Introduction

Managing money in today’s fast‑paced world has never been more important, and in 2026, households across the USA are turning to Personal finance apps 2026 as their go‑to financial partners. Rising living costs, digital payments, and the growing complexity of personal finance have made traditional spreadsheets and manual tracking outdated. Instead, families and individuals are embracing smart, AI‑powered tools that simplify expense tracking, savings goals, and financial planning.

The demand for the best budgeting apps in USA 2026 reflects a broader shift toward digital finance. These apps are not just calculators; they are intelligent platforms that connect with bank accounts, credit cards, and even smart home devices to provide real‑time insights. Whether it’s monitoring daily spending, setting up automated savings, or preparing for long‑term goals like retirement, budgeting apps are helping Americans take control of their financial future.

What makes this trend especially powerful is accessibility. Most Personal finance apps 2026 are designed with user‑friendly dashboards, personalized recommendations, and secure integrations, making them suitable for beginners as well as experienced investors. For readers exploring related innovations, Best AI Budgeting Apps in 2025 offers a look at how artificial intelligence has already transformed personal finance, paving the way for even more advanced tools in 2026.

Industry experts at Investopedia highlight that budgeting apps are now among the most downloaded financial AI budgeting tools USA, with adoption rates expected to grow steadily through 2026. This surge underscores the importance of choosing the right app — one that balances convenience, security, and advanced features.

Ultimately, the rise of budgeting apps in USA 2026 signals a new era of financial empowerment. By leveraging technology, households can save more, spend smarter, and achieve long‑term stability in an increasingly digital economy.

Rise of Digital Budgeting Tools

The popularity of budgeting apps in USA 2026 reflects a larger transformation in how households approach financial management. Over the past decade, digital tools have evolved from simple expense trackers into comprehensive platforms that integrate with banks, credit cards, and even smart home devices. This evolution has made budgeting more accessible, efficient, and personalized than ever before.

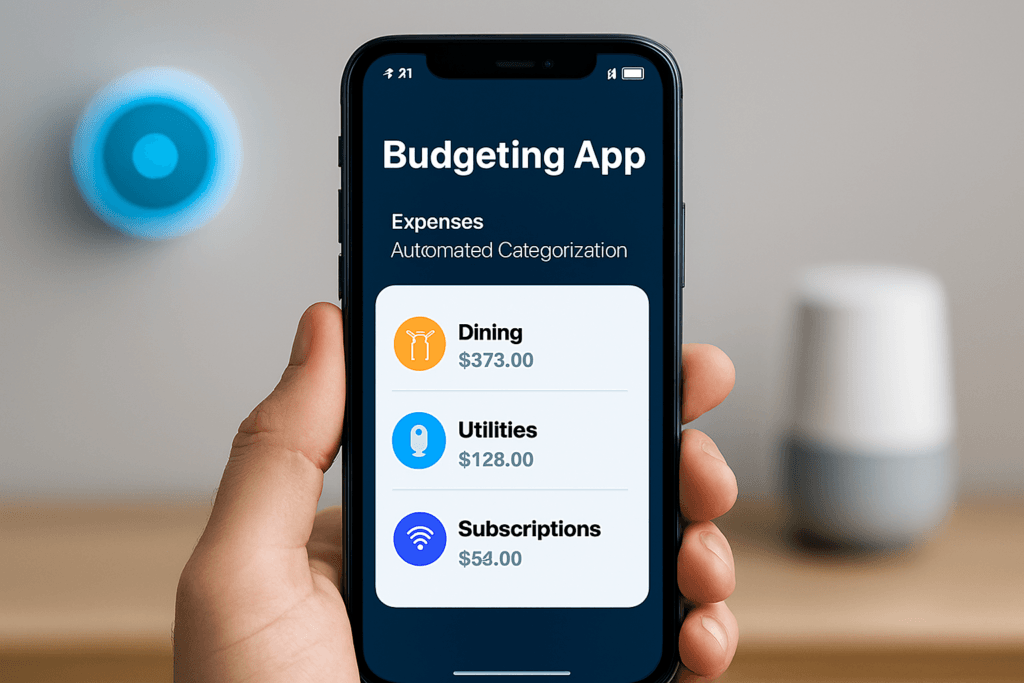

One of the key drivers behind this rise is automation. Modern budgeting apps for beginners automatically categorize expenses, track recurring bills, and highlight spending patterns without requiring manual input. This shift saves users time while providing accurate insights into their financial health. For example, apps can now detect overspending in categories like dining or subscriptions and instantly recommend adjustments to stay on track.

