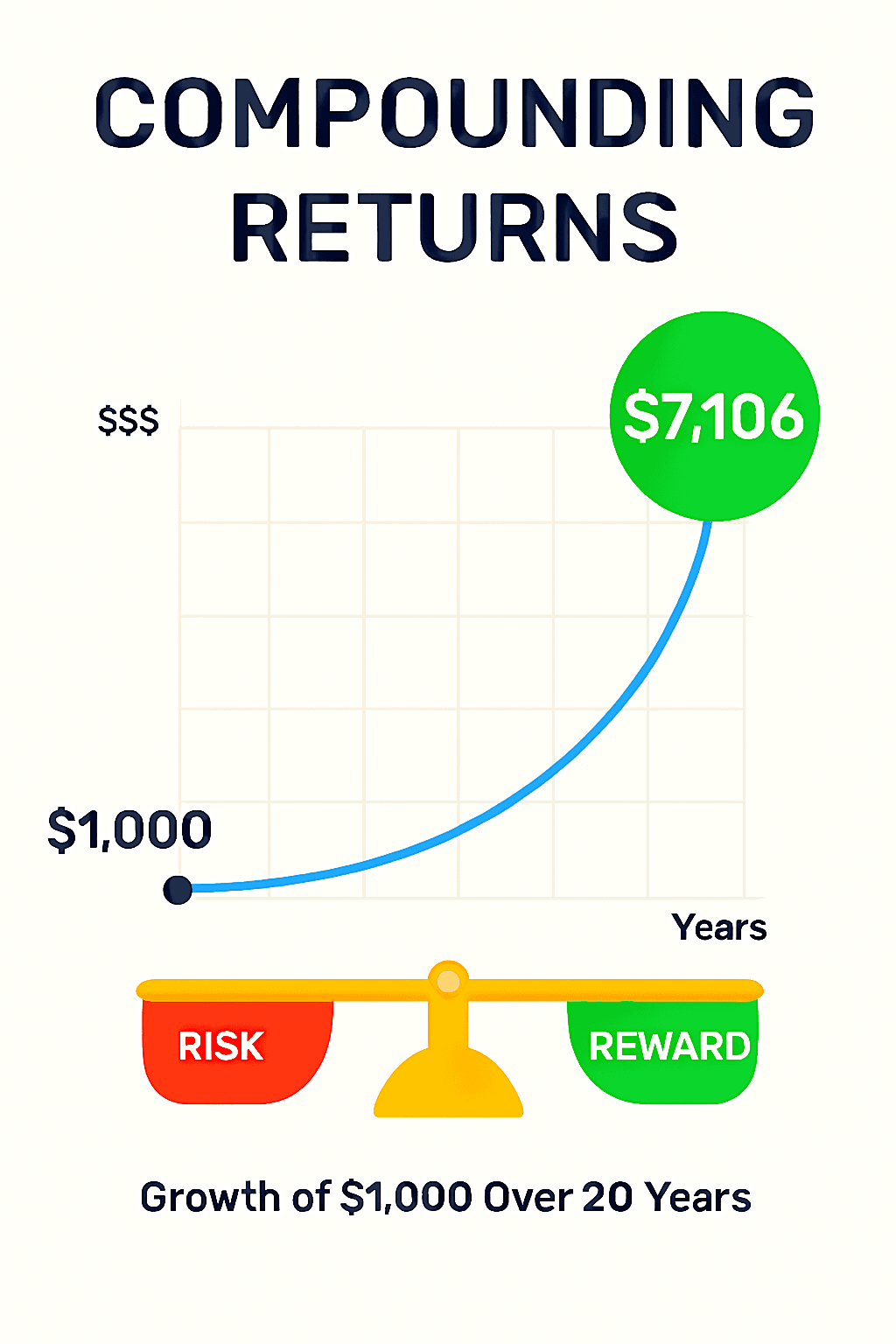

- Compounding Returns: Reinvested dividends and long-term growth multiply wealth.

- Financial Independence: Stock investing can generate passive income and reduce reliance on a paycheck.

