📝 Introduction

The world of investing is rapidly evolving, and the best AI wealth management platforms in USA 2026 are leading this transformation. Once dominated by traditional advisors, wealth management has now shifted toward intelligent, automated solutions that combine advanced analytics with personalized strategies. These platforms are not only convenient but also cost‑effective, making them accessible to a wider audience across the United States.

At the core of this shift are AI financial advisors USA, which use machine learning to analyze portfolios, predict market trends, and recommend tailored investment strategies. Unlike traditional advisors, these systems operate 24/7, ensuring investors never miss opportunities. For readers exploring how AI is reshaping personal finance, Fintech Innovations 2025 provides a strong foundation on the role of automation in money management.

Equally important are AI wealth apps 2026, which integrate budgeting, saving, and investing into one ecosystem. These apps allow users to track expenses, rebalance portfolios, and even optimize taxes — all from a smartphone. Industry experts at Forbes highlight that such apps are becoming essential for modern investors seeking efficiency and transparency.

Meanwhile, robo‑wealth platforms USA are democratizing access to professional‑grade investment tools. By automating portfolio rebalancing and risk management, they provide affordable solutions for beginners and retirees alike. For deeper insights into retirement planning, readers can explore AI Retirement Planning Tools in USA 2026.

Finally, AI portfolio managers are redefining long‑term wealth strategies. These platforms not only manage assets but also integrate with digital wallets and tax software, creating a holistic financial ecosystem. Together, the best AI wealth management platforms in USA 2026 represent the future of investing — smarter, safer, and more personalized than ever before.

AI transforming Wealth Management

The financial industry has undergone a dramatic transformation, and nowhere is this more evident than in the rise of AI financial advisors USA. Traditional wealth managers once relied on manual analysis and human intuition, but today, advanced algorithms and machine learning models are reshaping how portfolios are built, monitored, and optimized.

The appeal of robo‑wealth platforms USA lies in their ability to democratize access to professional‑grade investment strategies. Instead of paying high fees for human advisors, investors can now rely on automated systems that deliver personalized recommendations at a fraction of the cost. These platforms analyze market data in real time, rebalance portfolios automatically, and even optimize tax strategies — features once reserved for institutional investors.

Equally important is the growth of AI wealth apps 2026, which integrate seamlessly into everyday financial life. From budgeting and saving to investing and retirement planning, these apps provide a holistic view of personal finance. For readers exploring how fintech innovations paved the way for this shift, Fintech Innovations 2025: Personal Finance offers valuable context on the early adoption of AI in money management.

At the same time, robo‑wealth platforms in the USA are opening up professional‑level investment tools to everyday investors. By combining predictive analytics with behavioral insights, they help users avoid emotional decision‑making and stick to disciplined strategies. Industry experts at Forbes emphasize that AI‑driven portfolio management is now a cornerstone of modern wealth planning, offering both efficiency and transparency.

In short, the rise of AI in wealth management is not just a trend — it is a fundamental shift. The best AI wealth management platforms in USA 2026 are redefining financial planning, making it smarter, more accessible, and more secure than ever before.

Key Features Worth Evaluating

Choosing the best AI wealth management platforms in USA 2026 requires understanding the features that set them apart. These platforms are more than just digital tools; they are intelligent systems designed to optimize every aspect of financial planning.

1. Real‑Time Portfolio Analysis

Modern AI portfolio managers provide instant insights into market performance, asset allocation, and risk exposure. By analyzing thousands of data points in seconds, they help investors make informed decisions without delays. This feature ensures portfolios remain aligned with long‑term goals even during volatile markets.

2. Automated Rebalancing & Tax Optimization

One of the most valuable features of robo‑wealth platforms USA is automated rebalancing. These systems adjust portfolios to maintain target allocations, reducing risk and maximizing returns. Many also include tax‑loss harvesting and optimization tools, saving investors money while improving efficiency. For deeper insights, AI Retirement Planning Tools in USA 2026 explains how automation supports long‑term financial stability.

3. Security & Compliance

With sensitive financial data at stake, AI financial advisors USA must prioritize security. Leading platforms use advanced encryption, biometric authentication, and compliance with U.S. regulations to protect users. Industry experts at Investopedia emphasize that trust and transparency are critical in fintech adoption.