Another factor fueling adoption is the integration of artificial intelligence. AI‑powered budgeting tools analyze user behavior and provide tailored recommendations, helping households save more and plan smarter. For readers interested in related innovations, AI‑Powered Investing Apps for Beginners demonstrates how artificial intelligence is reshaping personal finance beyond budgeting.

Industry experts at NerdWallet note that digital budgeting tools are among the fastest‑growing segments in personal finance, with millions of downloads annually in the USA. This surge highlights the growing reliance on technology to simplify money management and reduce financial stress.

Ultimately, the rise of digital budgeting tools marks a turning point in household finance. By combining automation, AI, and user‑friendly design, these apps empower individuals to take control of their money with minimal effort. As adoption continues to grow, Budgeting apps for beginners are becoming essential companions for achieving financial stability in 2026 and beyond.

Key Features Worth Considering

Choosing the best budgeting apps in USA 2026 requires more than just downloading the most popular option. With dozens of platforms available, households need to focus on the features that truly make a difference in managing money. The right app should not only track expenses but also empower users to save smarter, spend wisely, and plan for the future.

One of the most essential features is automation. Modern budgeting apps automatically categorize transactions, detect recurring bills, and highlight spending trends. This reduces manual effort and ensures accuracy. For example, apps that sync directly with bank accounts and credit cards provide real‑time updates, helping users stay on top of their finances without constant input.

Another critical feature is AI‑powered insights. Artificial intelligence allows apps to analyze spending behavior and recommend personalized strategies. Whether it’s suggesting ways to cut down on dining expenses or highlighting opportunities to save, AI makes budgeting more proactive. For readers exploring related innovations, Top 10 AI‑Powered Personal Finance Tools in USA 2025 offers a deeper look at how AI is reshaping financial management.

Security is equally important. With sensitive financial data involved, apps must offer strong encryption, multi‑factor authentication, and transparent privacy policies. Industry experts at Forbes emphasize that security features are now a top priority for consumers choosing personal finance apps 2026.

Finally, user experience matters. The best apps provide intuitive dashboards, customizable categories, and goal‑setting tools that make budgeting simple and engaging. Accessibility across devices — smartphones, tablets, and desktops — ensures users can manage money anytime, anywhere.

Ultimately, the top features to look for in top budgeting apps USA 2026 combine automation, AI, security, and usability. By focusing on these essentials, households can select tools that deliver real value and long‑term financial stability.

Best Budgeting Apps in USA 2026 (Top 10 List)

With so many options available, choosing the best budgeting apps in USA 2026 can feel overwhelming. To simplify the process, here’s a list of the top apps that stand out for their features, usability, and value.

1. PocketGuard

- Best for: Quick spending snapshots

- Features: Shows how much you can safely spend after bills/savings.

- Pros: Simple interface, strong categorization.

- Cons: Limited advanced features.

2. You Need a Budget (YNAB)

- Best for: Goal‑driven budgeting

- Features: Assigns every dollar a purpose, strong community support.

- Pros: Excellent for long‑term planning.

- Cons: Higher annual cost ($109).

3. Goodbudget

- Best for: Envelope budgeting method

- Features: Digital envelopes for categories, sync across devices.

- Pros: Great for couples/families.

- Cons: Manual input required.

4. Monarch Money

- Best for: Modern design + investment tracking

- Features: Customizable dashboards, integrates with investment accounts.

- Pros: Clean UI, strong analytics.

- Cons: Subscription fee.

5. HoneyDue

- Best for: Partners Collaborating on Financial Planning.

- Features: Expense Sharing and Timely Bill Alerts.

- Pros: Transparent for partners.

- Cons: Limited solo use.

