Introduction

In 2025, managing money has become more than just a routine task — it’s a digital experience shaped by artificial intelligence and mobile technology. Beginners who are stepping into the world of investing often feel overwhelmed by complex platforms, unpredictable markets, and the fear of making costly mistakes. This is where AI Powered Investing Apps for Beginners come in. These tools simplify decision‑making by using algorithms to analyze trends, suggest strategies, and even automate trades, making investing less intimidating for newcomers.

At the same time, mobile wallets have transformed the way people handle everyday transactions. Whether it’s paying for groceries, transferring funds, or securing online purchases, mobile wallets provide convenience and safety that traditional banking methods can’t match. For beginners, combining an AI‑driven investing app with a reliable mobile wallet creates a powerful ecosystem: one tool helps grow wealth, while the other ensures secure and seamless payments.

What makes this combination especially relevant in 2025 is the global shift toward digital finance. In countries like the USA, UK, Canada, and Australia, users are demanding platforms like AI Powered Investing Apps for Beginners that are not only easy to use but also trustworthy and compliant with strict financial regulations. For beginners, this means they can start small, learn quickly, and build confidence without worrying about technical barriers.

This guide highlights the 10 best AI Powered Investing Apps for Beginners with Mobile Wallets available today. Each option has been carefully selected to balance usability, security, and innovation, ensuring that readers can make informed choices as they begin their financial journey.

For more ways to grow wealth, check out our guide on Best Passive Income Ideas for 2025.

What Are AI‑Powered Investing Apps?

Investing has always been about making informed decisions, but beginners often struggle with the complexity of financial markets. In 2025, technology has changed the game. AI Powered Investing Apps for Beginners are designed to simplify the process by using artificial intelligence to analyze data, predict trends, and provide personalized recommendations.

These AI Powered Investing Apps for Beginners act like digital mentors. Instead of spending hours studying charts or reading financial reports, beginners can rely on AI algorithms to highlight opportunities and risks in real time. Features such as robo‑advisors, automated portfolio balancing, and predictive analytics make investing more accessible than ever. For someone new to finance, this means less guesswork and more confidence.

Another advantage is customization. AI doesn’t just offer generic advice — it learns from user behavior. If a beginner prefers low‑risk investments, the app adjusts recommendations accordingly. If they want to explore stocks, ETFs, or even crypto, the app tailors insights to match those interests. This flexibility ensures that beginners can grow at their own pace without feeling overwhelmed.

In short, AI Powered Investing Apps for Beginners bridge the gap between complex financial knowledge and everyday users. They provide clarity, reduce errors, and empower people to start investing with confidence, even if they have no prior experience.

Beyond automation, these AI Powered Investing Apps for Beginners help beginners avoid emotional mistakes such as panic selling or chasing hype. By relying on AI‑driven insights, users can stay disciplined, follow consistent strategies, and gradually build confidence. This makes AI Powered Investing Apps for Beginners not just tools for trading, but long‑term partners in financial growth.

These apps also help beginners stay consistent with long‑term goals, reducing emotional bias and improving financial discipline.

Why Mobile Wallets Matter in 2025

Finance in 2025 is no longer limited to traditional banks or physical cards. Mobile wallets have become an essential part of everyday life, offering speed, convenience, and security that beginners can rely on. For someone just starting their financial journey, pairing a mobile wallet with AI Powered Investing Apps for Beginners creates a seamless ecosystem where investing and spending are both managed digitally.

Mobile wallets allow users to store payment information securely, make instant transfers, and complete purchases with just a tap. Features such as biometric authentication, two‑factor security, and advanced encryption make them safer than carrying cash or even using physical cards. Beginners benefit because they can focus on learning how to invest while trusting their wallet to handle transactions securely.

Another reason mobile wallets matter is integration. Many of the best investing apps now connect directly with wallets, allowing users to fund accounts, withdraw profits, or pay for services without switching platforms. This integration saves time and reduces friction, making financial management smoother for beginners.