4. Integration with Everyday Finance

The most effective AI wealth apps 2026 integrate seamlessly with budgeting tools, digital wallets, and retirement accounts. This creates a holistic ecosystem where users can manage expenses, savings, and investments in one place. Such integration ensures that wealth management is not isolated but part of a broader financial strategy.

In short, the best AI wealth management platforms in USA 2026 stand out by offering real‑time analysis, automated optimization, strong security, and seamless integration — features that empower investors to achieve smarter financial growth.

Top 10 Best AI Wealth Management Platforms in USA 2026

The demand for intelligent investing solutions has fueled the growth of the best AI wealth management platforms in USA 2026. These tools combine automation, personalization, and security to help investors achieve smarter financial growth. Below are the top 10 platforms redefining wealth management this year:

1. Fidelity AI Wealth

Fidelity integrates AI financial advisors USA with advanced analytics, retirement planning, and tax optimization.

2. Vanguard Digital Advisor

A leader in long‑term investing, Vanguard’s AI portfolio managers focus on retirement strategies and wealth building.

3. Charles Schwab Intelligent Portfolios

Schwab’s robo‑wealth platforms USA automate portfolio balancing and tax‑loss harvesting, making them ideal for cost‑conscious investors.

4. Wealthfront AI

Known for innovation, Wealthfront offers automated portfolio management and AI‑driven tax strategies.

5. Betterment AI

Betterment combines robo‑advisory services with personalized AI insights, appealing to both beginners and professionals.

6. SoFi Invest AI

SoFi integrates budgeting, lending, and investing, making it one of the most versatile AI wealth apps 2026.

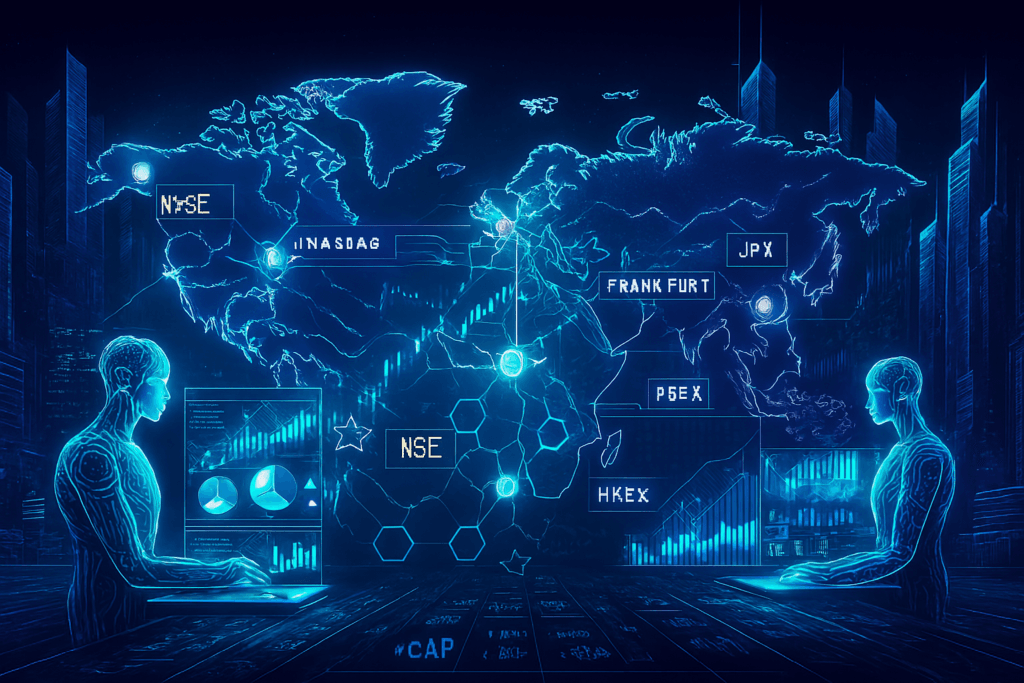

7. Interactive Brokers AI

Popular among professionals, this platform offers global market access with AI‑powered risk management.

8. TradeStation AI Wealth

Designed for active traders, TradeStation provides real‑time analytics and algorithmic trading features.