6. Mint (Intuit)

- Best for: All‑in‑one free budgeting

- Features: Expense tracking, credit score monitoring.

- Pros: Free, widely trusted.

- Cons: Ads and limited customization.

Sources:

7. Chronicle (Setapp)

- Best for: Bill tracking on Mac/iOS

- Features: Subscription management, reminders.

- Pros: Great for Apple ecosystem.

- Cons: Limited cross‑platform support.

8. Expenses (Setapp)

- Best for: Simple expense tracking

- Features: Categorization, quick entry.

- Pros: Lightweight, beginner‑friendly.

- Cons: May fall short for highly experienced users.

9. GreenBooks (Setapp)

- Best for: Visual budgeting

- Features: Graphs, charts, easy visualization.

- Pros: Engaging design.

- Cons: Mac/iOS only.

10. Monzo (Global Expansion)

- Best for: Banking + budgeting in one

- Features: Real‑time spending alerts, savings pots.

- Pros: Combines banking + budgeting.

- Cons: Limited availability in USA.

Integration with Smart Homes & Wallets

One of the most exciting developments in budgeting apps in USA 2026 is their integration with smart homes and digital wallets. As households adopt connected devices, AI budgeting tools USA are evolving to sync seamlessly with everyday technology, making financial management more intuitive and automated.

Smart home devices such as thermostats, refrigerators, and voice assistants are now capable of linking with budgeting apps to track utility costs and suggest savings. For example, a smart thermostat can report monthly energy usage directly into a budgeting dashboard, helping families see how lifestyle changes impact their finances. This integration transforms budgeting from a passive activity into a proactive system that adapts to real‑time household behavior.