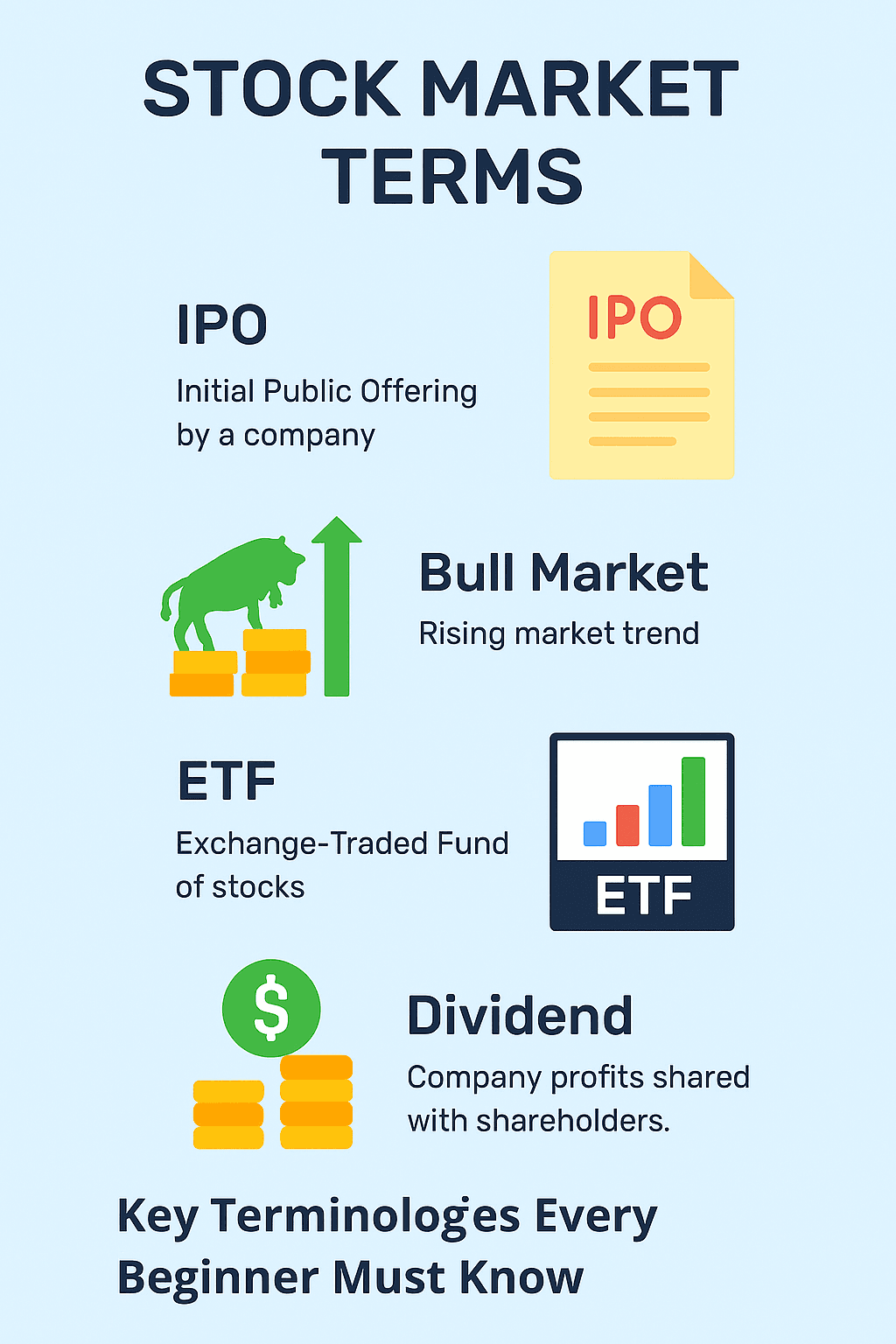

Key Terminologies Every Beginner Must Know

If you’re new to trading, our Beginner’s Guide to Stock Market Investing breaks down key terms like IPO, ETF, and dividend.

Before diving in, familiarize yourself with essential terms:

- Stock/Share: A part you own in a company.

- IPO (Initial Public Offering): When a company first sells shares to the public.

- Bull Market vs. Bear Market: Rising vs. falling market trends.

- Blue-Chip Stocks: Large, stable companies with strong reputations.

- ETF (Exchange-Traded Fund): A basket of stocks traded like a single share.

- Dividend: Profit distribution to shareholders.

The Beginner’s Guide to Stock Market Investing is designed for anyone who wants to grow wealth without feeling overwhelmed.

Step 1: Make Financial Goals

Ask yourself:

- Are you investing for retirement, wealth building, or short-term gains?

- How much risk can you tolerate?

- What is your investment horizon (5, 10, 20 years)?

Clear goals will guide your stock selection and strategy.

