Introduction

When exploring the best passive income ideas for 2025, dividend stocks consistently stand out as one of the most reliable strategies. Unlike speculative investments such as cryptocurrency or high‑risk startups, dividend stocks are backed by established companies that share a portion of their profits with shareholders. This makes them a unique blend of stability and growth, offering investors both regular cash flow and long‑term wealth creation.

Passive income is more than just a financial buzzword. It represents freedom, security, and the ability to earn money without trading hours for wages. In 2025, as inflation, global uncertainty, and digital disruption continue to reshape economies, investors are increasingly searching for strategies that provide predictable returns. Dividend stocks fit perfectly into this narrative because they reward patience and consistency rather than speculation.

For example, imagine owning shares in a company that pays quarterly dividends. Every three months, you receive a payout simply for holding the stock. Over time, these dividends can be reinvested to buy more shares, creating a compounding effect that accelerates wealth growth. This reinvestment strategy is why dividend stocks are often referred to as “the snowball effect of investing.” The longer you stay invested, the larger your income stream becomes.

Another reason dividend stocks are considered one of the best passive income ideas for 2025 is accessibility. Beginners can start with as little as $100 by purchasing shares of dividend‑paying companies or ETFs (Exchange‑Traded Funds). Unlike real estate, which requires significant capital, or digital products, which demand technical skills, dividend investing is straightforward. With a brokerage account and a small amount of capital, anyone can begin building passive income today.

In this blog, we’ll explore how dividend stocks work, highlight the best dividend ETFs and companies to consider in 2025, discuss risks and rewards, and provide a step‑by‑step roadmap for beginners. By the end, you’ll see why dividend investing is not just a theory but a proven path to financial freedom. It is part of the best passive income ideas for 2025.

What Are Dividend Stocks?

Dividend stocks are shares of companies that distribute a portion of their profits to shareholders in the form of dividends. These payouts are typically made quarterly, though some companies issue them monthly or annually. For investors, dividend stocks represent a way to earn money simply by holding shares, making them one of the most practical and predictable options among the best passive income ideas for 2025.

Dividends vs. Capital Gains

To understand dividend stocks, it’s important to distinguish between dividends and capital gains:

- Capital Gains: These occur when the price of a stock rises and you sell it for a profit. For example, buying a share at $50 and selling it at $70 gives you a $20 gain.

- Dividends: These are direct cash payments from the company’s profits. If the same company pays $2 per share annually, you earn that amount regardless of whether the stock price rises or falls.

This dual benefit — potential price appreciation plus regular payouts — is what makes dividend stocks so attractive.

Why Companies Pay Dividends

Not all companies pay dividends. Growth‑focused firms like tech startups often reinvest profits into expansion. It is part of the best passive income ideas for 2025. However, mature companies in sectors such as utilities, banking, healthcare, and consumer goods often generate steady profits and reward shareholders with dividends. Paying dividends signals financial strength and builds investor trust.

Types of Dividend Stocks

- Blue‑Chip Dividend Stocks: Large, stable companies with a long history of paying dividends (e.g., Johnson & Johnson, Procter & Gamble).

- High‑Yield Dividend Stocks: Companies offering above‑average dividend yields, often in sectors like energy or real estate.

- Dividend Growth Stocks: Firms that consistently increase their dividend payouts year after year.

- REITs (Real Estate Investment Trusts): Special companies that pay out most of their income as dividends, often yielding 5–10%.

Each type has unique benefits, and combining them can create a balanced portfolio.

Why Dividend Stocks Are Passive Income

Dividend stocks are considered passive income because they don’t require active work once purchased. Unlike freelancing or running a business, you don’t need to create products or manage clients. Your role is simply to invest wisely, hold shares, and let the dividends flow. With reinvestment, your income grows automatically through compounding. It is part of the best passive income ideas for 2025.