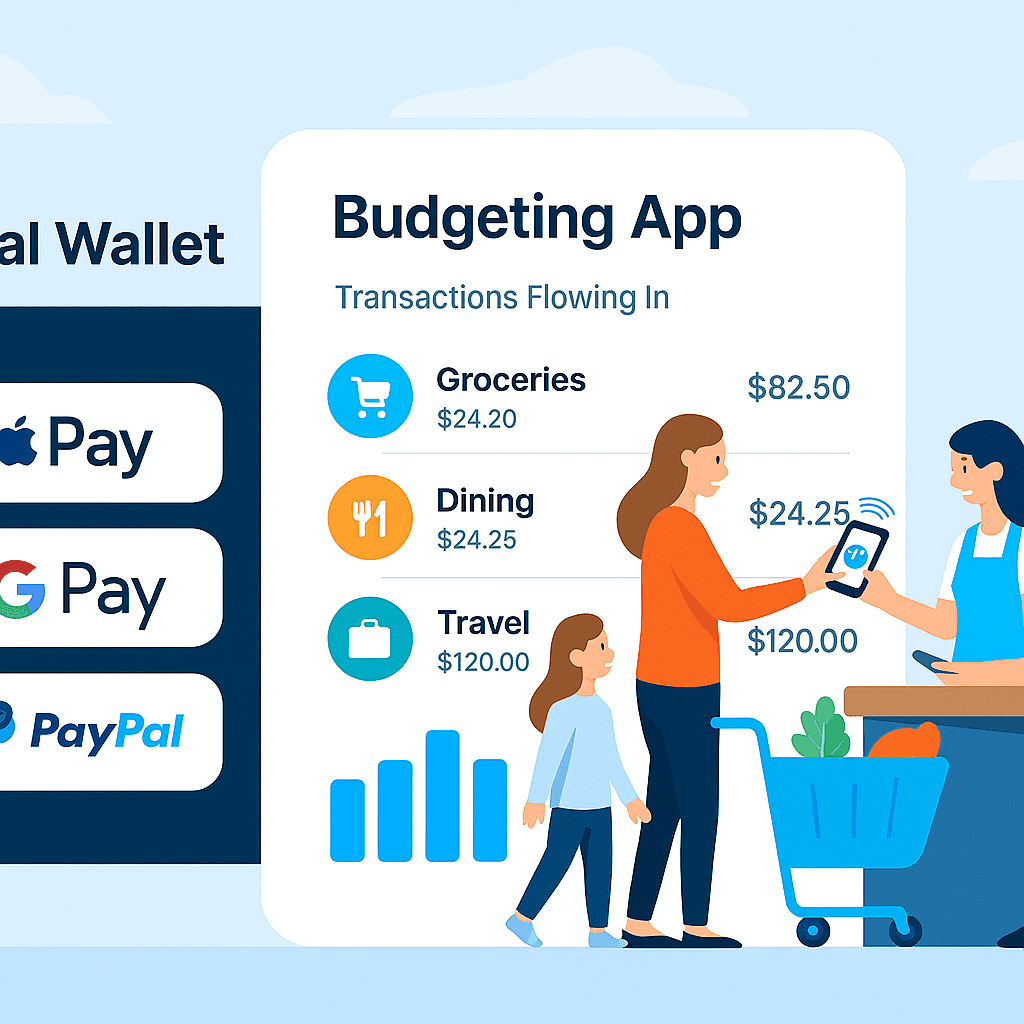

Digital wallets are also playing a central role. Apps like PayPal, Apple Pay, and Google Pay are increasingly integrated into budgeting platforms, allowing users to monitor transactions instantly. Instead of waiting for bank statements, households can view spending patterns in real time, categorize expenses, and adjust budgets accordingly. For readers exploring related innovations, Top 10 Mobile Wallets in USA 2026 provides insights into how wallets are reshaping payments and personal finance.

Industry experts at TechCrunch highlight that the convergence of smart homes and digital wallets is creating a new ecosystem of financial management. By combining automation, AI, and secure payment systems, budgeting apps for beginners are becoming central hubs for household finance.

Ultimately, the integration with smart homes and wallets represents the future of budgeting. Families can now save more efficiently, track expenses effortlessly, and enjoy a holistic view of their financial health — all from the comfort of their connected homes.

Challenges & Risks

While the best budgeting apps in USA 2026 offer powerful tools for managing money, households must also recognize the challenges and risks that come with relying on digital platforms. As adoption grows, issues of privacy, cost, and accessibility remain critical factors to consider.

One of the biggest risks is data privacy. Budgeting apps require access to sensitive financial information, including bank accounts and credit card transactions. Without strong encryption and transparent policies, users may face vulnerabilities to cyberattacks or unauthorized data sharing. Industry experts at Forbes emphasize that privacy concerns are among the top barriers to wider adoption of financial apps.

Another challenge is subscription costs. While many apps offer free versions, the most advanced features — such as AI‑powered insights, investment tracking, or multi‑device syncing — often come with monthly or annual fees. For families already managing tight budgets, these costs can feel counterproductive. For readers exploring alternatives, Best Budgeting Apps in 2025 highlights free and affordable options that remain relevant in 2026.

Accessibility is also a concern. Not all users have the technical literacy to navigate complex dashboards or integrate apps with smart homes and wallets. Without proper education and support, households may struggle to maximize the benefits of these tools.

Finally, there is the risk of over‑reliance on automation. While AI insights are valuable, they cannot replace human judgment. Families must balance app recommendations with personal financial goals to avoid mismanagement.

Ultimately, the challenges and risks of budgeting apps underscore the importance of choosing platforms carefully. By prioritizing privacy, affordability, and usability, households can enjoy the benefits of digital budgeting while minimizing potential downsides.

Future Outlook

The future of budgeting apps in USA 2026 points toward even deeper integration with artificial intelligence, automation, and connected financial ecosystems. As households demand smarter AI budgeting tools USA, these apps are expected to evolve from simple trackers into comprehensive financial hubs that manage every aspect of personal finance.

AI will play a central role in this transformation. Instead of just categorizing expenses, future apps will predict spending patterns, recommend personalized savings strategies, and even suggest investment opportunities based on user behavior. For readers exploring related innovations, Best AI Stock Trading Apps in USA 2026 shows how AI is already reshaping investment decisions, a trend that will soon merge with budgeting platforms.

