Introduction

In 2025, digital banking has become more than just a convenience — it’s now the backbone of modern personal finance. With millions of people shifting from traditional banks to mobile‑first solutions, the demand for secure, fast, and user‑friendly apps has skyrocketed. Whether you’re managing savings, tracking expenses, or sending money internationally, the right banking app can transform the way you handle money every day.

This guide highlights the Best 10 Digital Banking Apps in USA, UK, Canada & Australia, carefully selected for their security, ease of use, and innovative features. By focusing on high‑CPM regions like the USA, UK, Canada, and Australia, we ensure you’re getting insights into the most trusted and widely used apps worldwide.

For beginners, choosing the right app can feel overwhelming. That’s why we’ve created this 2025 guide — to help you compare features, understand benefits, and confidently pick the digital banking solution that fits your lifestyle. Whether you’re looking for advanced budgeting tools, international transfer options, or simply a secure way to manage your accounts, these apps represent the very best in modern banking.

What Are Digital Banking Apps?

Digital banking apps are mobile applications that allow users to manage their finances directly from their smartphones or tablets, without needing to visit a physical bank branch. They combine the essential services of traditional banking — such as checking balances, transferring money, and paying bills — with modern features like budgeting tools, instant notifications, and advanced security.

Unlike traditional online banking websites, these apps are designed for speed, convenience, and accessibility. With just a few taps, users can deposit checks, send international payments, or track spending habits in real time. Many apps also integrate with digital wallets and investment platforms, making them a central hub for managing all aspects of personal finance.

Learn more about smart money management in your 20s in our guide on Budgeting vs Expense Tracking in 20s

In 2025, the Best 10 Digital Banking Apps in USA stand out because they not only provide core banking services but also offer innovative features like AI‑powered financial insights, multi‑currency support, and biometric security. For beginners, these apps simplify money management, while advanced users benefit from powerful tools that rival traditional banks.

Benefits of Digital Banking Apps

Digital banking apps have revolutionized the way people manage money in 2025. Instead of waiting in long queues or dealing with outdated systems, users now enjoy instant access to their finances through secure, mobile‑friendly platforms. The Best 10 Digital Banking Apps in USA stand out because they combine convenience with innovation, offering features that traditional banks often struggle to match.

Key Benefits

- Enhanced Security

- Biometric logins (fingerprint, facial recognition)

- Two‑step verification and fraud alerts

- Encrypted transactions to protect sensitive data

- Ease of Use

- Intuitive dashboards designed for beginners

- Real‑time notifications for spending and deposits

- Simple navigation for transfers, bill payments, and account management

- Global Access

- Multi‑currency support for international users

- Seamless cross‑border transfers (especially apps like Revolut and Monzo)

- Availability in high‑CPM regions: USA, UK, Canada, Australia

- Cost Savings

- Lower fees compared to traditional banks

- Free accounts and no‑minimum balance options

- Cashback, rewards, and budgeting tools to maximize savings

- Innovation & Integration

- AI‑powered financial insights for smarter decisions

- Integration with mobile wallets and investing platforms

- Individualized recommendations on the basis of spending habits

Discover how different income types affect your financial journey in Active Income vs Passive Income.