Accessibility for Beginners

One of the biggest advantages of dividend investing is accessibility. You don’t need thousands of dollars to start. Many brokers allow fractional share purchases, meaning you can invest as little as $10 in a dividend‑paying company. This makes dividend stocks one of the most beginner‑friendly options among the best passive income ideas for 2025.

How Dividend Stocks Work

Dividend stocks generate income in a straightforward way: companies share a portion of their profits with shareholders. But to truly understand why they’re one of the best passive income ideas for 2025, let’s break down the mechanics step by step.

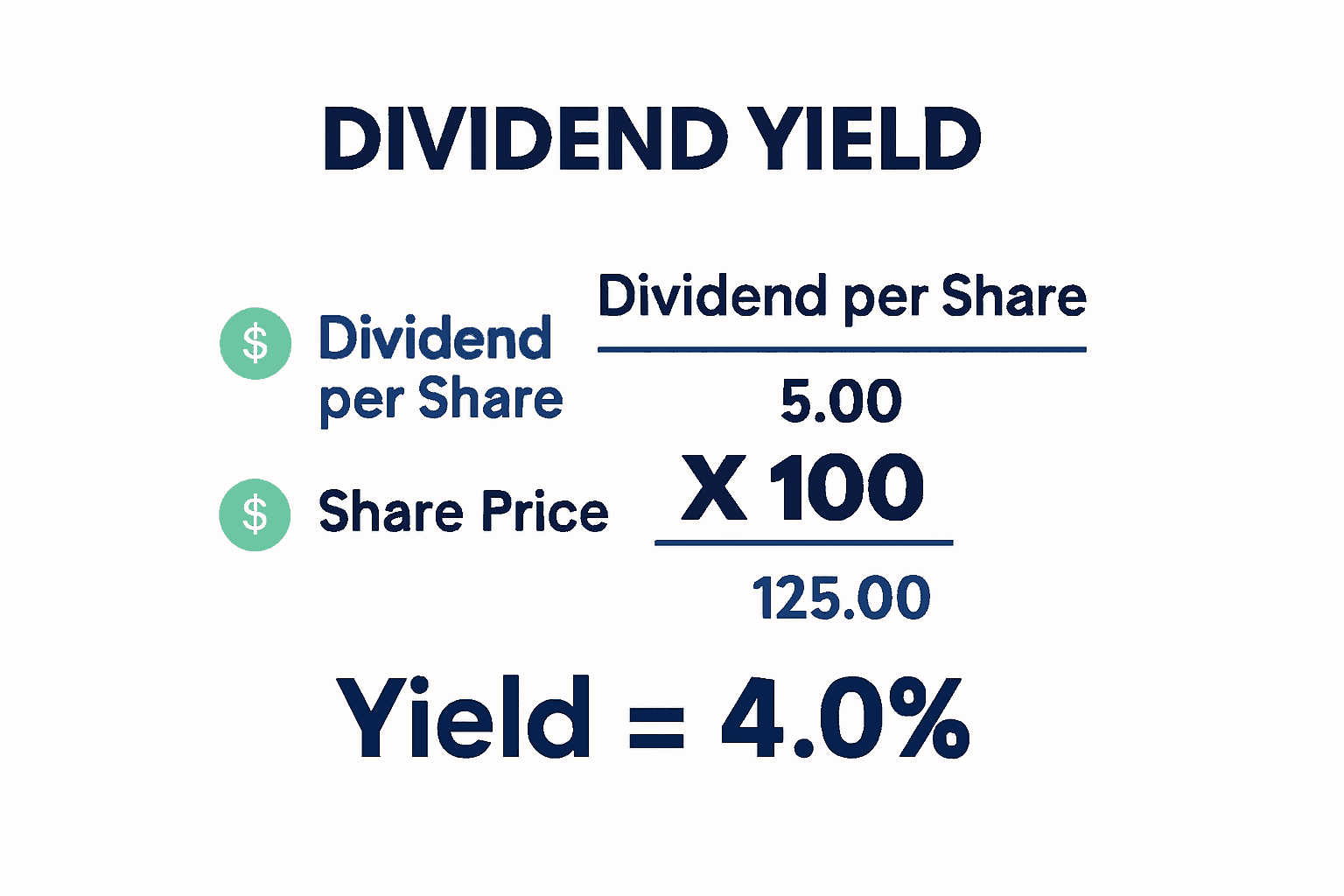

Dividend Yield Explained

The most common measure of dividend income is the dividend yield. It shows how much you earn relative to the stock price. It is part of the best passive income ideas for 2025.