Step 2: Choose the Right Brokerage

In 2025, online brokerages make investing accessible worldwide. Look for:

- Low fees and commissions

- User-friendly platforms

- Educational resources for beginners

- Access to global markets

Popular platforms include Robinhood, Fidelity, Interactive Brokers, and eToro.

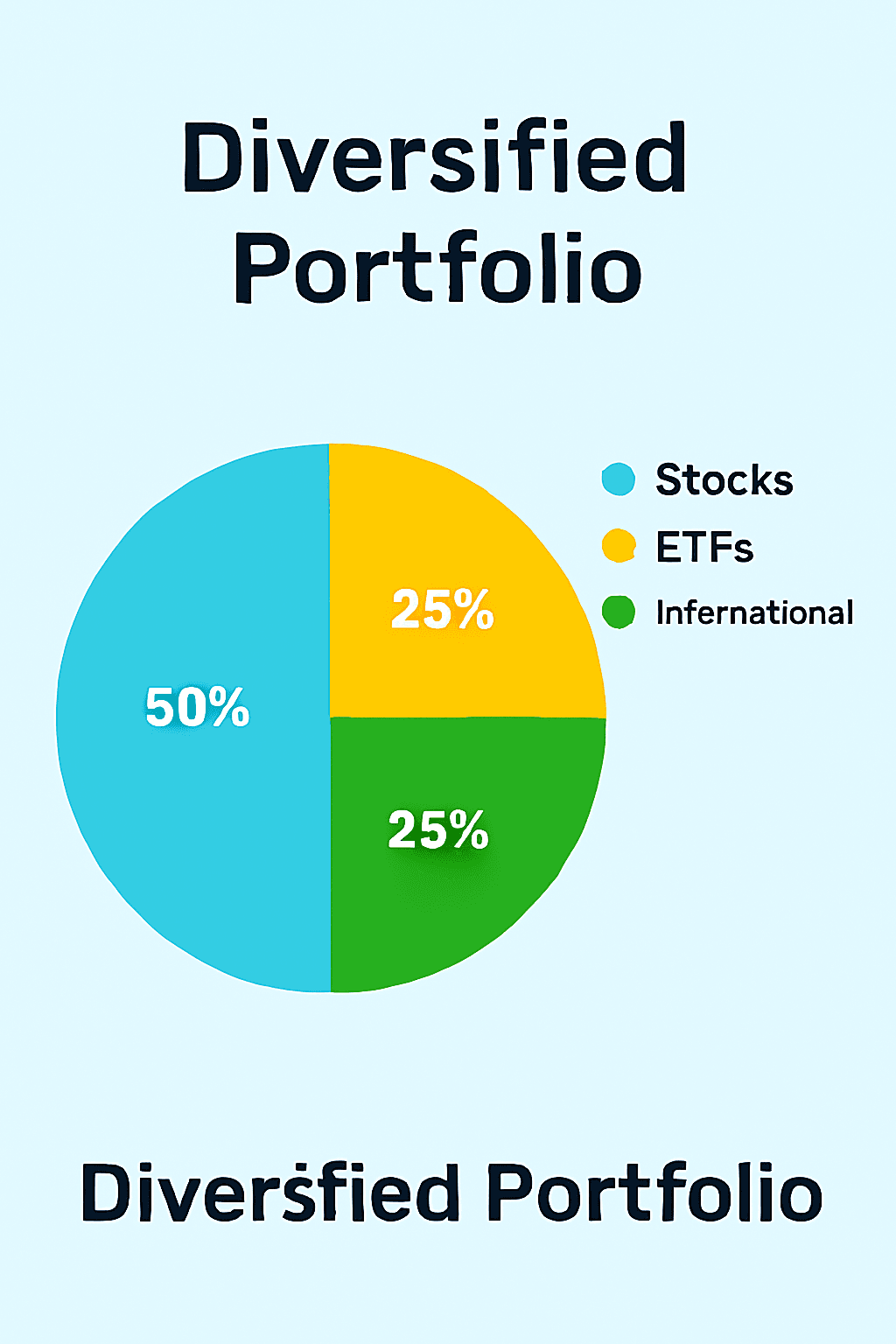

Step 3: Make your Portfolio Diversified

Diversification reduces risk. Instead of putting all your money into one stock:

- Mix large-cap, mid-cap, and small-cap stocks

- Add ETFs or index funds for stability

- Consider international stocks for global exposure

🧠 How to Choose Stocks as a Beginner

Choosing the right stocks can feel overwhelming at first, but it becomes easier once you understand what to look for. As a beginner, your goal should be to invest in companies that are financially stable, have a strong track record, and operate in industries with long-term growth potential.