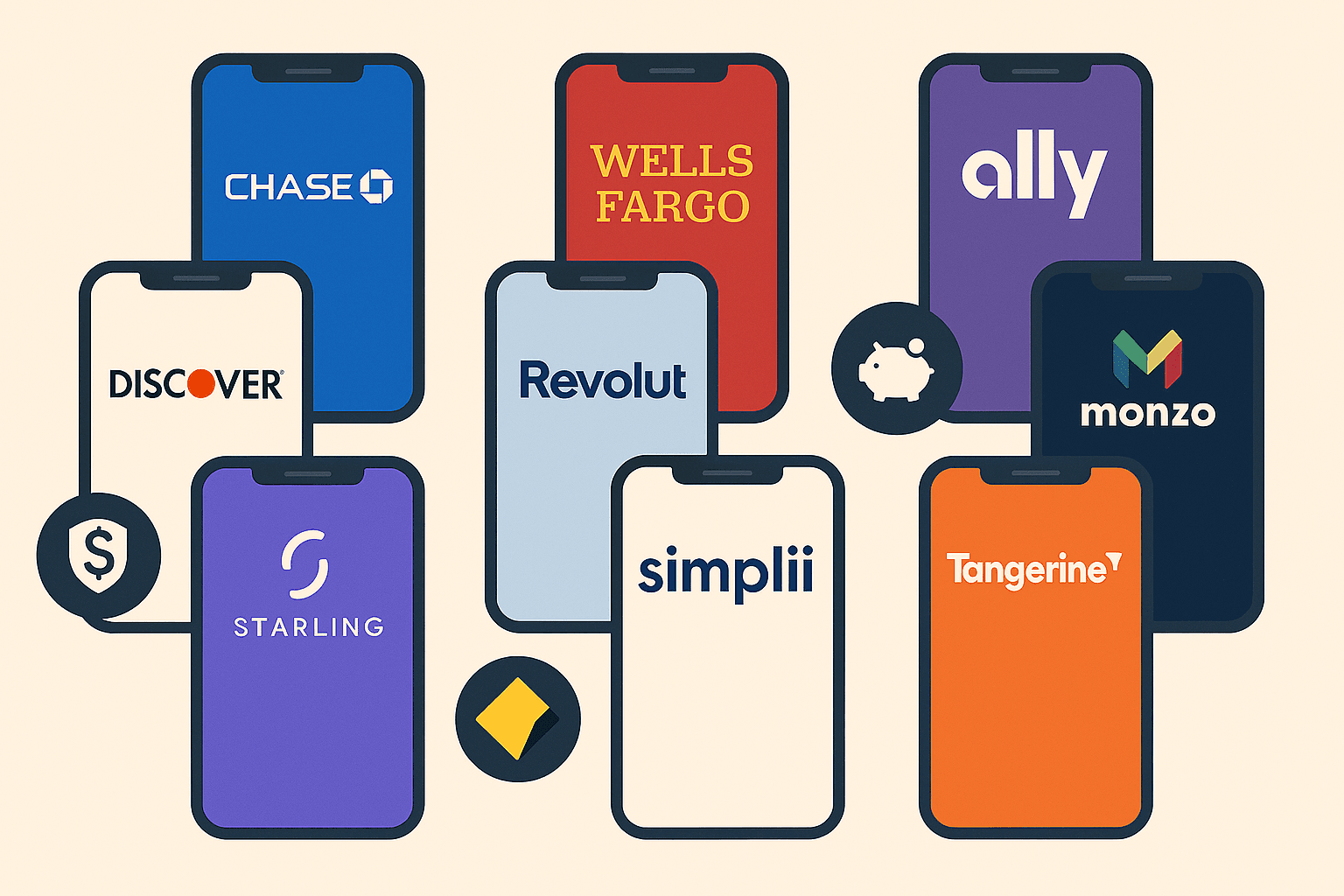

Best 10 Digital Banking Apps in USA, UK, Canada & Australia (2025 Guide)

1. Chase Mobile

Chase Mobile is one of the most trusted banking apps in the USA, offering a full suite of digital services. Users can check balances, transfer funds, pay bills, and even deposit checks directly from their smartphones. The app integrates seamlessly with Chase credit cards, allowing customers to track rewards and manage payments in one place. With advanced security features like biometric login and fraud alerts, Chase Mobile ensures safe transactions. As part of the Best 10 Digital Banking Apps in USA, it stands out for its reliability and nationwide reach.

🔗 Chase Mobile Banking

2. Wells Fargo Mobile

Wells Fargo Mobile provides a user‑friendly interface for everyday banking needs. Customers can view account balances, transfer money, and set up alerts for transactions. The app also includes budgeting tools and personalized financial insights. Security is a top priority, with two‑factor authentication and encrypted transactions. For beginners, Wells Fargo Mobile offers simplicity without compromising on features. Its strong presence across the USA makes it a key contender in the Best 10 Digital Banking Apps in USA list.

🔗 Wells Fargo Mobile App

Looking to grow wealth alongside banking apps? Check out Best Passive Income Ideas for 2025.

3. Ally Mobile Banking

Ally Mobile Banking is known for its fee‑free accounts and intuitive design. Users can manage savings, checking, and investment accounts all in one app. Ally also offers competitive interest rates and easy‑to‑use budgeting tools. With 24/7 customer support and strong security measures, it’s a favorite among digital‑first users. As part of the Best 10 Digital Banking Apps in USA, Ally appeals to those seeking modern banking without hidden fees.

🔗 Ally Online & Mobile Banking

4. Discover Mobile

Discover Mobile combines banking with rewards, making it ideal for customers who use Discover credit cards. The app allows users to manage accounts, pay bills, and redeem cashback rewards directly. It also offers budgeting insights and fraud protection. Discover Mobile’s integration of rewards with banking makes it unique among the Best 10 Digital Banking Apps in USA.

🔗 Discover Mobile Banking App

5. Revolut

Revolut is a UK‑based digital bank that has expanded globally. It offers multi‑currency accounts, international transfers, and cryptocurrency trading. Revolut is especially popular among travelers and international users. Its sleek design and advanced features make it one of the most innovative apps in the Best 10 Digital Banking Apps in USA, UK, Canada & Australia.