[

\text{Dividend Yield} = \frac{\text{Annual Dividend per Share}}{\text{Share Price}} \times 100

]

Example:

- Company XYZ trades at $50 per share.

- It pays $2 per share annually in dividends.

- Dividend yield = (\frac{2}{50} \times 100 = 4\%).

This means for every $100 invested, you earn $4 annually in passive income.

Dividend Payout Frequency

Most companies pay dividends quarterly (every three months). Some REITs and specialty firms pay monthly, which is attractive for investors seeking regular cash flow.

- Quarterly Example: $2 annual dividend = $0.50 per share every quarter.

- Monthly Example: Realty Income (NYSE: O) pays dividends every month, making it popular among passive income investors.

Reinvestment & Compounding (DRIP)

The real power of dividend stocks lies in compounding. Instead of taking dividends as cash, you can reinvest them through a Dividend Reinvestment Plan (DRIP). It is part of the best passive income ideas for 2025.

Example:

- You own 100 shares of a $50 stock paying $2 annually.

- You earn $200 in dividends.

- Instead of withdrawing, you reinvest to buy 4 more shares.

- Next year, you earn dividends on 104 shares, not 100.

Over time, this snowball effect accelerates growth. After 10–15 years, reinvested dividends can double or triple your income stream.

Total Return: Dividends + Capital Gains

Dividend stocks provide two sources of return:

- Dividends: Regular payouts.

- Capital Gains: Increase in stock price.

Example:

- You invest $10,000 in a stock yielding 4%.

- Annual dividends = $400.

- If the stock price rises 8% in a year, your portfolio grows to $10,800.

- Total return = $400 (dividends) + $800 (capital gains) = $1,200 (12%).

This dual benefit makes dividend stocks one of the best passive income ideas for 2025.

Why This Matters for Passive Income

- Predictability: You know when dividends will be paid.

- Scalability: The more shares you own, the larger your income stream.

- Flexibility: You can take dividends as cash or reinvest them.

For beginners, dividend investing is simple yet powerful. For advanced investors, strategies like dividend growth investing or combining dividends with options trading can further boost returns. It is part of the best passive income ideas for 2025.

Best Dividend ETFs & Stocks in 2025

When evaluating the best passive income ideas for 2025, dividend ETFs and individual dividend stocks are at the top of the list. They combine stability, diversification, and consistent payouts, making them ideal for both beginners and experienced investors. Let’s break down the top options to consider this year.

Why Dividend ETFs Are Safer for Beginners

Dividend ETFs (Exchange‑Traded Funds) pool together dozens or even hundreds of dividend‑paying companies. This diversification reduces risk because you’re not relying on a single company’s performance. If one company cuts its dividend, others in the fund can balance the loss. It is part of the best passive income ideas for 2025.

For beginners, ETFs are a simple way to access dividend income without needing to research individual stocks. They also come with lower fees compared to actively managed funds.