In countries like the USA, UK, Canada, and Australia, mobile wallets are not just popular — they’re becoming the default method of payment. For beginners, adopting these tools early means staying ahead of the curve and building confidence in digital finance. When combined with AI Powered Investing Apps for Beginners, mobile wallets provide the perfect balance of growth and security.

Criteria for Selection

Choosing the right financial tools can feel overwhelming, especially for beginners who are just starting their journey. To make this guide practical and trustworthy, each app and mobile wallet has been evaluated against clear criteria that ensure safety, usability, and long‑term value.

The first and most important factor is security. Both AI Powered Investing Apps for Beginners and mobile wallets must comply with strict regulations in countries like the USA, UK, Canada, and Australia. Features such as encryption, biometric login, and fraud detection are non‑negotiable. Beginners need platforms they can trust with their money and personal data.

Next is ease of use. Complex dashboards or confusing payment flows can discourage new users. The best AI Powered Investing Apps for Beginners are designed with simple interfaces, guided tutorials, and automated features that reduce the learning curve. Similarly, mobile wallets should allow quick transactions without unnecessary steps.

Cost transparency is another key factor. Hidden fees or unclear pricing can erode trust. Apps and wallets included in this list provide clear information about charges, whether for trades, transfers, or subscriptions.

Finally, global availability and integration matter. Beginners benefit most from tools that work across borders and connect seamlessly with other financial services. This ensures flexibility and convenience as they grow their financial confidence.