9. Public.com AI

Public emphasizes transparency and education, with AI insights tailored for beginner investors.

10. Acorns AI Wealth

Acorns uses AI to automate micro‑investing, helping users grow wealth effortlessly through everyday purchases.

For readers exploring related innovations, Best AI Crypto Portfolio Apps in USA 2026 offers insights into how AI is also transforming crypto wealth management. Meanwhile, Smart Money Moves 2025 provides practical strategies that align perfectly with these platforms.

Together, these best AI wealth management platforms in USA 2026 represent the future of investing — combining automation, personalization, and security to empower investors at every level.

Unified Access Across Financial Tools

One of the defining strengths of the best AI wealth management platforms in USA 2026 is their ability to integrate seamlessly with other financial tools. Instead of functioning as standalone apps, these platforms are evolving into connected ecosystems that cover budgeting, saving, investing, and retirement planning.

For example, many AI wealth apps 2026 now sync directly with budgeting tools, allowing users to view investment activity alongside everyday expenses. This holistic view helps investors balance short‑term spending with long‑term wealth creation. Readers exploring related innovations can check Best Budgeting Apps in USA 2026, which highlights how budgeting tools complement wealth platforms by keeping household finances in check.

Integration also extends to robo‑wealth platforms USA and digital wallets. Platforms like PayPal, Apple Pay, and Google Pay are increasingly linked to wealth management accounts, enabling instant deposits and withdrawals. This reduces friction and ensures investors can act quickly when opportunities arise. Industry experts at Investopedia note that wallet integration is becoming a standard feature in fintech, bridging the gap between spending and investing.

Another key development is the connection between AI financial advisors USA and retirement planning apps. By syncing portfolios with savings and retirement accounts, investors gain a clearer picture of their financial future. Internal readers can explore AI Retirement Planning Tools in USA 2026 to see how AI is already influencing long‑term strategies.

Finally, AI portfolio managers are expanding their reach by offering APIs that connect with tax software, insurance platforms, and even smart home devices. This creates a truly interconnected financial ecosystem where every decision — from paying bills to executing trades — is optimized by AI.

Challenges & Risks

While the best AI wealth management platforms in USA 2026 offer powerful tools for smarter investing, they also come with challenges and risks that investors must carefully consider.

1. Over‑Reliance on AI

One of the biggest concerns with AI financial advisors USA is the risk of depending too heavily on algorithms. While these systems provide valuable insights, they cannot fully replace human judgment. Market anomalies, geopolitical events, or sudden crises may require human oversight to avoid costly mistakes.

2. Subscription Costs

Although robo‑wealth platforms USA are more affordable than traditional advisors, subscription fees and premium features can add up. Investors must weigh whether the cost of advanced analytics, tax optimization, or personalized strategies justifies the returns. For readers balancing expenses, Best Budgeting Apps in USA 2026 offers practical tools to manage financial commitments alongside investing.

3. Data Privacy & Security

With sensitive financial data at stake, AI wealth apps 2026 face constant pressure to maintain strong security. Breaches or misuse of personal information could undermine trust in these platforms. Industry experts at Investopedia emphasize that compliance with U.S. regulations and advanced encryption are essential safeguards.

4. Algorithmic Bias & Transparency

Even the most advanced AI portfolio managers can be influenced by biased data sets or opaque algorithms. Investors may not always understand how recommendations are generated, raising concerns about transparency and fairness.

In summary, while the best AI wealth management platforms in USA 2026 provide unmatched convenience and intelligence, investors must remain vigilant. Balancing automation with human oversight, monitoring costs, and ensuring data security are critical steps to mitigate risks and build long‑term financial confidence.

Future Outlook

The future of the best AI wealth management platforms in USA 2026 is defined by innovation, personalization, and deeper integration with emerging technologies. As artificial intelligence continues to evolve, these platforms are expected to become even more sophisticated, offering investors smarter tools for long‑term financial success.

One major trend is the integration of AI with blockchain technology. By combining secure, decentralized ledgers with AI portfolio managers, investors will gain unprecedented transparency and efficiency in wealth management. This shift will reduce fraud, improve compliance, and create a more trustworthy financial ecosystem. For readers exploring broader trends, Top 10 Global Investment Trends in 2026 highlights how blockchain and AI are reshaping global finance.