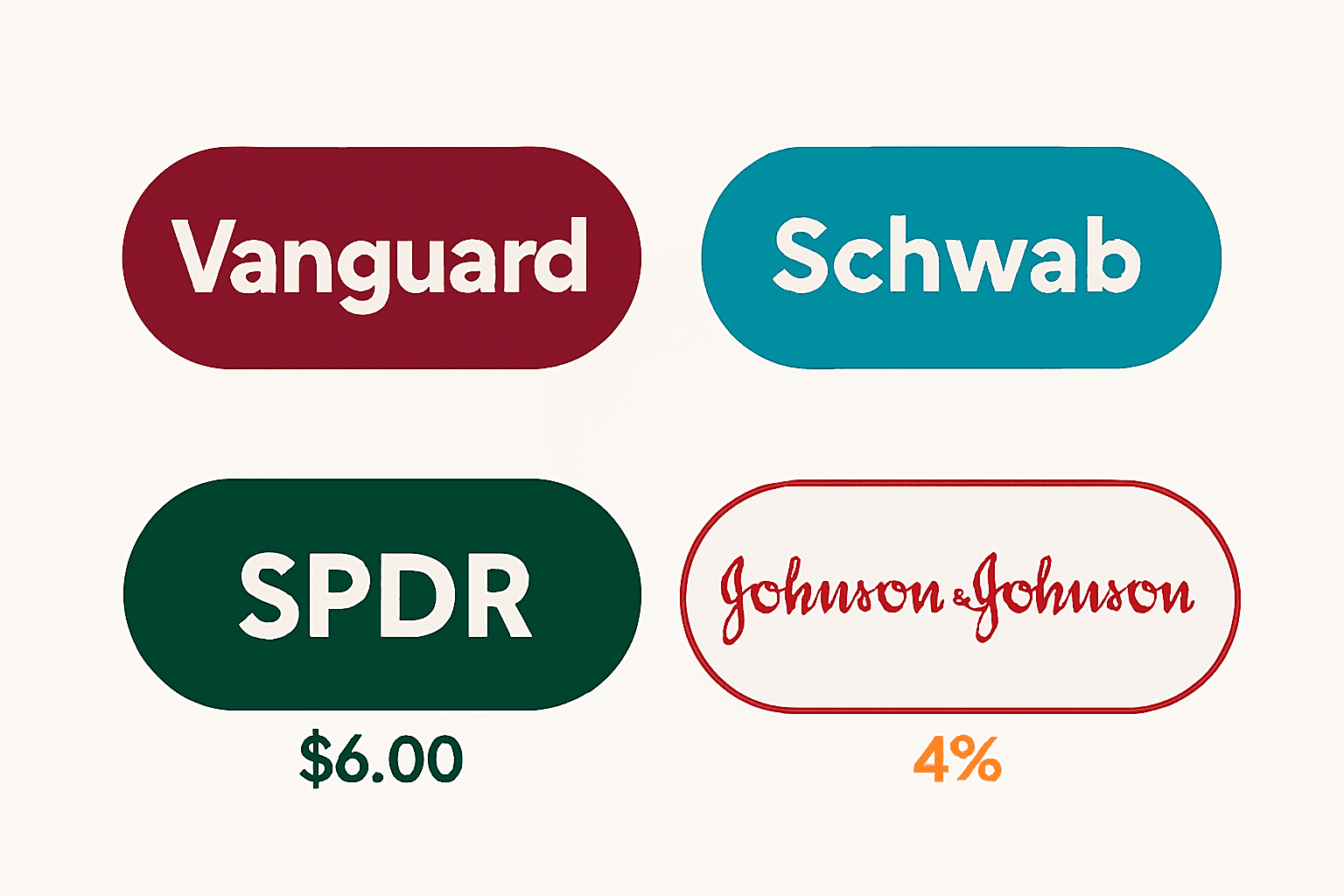

Top Dividend ETFs in 2025

- Vanguard High Dividend Yield (VYM)

- Focuses on large U.S. companies with above‑average dividend yields.

- Current yield: ~3.2%

- Ideal for investors seeking stability and broad exposure.

- Schwab U.S. Dividend Equity ETF (SCHD)

- Known for consistent payouts and strong dividend growth.

- Yield: ~3.5%

- Includes financially strong companies with sustainable dividends.

- SPDR S&P Dividend ETF (SDY)

- Tracks companies with at least 20 years of consecutive dividend increases.