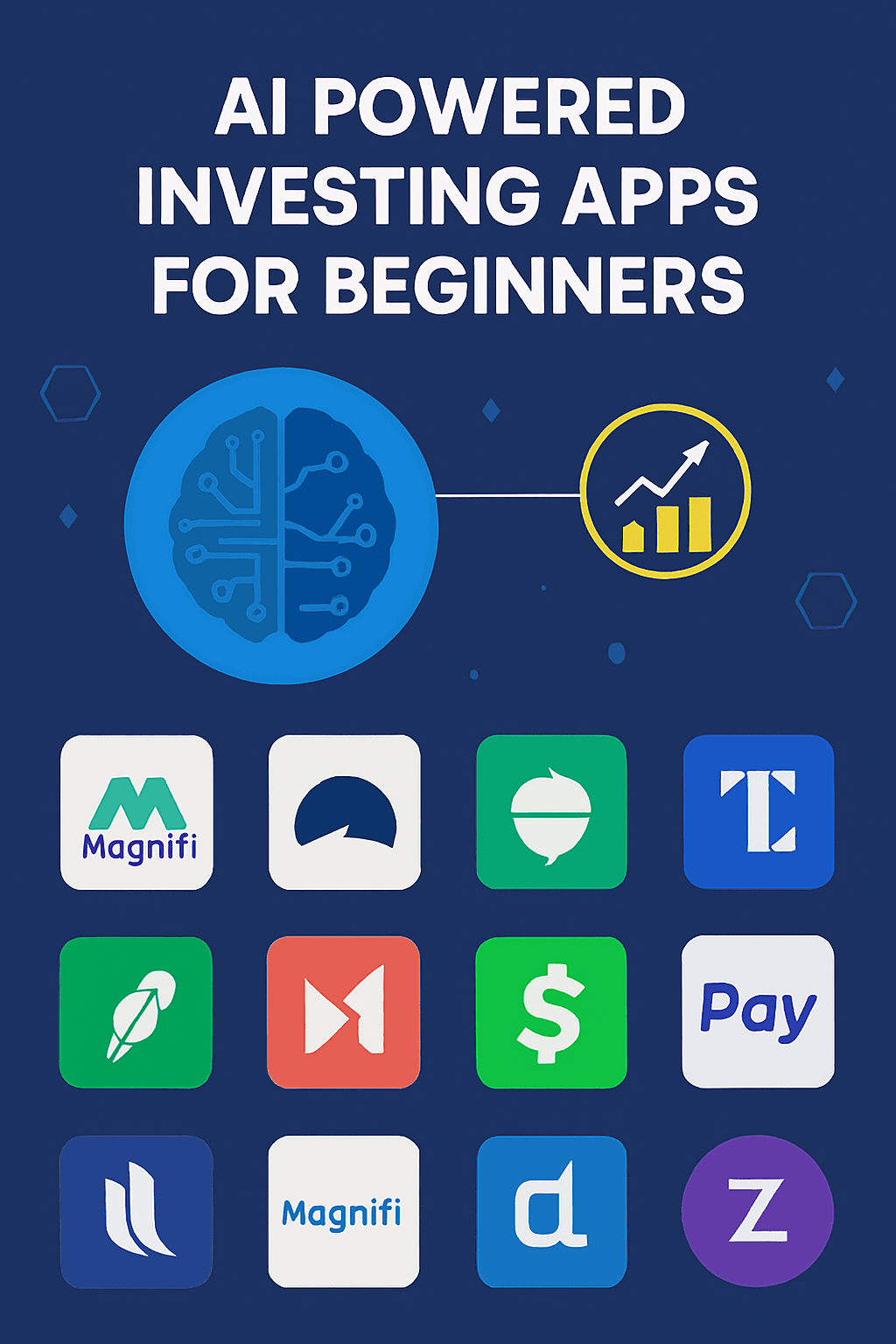

Top 10 AI‑Powered Investing Apps for Beginners

The rise of artificial intelligence has transformed investing from a complex task into something accessible for everyday users. Beginners now have the chance to use apps that provide real‑time insights, automated portfolio management, and personalized strategies. Below are ten standout platforms in 2025 that combine usability, security, and innovation. Beginners should explore multiple AI Powered Investing Apps for Beginners to compare features, fees, and usability before committing, ensuring they choose the best fit.

1. Bobby (RockFlow AI)

- Best For: Smart, seamless investing + trading

- Features: Conversational AI agent, in‑app trading, beginner‑friendly guidance

- Why It’s Great for Beginners: Feels like chatting with a financial coach while executing trades instantly.

2. Magnifi

- Best For: Account analysis and broker integration

- Features: Links with major brokers, personalized portfolio insights

- Beginner Advantage: Simplifies account setup and provides clear, actionable recommendations.

- Learn more about Magnifi directly from their official website.

Want to compare brokers? Read our breakdown of the 10 Best Online Brokers for Beginners.

3. Tickeron

- Best For: Quantitative analysis and trading signals

- Features: AI‑driven predictions, backtesting tools, robo‑advisors

- Beginner Advantage: Offers guided strategies without requiring deep technical knowledge.

Explore AI trading signals at Tickeron’s official site.

4. Incite AI

- Best For: Q&A style financial learning

- Features: Conversational bot for market questions, educational insights

- Beginner Advantage: Helps users learn while investing, reducing confusion.

5. Wealthfront (AI Enhanced)

- Best For: Automated portfolio management

- Features: AI‑driven rebalancing, tax‑loss harvesting, diversified portfolios

- Beginner Advantage: Hands‑off investing with strong compliance and security.

See Wealthfront’s AI‑driven portfolios on their official site.

6. Betterment (AI Robo‑Advisor)

- Best For: Long‑term investing goals

- Features: AI‑powered goal tracking, personalized portfolios

- Beginner Advantage: Easy to set up, perfect for retirement or savings plans.

If you’re new to stock investing, our detailed post on How to Invest in Stocks will help you build a strong foundation.

7. Q.ai

- Best For: AI investment kits

- Features: Pre‑built portfolios powered by machine learning

- Beginner Advantage: Lets users invest in themes (tech, green energy) without deep research.

8. SoFi Invest (AI Features)

- Best For: All‑in‑one finance + investing

- Features: AI insights, fractional shares, mobile wallet integration

- Beginner Advantage: Combines investing with everyday financial tools.

9. Robinhood (AI Upgrades 2025)

- Best For: Commission‑free trading with AI insights

- Features: Predictive analytics, beginner tutorials, mobile wallet compatibility

- Beginner Advantage: Simple interface, strong community support.

Curious about stock types? Learn the difference in our guide on Common vs Preferred Stocks in 2025.

10. Acorns (AI Smart Saving)

- Best For: Micro‑investing and savings automation

- Features: Rounds up purchases, invests spare change using AI portfolios

- Beginner Advantage: Perfect for absolute beginners who want to start small.

