Introduction

In 2025, young adults are facing a financial landscape that is more dynamic than ever before. The rise of the gig economy, digital products, and investment platforms has made the debate of active income vs passive income one of the most important conversations in personal finance. Understanding active income vs passive income is not just about knowing definitions — it’s about recognizing how each stream of money impacts your lifestyle, your freedom, and your long‑term wealth.

When people talk about active income vs passive income, they often frame it as a choice: should you work harder at your job or build investments that earn while you sleep? The truth is, active income vs passive income is not an either/or decision. Both play critical roles in building financial independence. Active income provides stability and immediate cash flow, while passive income creates scalability and long‑term wealth.

This blog will break down active income vs passive income in detail, showing you the pros, cons, and strategies to balance both. By the end, you’ll see why active income vs passive income is the secret path to wealth in 2025, especially for young adults in the USA, UK, Canada, and Australia.

Budgeting vs expense tracking guide

What is Active Income?

Active income is the money you earn by trading time for money. In the active income vs passive income debate, active income is the most familiar form — salaries, hourly wages, freelance projects, or commissions. Every time you show up to work, you generate active income.

Examples of active income include:

- A full‑time job with a monthly salary.

- Freelancing on platforms like Upwork or Fiverr.

- Consulting projects where you bill by the hour.

- Sales commissions from closing deals.

The advantage of active income in the active income vs passive income discussion is stability. You know when your paycheck is coming, and you can plan your monthly expenses accordingly. For young adults, active income is often the first step toward financial independence.

However, the downside of active income in the active income vs passive income framework is scalability. You only have 24 hours in a day, and your earning potential is capped by time and energy. Burnout, job loss, or market changes can quickly disrupt active income streams.

That’s why understanding active income vs passive income is so crucial — active income provides security, but it cannot alone create wealth.

What is Passive Income?

Passive income refers to earnings that continue to flow with little day‑to‑day involvement once the foundation is built. Within the active income vs passive income discussion, it’s often viewed as the ideal scenario — money coming in even while you rest. Unlike active income, which requires constant work, passive income leverages systems, investments, or assets to generate cash flow.

Examples of passive income include:

- Dividends from stocks or ETFs. (dividends explained by Investopedia)

- Rental income from property or Airbnb.

- Affiliate marketing and digital products (courses, eBooks).

- Crypto staking and decentralized finance (DeFi) platforms in 2025.

The advantage of passive income in the active income vs passive income framework is scalability. Once established, passive income can grow without requiring more hours of your time. For young adults, passive income represents freedom — the ability to travel, invest, or pursue passions without worrying about a paycheck.

However, passive income also has challenges. In the active income vs passive income comparison, passive income often requires upfront effort, capital, or risk. Building a rental property portfolio or launching a digital product takes time and investment. Returns may be delayed, and not every passive income stream succeeds.

Still, in the active income vs passive income journey, passive income is the key to long‑term wealth. It’s what allows financial independence and early retirement to become possible.