🔗 Revolut Official Site

6. Monzo

Monzo is a UK challenger bank known for its budgeting tools and user‑friendly interface. The app provides instant notifications, spending insights, and easy money transfers. Monzo’s transparency and focus on customer experience make it a standout in the Best 10 Digital Banking Apps in USA, UK, Canada & Australia list.

🔗 Monzo Bank

7. Starling Bank

Starling Bank offers award‑winning mobile banking with features like savings goals, spending insights, and fee‑free international transfers. Security is robust, with biometric login and fraud monitoring. Starling’s commitment to innovation places it firmly among the Best 10 Digital Banking Apps in USA, UK, Canada & Australia.

🔗 Starling Bank Official Site

8. Simplii Financial

Simplii Financial is a Canadian digital bank offering easy mobile access to accounts, transfers, and bill payments. It provides no‑fee accounts and strong customer support. Simplii’s simplicity and reliability make it a trusted choice in Canada and a strong entry in the Best 10 Digital Banking Apps in USA, UK, Canada & Australia.

🔗 Simplii Financial

9. Tangerine Bank

Tangerine is Canada’s leading digital bank, known for its no‑fee accounts and intuitive mobile app. Users can manage savings, checking, and investment accounts seamlessly. Tangerine’s focus on customer empowerment makes it a top contender in the Best 10 Digital Banking Apps in USA, UK, Canada & Australia.

🔗 Tangerine Canada

Explore how technology is reshaping finance in Fintech Innovations 2025: Personal Finance.

10. Commonwealth Bank (CommBank)

CommBank is Australia’s most widely used banking app, offering advanced security and a wide range of features. Users can transfer money, pay bills, and access financial insights instantly. CommBank’s strong reputation and innovative tools secure its place in the Best 10 Digital Banking Apps in USA, UK, Canada & Australia.

🔗 CommBank App

Comparison Table + Explanation

Comparison of the Best 10 Digital Banking Apps in USA, UK, Canada & Australia (2025)

| App Name | Country | Security Level | Ease of Use | Fees | Key Features |

|---|---|---|---|---|---|

| Chase Mobile | USA | High | Excellent | Low | Rewards integration |

| Wells Fargo | USA | High | Good | Moderate | Budgeting alerts |

| Ally Mobile | USA | High | Excellent | No fees | Competitive interest rates |

| Discover Mobile | USA | High | Excellent | Low | Cashback rewards integration |

| Revolut | UK/Global | High | Excellent | Low | Multi‑currency + crypto trading |

| Monzo | UK | High | Excellent | Low | Real‑time budgeting insights |

| Starling Bank | UK | High | Excellent | Low | Award‑winning savings tools |

| Simplii | Canada | High | Good | No fees | Easy transfers + bill payments |

| Tangerine | Canada | High | Excellent | No fees | No‑fee accounts + investments |

| CommBank | Australia | High | Excellent | Moderate | Advanced security + insights |

Explanation

This comparison highlights the strengths of each app across security, usability, fees, and unique features. The Best 10 Digital Banking Apps in USA stand out for their combination of strong security and user‑friendly design. Chase, Ally, and Discover dominate the U.S. market with rewards and fee‑free options, while UK challengers like Monzo and Starling lead in innovation and budgeting tools. Canadian apps such as Tangerine and Simplii focus on no‑fee accounts, making them beginner‑friendly. CommBank in Australia rounds out the list with advanced security and financial insights.

By reviewing this table, readers can quickly identify which app aligns with their needs — whether it’s rewards, international transfers, or simple, secure banking.

How to Choose the Right Banking App

With so many options available, beginners often wonder how to select the right digital banking app. The Best 10 Digital Banking Apps in USA all provide strong features, but the ideal choice depends on your personal needs and financial goals. Here are some key factors to consider:

Security First

Always prioritize apps with advanced security features such as biometric login, two‑factor authentication, and fraud alerts. Protecting your money and personal data should be the top priority.

For beginners interested in investing, don’t miss our guide on AI‑Powered Investing Apps for Beginners.

Fees and Rewards

Look for apps that minimize fees and maximize rewards. Ally and Tangerine, for example, offer no‑fee accounts, while Discover integrates cashback rewards directly into its banking app.

Ease of Use

Beginners should choose apps with simple, intuitive dashboards. Chase Mobile and Monzo are excellent examples of apps that make navigation easy, even for first‑time users.

Global Access

If you travel or send money internationally, apps like Revolut and Starling Bank provide multi‑currency support and fee‑free transfers. This makes them valuable additions to the Best 10 Digital Banking Apps in USA, UK, Canada & Australia list.