Start micro‑investing with Acorns at their official site.

Summary of Benefits

- Ease of Use: All apps prioritize beginner‑friendly interfaces.

- AI Insights: Predictive analytics and robo‑advisors reduce guesswork.

- Integration: Many apps connect with mobile wallets for seamless transactions.

- Global Reach: Available in USA, UK, Canada, and Australia, aligning with your target audience.

Pro Tip: Beginners should experiment with at least two different AI Powered Investing Apps for Beginners before committing to one platform. Each app offers unique features — some focus on robo‑advisors, others emphasize educational content or predictive analytics. By comparing fees, usability, and integration of AI Powered Investing Apps for Beginners with mobile wallets, users gain a clearer understanding of which app fits their personal style. This hands‑on approach reduces risk, improves learning, and ensures that beginners don’t feel locked into a single system too early in their journey.

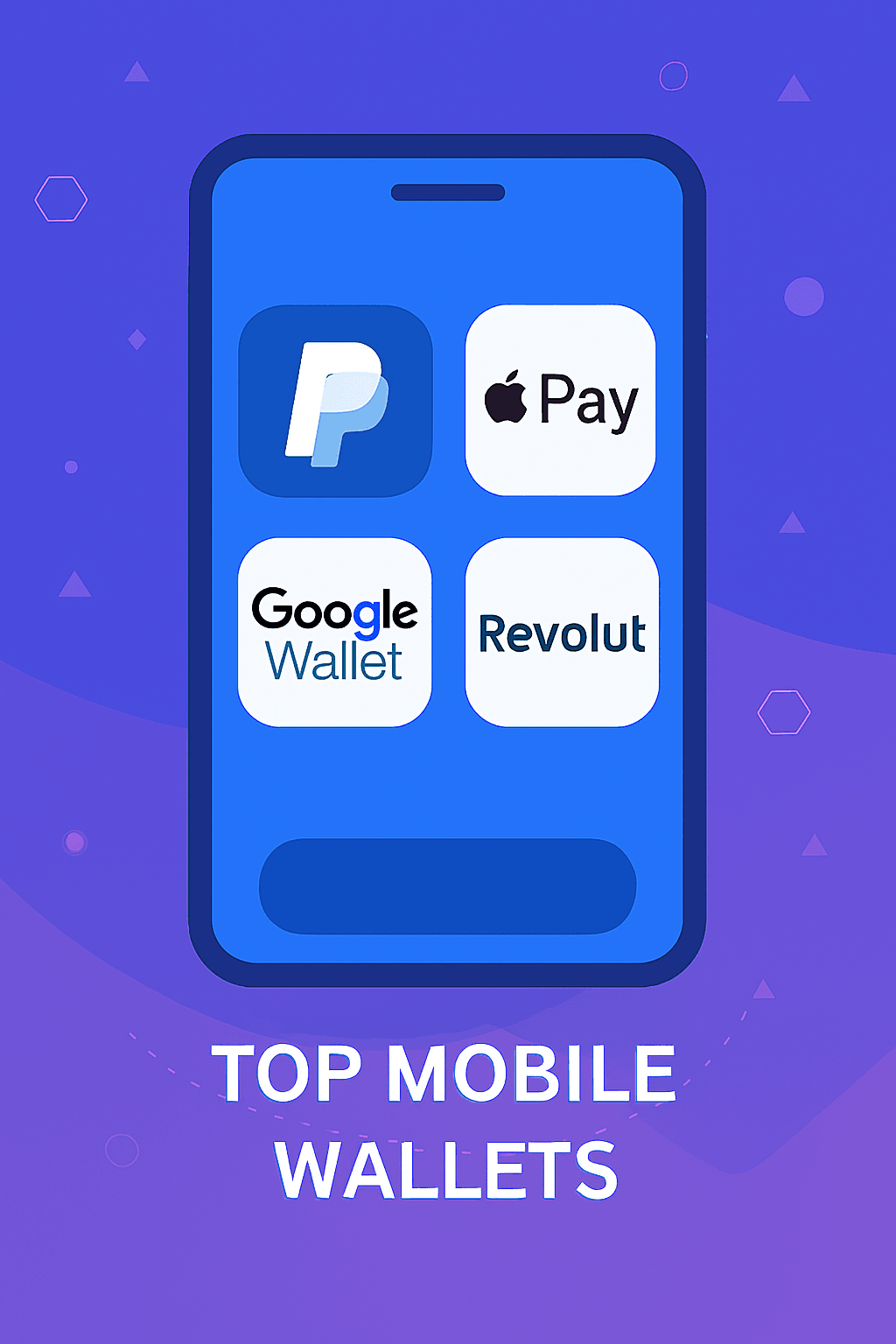

Top Mobile Wallets for Beginners in 2025

While AI Powered Investing Apps for Beginners simplify wealth creation, mobile wallets ensure that transactions remain secure and effortless. For beginners, the right wallet provides confidence in handling money digitally, whether it’s funding an investment account or paying for everyday purchases. Below are some of the most trusted mobile wallets in 2025.

Mobile wallets also encourage financial discipline. By tracking spending, setting limits, and offering instant notifications, they help beginners develop healthy money habits. When combined with AI Powered Investing Apps for Beginners, wallets transform into more than just payment tools — they become essential companions for secure, growth‑oriented financial management. Mobile wallets encourage healthy spending habits, offering instant notifications and budgeting tools that support beginners in managing money alongside AI Powered Investing Apps for Beginners.

Some AI Powered Investing Apps for Beginners are as follows:

1. PayPal

- Best For: Global payments and easy integration

- Features: Widely accepted, strong buyer protection, seamless app‑to‑app transfers

- Beginner Advantage: Simple setup and trusted brand recognition worldwide.

- Get started with PayPal at their official site.

2. Apple Pay

- Best For: iPhone users in USA, UK, Canada, Australia