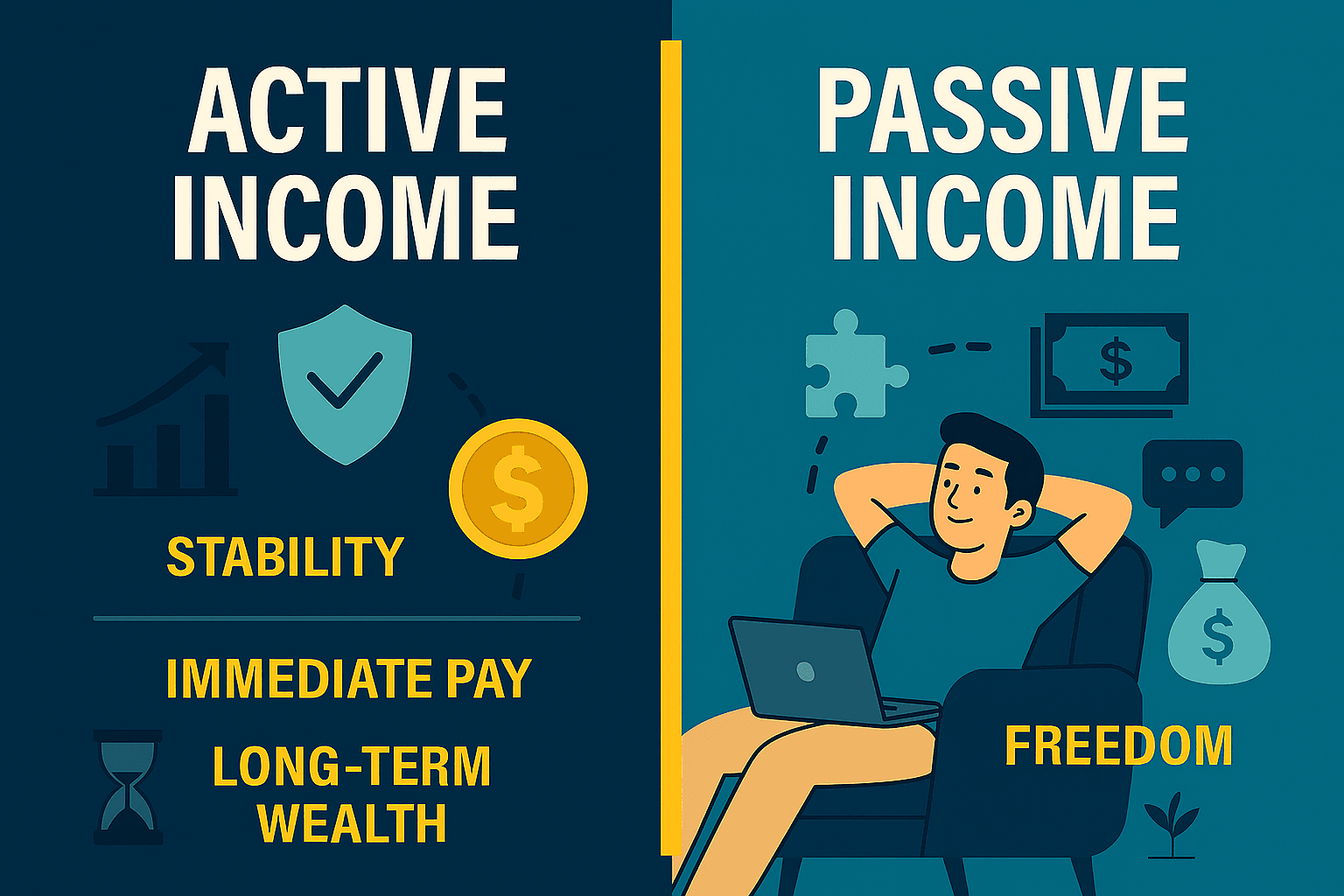

Active Income vs Passive Income: Main Differences

To truly understand active income vs passive income, let’s break down the differences side by side:

| Aspect | Active Income | Passive Income |

|---|---|---|

| Effort | Continuous work required | Initial setup, minimal ongoing |

| Stability | High (predictable paycheck) | Variable (depends on investments/market) |

| Scalability | Limited (time‑bound) | High (assets grow without extra hours) |

| Risk | Low (job security) | Medium to high (investment risk) |

| Wealth Potential | Moderate | High (compounding returns) |

In the active income vs passive income debate, the table shows why both matter. Active income provides stability and covers immediate needs, while passive income builds wealth and freedom.

For example, a young professional in the UK may rely on active income from a 9‑to‑5 job but also invest in dividend stocks for passive income. In Canada, someone might freelance (active income) while renting out a property (passive income). These combinations highlight how active income vs passive income is not a choice but a balance.