To explore key financial ratios like P/E and EPS, check out Investopedia’s stock analysis guide.

Start by researching blue-chip stocks — these are large, well-established companies like Apple, Microsoft, or Coca-Cola. They tend to be less volatile and often pay dividends, making them ideal for beginners seeking steady growth.

By following this Beginner’s Guide to Stock Market Investing, you’ll learn how to diversify, manage risk, and invest for the long term

Next, explore growth stocks, which are companies expected to grow faster than the market average. These might not pay dividends, but they reinvest profits to expand rapidly. Think of tech companies, renewable energy firms, or innovative healthcare startups.

You can also consider value stocks, which are undervalued by the market but have solid fundamentals. These are great for long-term investors who want to buy low and hold until the market corrects itself.

Before investing, ask:

- Is the company profitable?

- Does it have manageable debt?

- Is its revenue growing year over year?

- What do analysts say about its future?

Use tools like Yahoo Finance, Google Finance, or your brokerage’s research section to compare financial ratios like P/E (Price-to-Earnings), EPS (Earnings Per Share), and ROE (Return on Equity).

Finally, avoid the temptation to chase hype. Just because a stock is trending on social media doesn’t mean it’s a good investment. Stick to your strategy, do your research, and remember — investing is a marathon, not a sprint.

🧠 Why Long-Term Thinking Matters in Stock Investing

One of the most powerful advantages beginner investors can develop is a long-term mindset. The stock market is inherently volatile — prices go up and down daily based on news, earnings reports, interest rates, and even social media trends. But over time, quality investments tend to grow in value, especially when backed by strong fundamentals.

For a deeper look at historical market returns and long-term investing strategies, visit Morningstar’s investment insights.

Take the example of someone who invested $1,000 in an S&P 500 index fund in 2005. Despite market crashes in 2008 and 2020, that investment would be worth over $4,000 by 2025 — thanks to compounding returns and market recovery. The key? Patience and consistency.

Long-term investors focus on business performance, not short-term price movements. They understand that temporary dips are normal and often present buying opportunities. Instead of reacting emotionally, they stay committed to their strategy and let time do the heavy lifting.

To build this mindset:

- Avoid checking your portfolio daily

- Set clear goals (e.g., retirement, buying a home)

- Reinvest dividends

- Stick to diversified holdings

Remember, investing isn’t about timing the market — it’s about time in the market. The longer you stay invested, the more likely you are to benefit from growth, compounding, and resilience. This beginner’s guide to stock market investing will help you in that.

Step 4: Understand Risk Management

- Never invest money you can’t afford to lose

- Use Stop-loss in orders to limit downside

- Don’t get attached emotionally — stick to your plan

- Start small and increase investments gradually

This beginner’s guide to stock market investing will help you to understand that.

Step 5: Learn Basic Analysis

Two main approaches:

- Fundamental Analysis: Study company earnings, revenue, debt, and industry trends.

- Technical Analysis: Use charts and patterns to predict price movements.

Beginners should focus more on fundamentals to identify strong companies. This beginner’s guide to stock market investing will help you in this process.

Step 6: Start with Safer Options

If you’re nervous about individual stocks:

- Begin with index funds (like S&P 500 ETFs)