- Features: Biometric security, contactless payments, integration with banking apps

- Beginner Advantage: Extremely secure and beginner‑friendly for those already in the Apple ecosystem.

Learn more about Apple Pay at Apple’s official site.

3. Google Wallet

- Best For: Android users and cross‑platform payments

- Features: Tap‑to‑pay, integration with Gmail and Google services, advanced encryption

- Beginner Advantage: Easy to use and widely supported across retailers.

See Google Wallet features at Google’s official site.

4. Samsung Wallet

- Best For: Android users who want versatility

- Features: Payment storage, loyalty cards, crypto support

- Beginner Advantage: Offers more than just payments, making it a multifunctional wallet.

Explore Samsung Wallet at Samsung’s official site.

5. Venmo

- Best For: Social payments in USA

- Features: Peer‑to‑peer transfers, social feed, integration with PayPal

- Beginner Advantage: Perfect for beginners who want simple, fun, and fast transfers.

6. Cash App

- Best For: Peer‑to‑peer payments + investing

- Features: Direct deposits, stock and crypto investing, debit card option

- Beginner Advantage: Combines wallet features with beginner‑friendly investing tools.

7. Revolut

- Best For: International users in UK, Canada, Australia

- Features: Currency exchange, budgeting tools, crypto support

- Beginner Advantage: Great for beginners who want global flexibility and financial control.

8. Wise (formerly TransferWise)

- Best For: Cross‑border payments

- Features: Low‑cost international transfers, multi‑currency accounts

- Beginner Advantage: Ideal for beginners managing money across different countries.

Mobile wallets are part of a bigger trend — explore more in our post on Fintech Innovations 2025: Personal Finance.

9. Zelle

- Best For: Instant transfers in USA

- Features: Direct bank‑to‑bank payments, no fees

- Beginner Advantage: Simple, fast, and secure for beginners who want direct transfers.

10. Payoneer

- Best For: Freelancers and global payments

- Features: International transfers, prepaid cards, business integrations

- Beginner Advantage: Perfect for beginners earning online and needing global payment solutions.

Explore Payoneer’s global payment solutions at their official site.

For a deeper dive into wallets, see our full list of Top 10 Mobile Wallets in USA, UK, Canada, Australia.