Another major development will be integration with smart homes and digital wallets. As connected devices become standard, budgeting apps will automatically track utility costs, subscription payments, and household spending in real time. This convergence will allow families to see the financial impact of their daily routines instantly. Industry experts at TechCrunch predict that by 2030, budgeting apps will act as central dashboards for both household and financial management.

Global expansion is also on the horizon. While the USA leads adoption, countries like the UK, Canada, and Australia are expected to embrace similar tools, adapting them to local financial systems. This creates opportunities for apps to scale internationally, offering consistent experiences across markets.

Ultimately, the future outlook for budgeting apps is one of growth, intelligence, and accessibility. By combining AI, automation, and global reach, these platforms will empower households to save more, spend smarter, and achieve long‑term financial stability in an increasingly digital economy.

User Scenarios — How Different People Use Budgeting Apps

The true strength of the best budgeting apps in USA 2026 lies in their adaptability. Different users — from students to retirees — can benefit in unique ways, making these tools essential across all demographics.

Students: For college students managing tuition, rent, and daily expenses, top budgeting apps USA 2026 provide clarity. Tools like Mint or PocketGuard help track small purchases, prevent overspending, and set savings goals for textbooks or travel. By automating expense categorization, students can focus on academics while maintaining financial discipline.

Young Professionals: Early‑career workers often juggle salaries, bills, and lifestyle expenses. Top budgeting apps USA 2026 such as YNAB or Monarch Money allow them to assign every dollar a purpose, ensuring savings for emergencies or investments. For readers exploring related strategies, Smart Money Moves 2025 offers practical tips that align perfectly with budgeting app features.

Families: Household budgeting can be complex, with multiple incomes and shared expenses. Budgeting apps for beginners like HoneyDue and Goodbudget simplify this by offering transparency and shared dashboards. Couples can track bills together, set joint savings goals, and avoid financial misunderstandings.

Retirees: For retirees living on fixed incomes, top budgeting apps USA 2026 provide peace of mind. By monitoring recurring expenses and highlighting unnecessary spending, tools like GreenBooks or Monarch Money help maintain financial stability during retirement. Industry experts at NerdWallet emphasize that retirees benefit most from apps with simple interfaces and strong security.

Ultimately, these user scenarios highlight the versatility of budgeting apps. Whether it’s a student saving for books, a professional planning investments, a family managing bills, or a retiree protecting savings, the best budgeting apps in USA 2026 adapt to every stage of life.

Conclusion

The rise of budgeting apps in USA 2026 marks a turning point in personal finance. What was once a tedious process of spreadsheets and manual tracking has now evolved into intelligent, automated platforms that empower households to save more, spend smarter, and plan for the future. From AI‑powered insights to seamless integration with smart homes and digital wallets, these apps are redefining how Americans manage money in their daily lives.

The diversity of options — from beginner‑friendly AI budgeting tools USA like PocketGuard and Mint to top budgeting apps USA 2026 advanced platforms such as YNAB and Monarch Money — ensures that every household can find a solution tailored to its needs. For couples, apps like HoneyDue provide transparency and shared accountability, while visual tools like GreenBooks make budgeting engaging and easy to understand.

For readers exploring related innovations, Top 10 AI‑Powered Personal Finance Tools in USA 2025 offers a broader look at how artificial intelligence is transforming financial management, while Best AI Budgeting Apps in 2025 highlights earlier trends that paved the way for today’s advancements. Together, these resources show how budgeting apps are part of a larger ecosystem of fintech innovation.

Industry experts at Investopedia emphasize that households adopting digital budgeting tools early will enjoy long‑term financial resilience. This underscores the importance of choosing the right app — one that balances automation, security, and usability.

Ultimately, the conclusion is clear: the best budgeting apps in USA 2026 are not just tools, they are financial companions. By embracing these platforms today, families can position themselves at the forefront of a digital revolution that promises efficiency, security, and lasting financial stability.

📝 Final Note

In the end, adopting the best budgeting apps in USA 2026 is more than a financial choice — it’s a lifestyle upgrade. These AI budgeting tools USA empower households to stay disciplined, reduce stress, and achieve long‑term goals. By embracing technology today, families secure tomorrow’s financial freedom with smarter, simpler, and more reliable budgeting solutions.