Another key development is hyper‑personalization. Future AI financial advisors USA will not only analyze market data but also adapt to individual investor behavior, risk tolerance, and life goals. This means portfolios will be tailored in real time, ensuring strategies remain aligned with changing circumstances.

Additionally, robo‑wealth platforms USA are expected to evolve into hybrid models that combine AI automation with human expertise. Investors will benefit from the efficiency of algorithms while still having access to human advisors for complex decisions. Industry experts at Investopedia note that hybrid advisory models are gaining traction as they balance trust with innovation.

Finally, AI wealth apps 2026 will expand beyond investing to include tax optimization, insurance planning, and even integration with smart home devices. This interconnected ecosystem will allow users to manage every aspect of their financial lives seamlessly.

In short, the future outlook for AI wealth management is one of growth, innovation, and personalization. The platforms of tomorrow will empower investors to achieve financial independence with greater confidence and security.

📝 Section 8: User Scenarios

The versatility of the best AI wealth management platforms in USA 2026 lies in how they adapt to different types of investors. Whether you are a beginner, a professional trader, or a retiree, these platforms provide tailored solutions that match unique financial goals.

Beginners:

For newcomers, AI wealth apps 2026 simplify the complexity of investing. Platforms like Betterment AI and Public.com AI offer educational resources alongside automated portfolio management. This makes it easier to understand market movements without feeling overwhelmed. For readers starting their journey, How to Invest in Stocks provides a strong foundation that complements these apps.

Professionals:

Active investors and financial professionals benefit from speed and precision. AI portfolio managers such as Interactive Brokers AI and TradeStation AI deliver real‑time analytics, risk management, and automated execution. These features help professionals capitalize on opportunities while minimizing risks. Industry experts at Forbes emphasize that automation is now essential for high‑frequency trading and advanced portfolio strategies.

Retirees:

For retirees managing fixed incomes, robo‑wealth platforms USA like Wealthfront AI and Vanguard Digital Advisor provide automated portfolio balancing and tax optimization. These tools ensure financial stability without requiring constant monitoring. Internal readers can explore AI Retirement Planning Tools in USA 2026 for deeper insights into how AI supports retirement planning.

Ultimately, these user scenarios highlight the adaptability of the best AI wealth management platforms in USA 2026. From beginners to professionals and retirees, AI empowers every investor to make smarter, more confident decisions in wealth management.

📝 Section 9: Conclusion

The emergence of the best AI wealth management platforms in USA 2026 signals a new era in personal finance. These platforms are not just digital tools; they represent a fundamental shift in how Americans build, protect, and grow their wealth. By combining automation, personalization, and advanced analytics, AI is making wealth management smarter, safer, and more accessible than ever before.

Through AI financial advisors USA, investors gain real‑time insights and tailored strategies that reduce emotional bias and improve decision‑making. Meanwhile, robo‑wealth platforms USA democratize access to professional‑grade portfolio management, offering affordable solutions for beginners, professionals, and retirees alike. For readers exploring practical strategies that align with these innovations, Smart Money Moves 2025 provides actionable steps for building financial confidence.

Equally important are AI wealth apps 2026, which integrate budgeting, saving, and investing into one ecosystem. This interconnected approach ensures that wealth management is not isolated but part of a broader financial lifestyle. Internal readers can explore Best Budgeting Apps in USA 2026 to see how everyday financial tools complement AI‑driven investing.

Looking ahead, AI portfolio managers will continue to evolve, offering hyper‑personalized strategies and deeper integration with blockchain, tax optimization, and retirement planning. Industry experts at Investopedia emphasize that transparency and trust will remain critical as these platforms expand their influence.

In summary, the best AI wealth management platforms in USA 2026 empower investors to achieve financial independence with greater confidence. By balancing automation with human oversight, households can harness AI to secure their future and unlock smarter paths to long‑term prosperity.

Final Note

The best AI wealth management platforms in USA 2026 empower investors with automation, personalization, and security. By integrating AI financial advisors, robo‑wealth platforms, and portfolio managers, these tools redefine financial planning, helping individuals achieve smarter growth, stronger stability, and long‑term prosperity in a rapidly evolving digital economy.