Summary of Benefits

- Security: Biometric login, encryption, fraud protection.

- Easy to use: Setup is simple and intuitive interfaces.

- Integration: Many wallets connect directly with investing apps.

- Global Reach: Available in USA, UK, Canada, and Australia.

For beginners, mobile wallets are more than just payment tools — they are gateways to financial independence. When paired with AI Powered Investing Apps for Beginners, they create a secure and growth‑oriented digital ecosystem.

Comparison: AI‑Powered Investing Apps vs Mobile Wallets

Beginners often wonder whether they should focus more on investing apps or mobile wallets. In AI Powered Investing Apps for Beginners, the truth is that both play different but complementary roles. The table below highlights the key differences and how they work together to create a complete digital finance ecosystem.

| Feature | AI‑Powered Investing Apps for Beginners | Mobile Wallets for Beginners |

|---|---|---|

| Primary Purpose | Grow wealth through AI‑driven investing | Secure, fast digital payments |

| Ease of Use | Guided tutorials, robo‑advisors | Tap‑to‑pay, simple transfers |

| Security | Encryption, compliance, fraud alerts | Biometric login, encryption |

| Integration | Connects with wallets for funding | Links with apps for investing |

| Best For | Beginners learning to invest | Beginners managing daily money |

| Global Reach | USA, UK, Canada, Australia | USA, UK, Canada, Australia |

How Beginners Can Get Started

Starting your financial journey in 2025 doesn’t have to be complicated. With the right tools, beginners can combine AI Powered Investing Apps for Beginners and mobile wallets to build confidence while managing money digitally. Here’s a simple step‑by‑step approach:

- Download a Trusted App and Wallet

Choose one AI investing app and one mobile wallet from the lists above. Make sure they are available in your country (USA, UK, Canada, or Australia) and meet your security needs. - Create and Secure Accounts

Use strong passwords, enable two‑factor authentication, and activate biometric login where possible. Security should always be the first priority. - Fund Your Wallet and App

Add money to your mobile wallet, then connect it to your investing app. This integration makes it easy to transfer funds for investments or withdraw profits. - Start Small

Begin with micro‑investments or low‑risk portfolios. Many apps allow you to invest spare change or small amounts, which is perfect for beginners. - Learn and Grow

Use the AI features to study recommendations, track performance, and adjust strategies. Over time, increase your investments as your confidence grows.

By following these steps of AI Powered Investing Apps for Beginners, beginners can safely enter the world of digital finance, combining the power of AI investing with the convenience of mobile wallets.

Conclusion

The world of finance in 2025 is shaped by innovation, and beginners now have more opportunities than ever to take control of their money. By combining AI Powered Investing Apps for Beginners with secure mobile wallets, users can build wealth while managing everyday transactions with confidence.

AI powered investing apps for beginners simplify complex decisions, offering personalized insights and automated strategies that reduce the risk of costly mistakes. Mobile wallets, on the other hand, provide the convenience and security needed for seamless payments in a digital economy. Together, AI Powered Investing Apps for Beginners with mobile wallets form a complete ecosystem that empowers beginners to start small, learn quickly, and grow steadily.

For readers in the USA, UK, Canada, and Australia, adopting these AI Powered Investing Apps for Beginners early means staying ahead of financial trends and building a strong foundation for the future. The journey begins with one step — download, connect, and let technology guide your path to smarter investing. To continue your journey, explore our pillar post on Best Passive Income Ideas for 2025 for more strategies.

Pingback: Top 10 Cryptocurrency Wallets in USA 2025: Secure & Easy Bitcoin Storage - RevoValue

Pingback: Best 10 Digital Banking Apps in USA, UK, Canada & Australia (2025 Guide) - RevoValue

Pingback: Best AI Crypto Portfolio Apps in USA 2026 for Beginners - RevoValue

Pingback: Top 10 AI-Powered Personal Finance Tools in USA 2025 - RevoValue

Pingback: Best Budgeting Apps in USA 2026: Save More, Spend Smarter - RevoValue

Pingback: Best AI Stock Trading Apps in USA 2026: Smarter Investing for Beginners & Experts - RevoValue