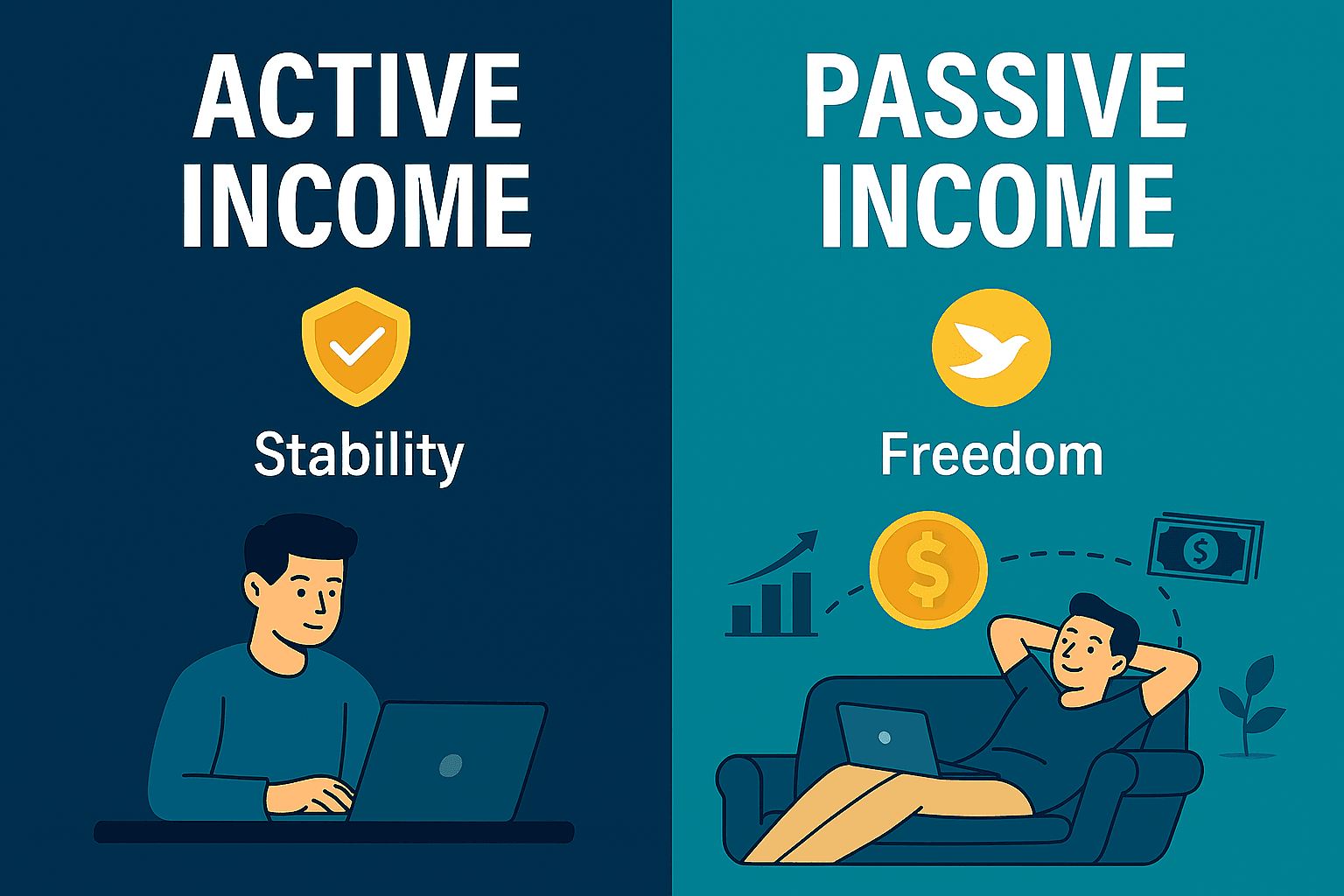

Why Young Adults Need Both

In the debate of active income vs passive income, the truth is that young adults cannot rely on just one. Active income provides the immediate stability needed to pay rent, cover bills, and manage daily expenses. Passive income, on the other hand, builds long‑term wealth and financial freedom.

Think of active income vs passive income as two sides of the same coin. Active income is the foundation — it keeps you secure today. Passive income is the growth engine — it ensures you’re secure tomorrow. Without active income, it’s difficult to invest or build passive streams. Without passive income, you’ll always be tied to your job or freelance work.

For example:

- A student in the USA may work part‑time (active income) while building a YouTube channel that earns ad revenue (passive income).

- A young professional in Canada may freelance in web design (active income) while investing in ETFs (passive income).