- Yield: ~3%

- Perfect for investors who value reliability and long‑term growth.

- iShares Select Dividend ETF (DVY)

- Focuses on high‑yield U.S. companies.

- Yield: ~4%

- Slightly riskier but offers higher income potential.

Top Dividend Stocks in 2025

For investors who prefer individual companies. It is part of the best passive income ideas for 2025. Here are some strong performers:

- Johnson & Johnson (JNJ): A healthcare giant with decades of dividend growth. Yield ~2.8%.

- Procter & Gamble (PG): Consumer goods leader, reliable payouts. Yield ~2.5%.

- Realty Income (O): Known as “The Monthly Dividend Company.” Yield ~5%.

- Ares Capital (ARCC): A business development company offering yields above 8%.

- Verizon (VZ): Telecom giant with a stable yield around 6%.

Balancing ETFs and Stocks

- ETFs: Safer, diversified, lower effort.

- Stocks: Higher yields possible, but require research and monitoring.

A balanced portfolio might include one or two dividend ETFs for stability, plus a handful of high‑yield stocks for extra income. This mix ensures steady cash flow while still capturing growth opportunities. It is part of the best passive income ideas for 2025.

Why These Picks Matter in 2025

With inflation and market uncertainty, investors are prioritizing predictable income streams. Dividend ETFs and stocks provide exactly that. They’re accessible to beginners, scalable for advanced investors, and proven to deliver results. This makes them one of the best passive income ideas for 2025.

Risks & Rewards of Dividend Investing

When considering dividend stocks as one of the best passive income ideas for 2025, it’s important to understand both the rewards and the risks. While dividends provide predictable income, no investment is completely risk‑free. A balanced perspective helps investors make smarter decisions and avoid common pitfalls.

Rewards of Dividend Investing

- Steady Income Stream

Dividend stocks provide regular payouts, often quarterly or monthly. For retirees or those seeking financial independence, this steady cash flow can supplement salaries or replace active income altogether. - Compounding Growth

Through Dividend Reinvestment Plans (DRIPs), investors can reinvest payouts to buy more shares. Over time, this creates a compounding effect, accelerating portfolio growth without additional capital. - Inflation Hedge

Many companies increase dividends annually. This growth helps protect investors against inflation, ensuring that income keeps pace with rising costs. - Lower Volatility Compared to Growth Stocks

Dividend‑paying companies are often mature and financially stable. They tend to be less volatile than high‑growth startups, making them attractive during uncertain economic times.

Risks of Dividend Investing

- Dividend Cuts or Suspensions

Companies can eliminate or reduce dividends during financial stress. For example, during the 2020 pandemic, several major firms suspended payouts to conserve cash. Investors relying solely on dividends may face sudden income drops. - Market Volatility

While dividends provide stability, stock prices still fluctuate. A company paying a 4% yield may see its share price drop 20% in a downturn, reducing portfolio value even if dividends continue. - Sector Concentration Risk

High‑yield sectors like energy, telecom, or REITs may look attractive but can expose investors to industry‑specific risks. Over‑reliance on one sector increases vulnerability. - Tax Considerations

In some countries, dividends are taxed at higher rates than capital gains. For international investors, withholding taxes may reduce net income.

Balancing Risks and Rewards

The key to successful dividend investing is diversification. By combining dividend ETFs with individual stocks across multiple sectors, investors can reduce risk while maintaining steady income. For example, pairing a broad ETF like SCHD with a high‑yield REIT such as Realty Income balances stability with higher payouts.

Dividend investing is not about chasing the highest yield. It’s about building a sustainable, long‑term income stream. When approached strategically, dividend stocks remain one of the best passive income ideas for 2025, offering both reliability and growth potential.