- Explore dividend-paying stocks for steady income

- Use robo-advisors for automated portfolio management

Common Mistakes Beginners Should Avoid

- Chasing hot tips without research

- Overtrading due to fear or greed

- Ignoring diversification

- Not having an exit strategy

- Failing to reinvest dividends

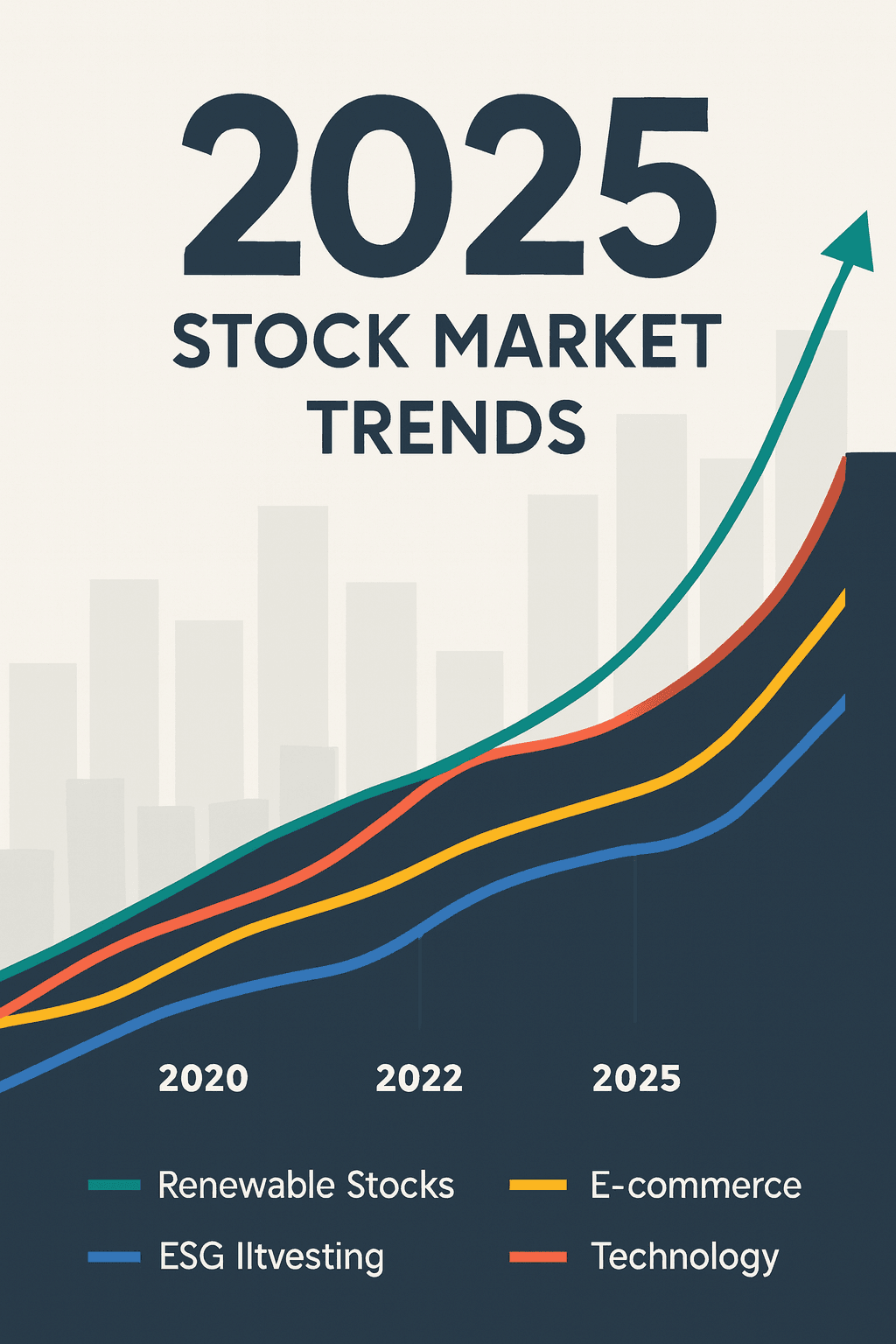

Trends to Watch in 2025

- Green energy stocks (solar, EVs, renewables)

- Artificial intelligence and fintech companies

- Healthcare innovation (biotech, telemedicine)

- Global inflation hedges (commodities, defensive stocks)

Practical Example: How $1,000 Can Grow

If you invest $1,000 in an ETF averaging 8% annual returns:

- After 10 years: ~$2,158

- After 20 years: ~$4,661

- After 30 years: ~$10,063

This demonstrates the power of compounding. After reading this beginner’s guide to stock market investing you will be able to know the power of compounding.

Step 7: Stay Educated

The stock market evolves constantly. Keep learning through beginner’s guide to stock market investing blogs and others like:

- Finance blogs (like RevoValue)

- Books like “The Intelligent Investor“

- Online courses and webinars

- Following credible financial news sources

Conclusion

Stock market investing is not about quick wins — it’s about building wealth steadily over time. By setting clear goals, diversifying wisely, managing risk, and staying disciplined, beginners can confidently enter the market in 2025. Whether you’re in the USA, UK, Canada, or Australia, this Beginner’s Guide to Stock Market Investing applies globally.

Remember: patience and consistency are your greatest allies.

If you liked this beginner’s guide to stock market investing. You can explore our homepage to learn more interesting topics like this.

Pingback: Top 10 Cryptocurrency Wallets in USA 2025: Secure & Easy Bitcoin Storage - RevoValue