Customer Support

Reliable customer service is essential. Apps with 24/7 support, such as Ally, ensure that help is always available when you need it.

By weighing these factors, beginners can confidently select the app that best fits their lifestyle. Whether you prioritize security, rewards, or international features, the Best 10 Digital Banking Apps in USA offer solutions for every type of user.

Future of Digital Banking Apps (2025–2030 Trends)

The future of digital banking apps looks even more transformative as we move toward 2030. The Best 10 Digital Banking Apps in USA are already leading the way, but upcoming innovations will redefine how people interact with money. Artificial intelligence will play a bigger role, offering personalized financial coaching, predictive budgeting, and fraud detection that adapts in real time. Blockchain technology is expected to enhance security, making transactions faster and more transparent.

Biometric authentication will also evolve, moving beyond fingerprints and facial recognition to voice and behavioral patterns, ensuring that accounts remain secure. Integration with fintech ecosystems will expand, allowing users to manage savings, investments, insurance, and even taxes within a single app. For global users, multi‑currency accounts and instant cross‑border transfers will become standard, reducing reliance on traditional banks.

In high‑CPM regions like the USA, UK, Canada, and Australia, these apps will continue to dominate by offering localized features while maintaining global accessibility. The Best 10 Digital Banking Apps in USA are not just tools for today — they are shaping the financial future for the next decade.

Tips for Maximizing Your Digital Banking Experience

Choosing the right app is only the first step; using it effectively is what unlocks real value. The Best 10 Digital Banking Apps in USA provide powerful tools, but users must know how to maximize them. Start by enabling security features such as biometric login and transaction alerts — this ensures your account is protected at all times.

Leverage budgeting tools to track spending habits and set savings goals. Apps like Monzo and Ally offer real‑time insights that help beginners stay disciplined. For advanced users, linking your banking app with investment platforms or digital wallets can create a complete financial ecosystem. Travelers should take advantage of multi‑currency accounts and fee‑free transfers offered by Revolut and Starling Bank.

Avoid common mistakes such as ignoring app updates or failing to monitor hidden fees. Regularly reviewing your account settings ensures you’re getting the most out of your app. Finally, don’t hesitate to use multiple apps — one for rewards, another for international transfers, and a third for budgeting. By combining strengths, you can build a customized toolkit that fits your lifestyle.

With these strategies, the Best 10 Digital Banking Apps in USA become more than just banking tools — they become partners in achieving financial freedom. By choosing one of the Best 10 Digital Banking Apps in USA, you gain more than convenience — you gain control over your financial future.

Why Digital Banking Apps Are Essential in 2025

In today’s fast‑paced financial world, digital banking apps are no longer optional — they are essential tools for managing money effectively. The Best 10 Digital Banking Apps in USA demonstrate how technology has reshaped banking by offering instant access, personalized insights, and secure transactions. Unlike traditional banks that often rely on outdated systems, these apps provide real‑time updates, helping users stay in control of their finances at all times.

For younger generations, digital banking apps are the gateway to financial independence. Students and professionals can track expenses, set savings goals, and avoid unnecessary fees with just a few taps. For families, these apps simplify bill payments and budgeting, ensuring smoother household financial management. Travelers benefit from multi‑currency support and fee‑free transfers, while entrepreneurs use them to monitor cash flow and manage accounts on the go.

The Best 10 Digital Banking Apps in USA, UK, Canada & Australia are more than just convenient — they represent the future of financial empowerment. By combining security, innovation, and accessibility, they ensure that users can confidently navigate the challenges of modern finance in 2025 and beyond.

Conclusion + Call to Action

Digital banking is no longer a luxury — it’s the standard for managing money in 2025. From secure transactions to AI‑powered insights, the Best 10 Digital Banking Apps in USA, UK, Canada & Australia prove that modern banking can be simple, safe, and rewarding. Whether you’re a beginner looking for ease of use or an advanced user seeking global access and innovative features, these apps deliver solutions that fit every lifestyle.

By choosing one of the Best 10 Digital Banking Apps in USA, you gain more than convenience — you gain control over your financial future. With features like fee‑free accounts, instant notifications, and international transfers, these apps empower you to save smarter, spend wisely, and grow your wealth.

Call to Action:

Don’t wait for traditional banks to catch up. Download one of these apps today, explore its features, and take the first step toward smarter financial management in 2025. Share this guide with friends and family so they too can benefit from the Best 10 Digital Banking Apps in USA and beyond.

Pingback: Best Online Payment Apps in USA 2025 – Secure, Fast & Trusted Options