Beginner’s Guide to Getting Started

For beginners, dividend investing may seem complicated at first glance. But in reality, it’s one of the simplest ways to build passive income. With the right steps, anyone can start earning dividends in 2025, even with a small amount of capital. It is part of the best passive income ideas for 2025. Here’s a practical roadmap:

Step 1: Open a Brokerage Account

The first step is to open an account with a trusted brokerage. Popular platforms include Fidelity, Vanguard, Charles Schwab, Robinhood, and Interactive Brokers. It is part of the best passive income ideas for 2025. Many of these allow fractional share purchases, meaning you can invest with as little as $10.

When choosing a broker, look for:

- Low or zero trading fees

- Access to dividend ETFs and international stocks

- Easy‑to‑use mobile apps for tracking investments

Step 2: Choose Dividend ETFs or Stocks

Beginners should start with dividend ETFs because they provide instant diversification. Options like VYM, SCHD, or SDY spread risk across dozens of companies.

Once comfortable, you can add individual dividend stocks such as Johnson & Johnson (JNJ) or Realty Income (O) for higher yields.

Step 3: Set Up Dividend Reinvestment (DRIP)

Most brokers allow you to automatically reinvest dividends. This is called a Dividend Reinvestment Plan (DRIP). Instead of receiving cash, your dividends buy more shares. It is part of the best passive income ideas for 2025. Over time, this creates a compounding effect that accelerates portfolio growth.

For example:

- $500 invested in SCHD yields ~3.5% annually = $17.50 in dividends.

- With DRIP, those dividends buy more shares.

- Next year, you earn dividends on a slightly larger investment.

- After 10 years, your portfolio grows significantly without adding extra money.

Step 4: Diversify Across Sectors

Don’t put all your money into one industry. It is part of the best passive income ideas for 2025. Spread investments across:

- Utilities (stable payouts)

- Healthcare (long‑term growth)

- Telecom (high yields)

- REITs (real estate exposure)

Diversification reduces risk and ensures steady income even if one sector struggles.

Step 5: Track Performance

Use free tools like Yahoo Finance, Google Sheets, or your broker’s dashboard to monitor dividend payouts, yields, and portfolio growth. Tracking helps you stay disciplined and avoid emotional decisions during market swings. It is part of the best passive income ideas for 2025.

Why This Matters in 2025

With inflation and economic uncertainty, beginners need strategies that are simple, reliable, and scalable. Dividend investing checks all these boxes. By following these steps, anyone can start building passive income streams, making dividend stocks one of the best passive income ideas for 2025.

Conclusion

Dividend stocks remain one of the most reliable strategies among the best passive income ideas for 2025. They offer investors a unique combination of stability, regular payouts, and long‑term growth potential. Unlike speculative assets, dividend stocks are backed by established companies with proven track records, making them a cornerstone for anyone seeking predictable income streams.

In today’s economic environment, where inflation and uncertainty challenge traditional savings methods, dividend investing provides a practical solution. The ability to generate consistent cash flow while reinvesting dividends for compounding growth ensures that your portfolio not only produces income but also builds wealth over time. This dual benefit — dividends plus capital gains — makes dividend stocks especially powerful for long‑term investors.

For beginners, dividend ETFs provide an easy entry point with built‑in diversification. For more experienced investors, selecting individual dividend stocks allows for higher yields and tailored strategies. Regardless of approach, the key is consistency, diversification, and patience.

The takeaway is simple: dividend investing is not about chasing the highest yield. It’s about building a sustainable, long‑term income stream that grows steadily year after year. By combining dividend ETFs for stability with select individual stocks for higher returns, investors can create a balanced portfolio that withstands market fluctuations.

As you explore the best passive income ideas for 2025, dividend stocks should be at the top of your list. They provide the perfect blend of reliability and opportunity, empowering you to take control of your financial future.

Pingback: Best Passive Income Ideas for 2025 - RevoValue – Smart Finance Insights

Pingback: Proven Guide: How to Invest in Stocks for Beginners in 2025 - RevoValue – Smart Finance Insights

Pingback: Best Fintech Innovations 2025 Personal Finance | Abdullah – Finance Blogger - RevoValue – Smart Finance Insights