- In Australia, someone might teach fitness classes (active income) while selling digital workout guides online (passive income).

These examples show why active income vs passive income is not a choice but a strategy. Young adults need both to balance security and freedom.

Building Passive Income Streams in 2025

Passive income is the game‑changer in the active income vs passive income journey. In 2025, opportunities for passive income are more diverse than ever before. Here are some of the most effective streams:

- Digital Products: Courses, eBooks, templates, or guides. Once created, they can sell repeatedly with little extra effort.

- Affiliate Marketing: Promoting products through blogs or social media. Each sale generates commission.

- Dividend Stocks & ETFs: Investing in companies that pay regular dividends. This is one of the most reliable passive income streams.

- Real Estate: Rental properties or REITs (Real Estate Investment Trusts). Platforms like Airbnb make this easier for young adults.

- Crypto Staking & DeFi: In 2025, decentralized finance platforms allow users to earn interest by staking crypto assets.

In the active income vs passive income framework, passive income requires upfront effort or capital. But once established, it grows without demanding more hours of your day. For young adults, starting small — like selling a digital product or investing in a low‑cost ETF — can be the first step toward financial independence.

Country‑Specific Insights

The debate of active income vs passive income looks different depending on where you live. In 2025, young adults across the USA, UK, Canada, and Australia are finding unique ways to balance both.

- USA: Active income often comes from full‑time jobs or side hustles like freelancing. Passive income is popular through dividend stocks, Airbnb rentals, and digital products. The combination shows how active income vs passive income is shaping financial independence in America.

- UK: Many young adults rely on active income from traditional employment but are increasingly exploring subscription businesses and rental property for passive streams. Here, active income vs passive income is about balancing stability with entrepreneurial risk.

- Canada: Freelancing and consulting provide strong active income opportunities, while ETFs and real estate are common passive income choices. Canadians see active income vs passive income as a way to hedge against rising housing costs.

- Australia: Lifestyle businesses and digital products are booming. Australians often combine active income from service jobs with passive income from online ventures. The active income vs passive income balance here reflects a culture of flexibility and innovation.

Tools & Apps

Technology makes managing active income vs passive income easier than ever. In 2025, apps and platforms are helping young adults track, grow, and diversify their income streams.

- Upwork / Fiverr → Active income through freelancing and project work.

- Robinhood / Wealthsimple → Passive income via stock dividends and ETFs.

- Airbnb → Passive rental income from property or shared spaces.

- Teachable / Gumroad → Passive income from digital products like courses or eBooks.

- Coinbase / Binance → Passive income through crypto staking and DeFi platforms.

These tools highlight how active income vs passive income is no longer just theory — it’s practical, accessible, and app‑driven. By combining the right platforms, young adults can build both streams simultaneously.

Psychology of Wealth

The debate of active income vs passive income is not just financial — it’s psychological. Active income provides a sense of security. You know when your paycheck is coming, and that stability reduces stress. Passive income, however, provides freedom. It allows you to dream bigger, take risks, and live without constant financial pressure.

In the active income vs passive income journey, young adults often struggle with mindset. Active income feels safe but limiting. Passive income feels exciting but uncertain. The key is balance: use active income to build confidence and cover essentials, while gradually creating passive streams that reduce dependency on your job.

When you understand active income vs passive income, you realize wealth is not just about numbers. It’s about control, freedom, and peace of mind.

Conclusion

In 2025, the path to financial independence is clearer than ever: it lies in mastering active income vs passive income. Active income gives you stability today, while passive income builds wealth for tomorrow. Together, they form the secret path to long‑term success.

Whether you’re in the USA, UK, Canada, or Australia, the principle of active income vs passive income applies universally. Start with active income to secure your present, then invest time and effort into passive streams to secure your future.

Remember, active income vs passive income is not a choice — it’s a strategy. The young adults who embrace both will be the ones who achieve financial freedom in 2025 and beyond.

Finance guides on RevoValue.com

Pingback: Best Passive Income Ideas for 2025 - RevoValue – Smart Finance Insights

Pingback: Best 10 Digital Banking Apps in USA, UK, Canada & Australia (2025 Guide) - RevoValue – Smart Finance Insights